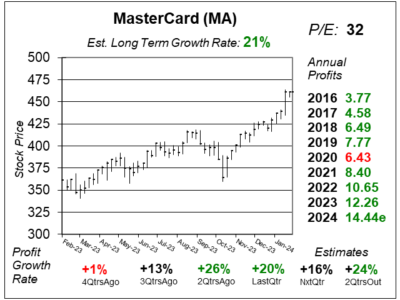

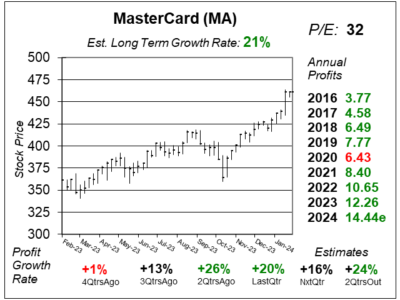

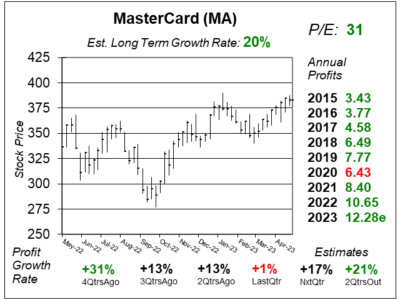

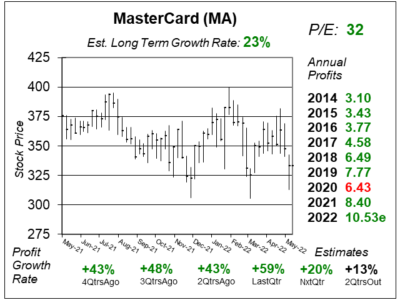

MasterCard (MA) Delivers Solid Results Driven By Healthy Consumer Spending

MasterCard (MA) is seeing healthy consumer spending, with revenue and profits coming in above expectations as the stock climbs.

MasterCard (MA) is seeing healthy consumer spending, with revenue and profits coming in above expectations as the stock climbs.

MasterCard (MA) delivered accelerating profit growth last quarter as its customers are paying up for its fraud prevention services.

MasterCard (MA) stock has been moving up — and hit an All-Time high — as consumers spend on travel and entertainment.

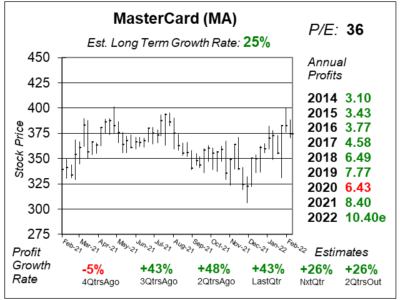

MasterCard (MA) is seeing good growth for its cybersecurity and fraud prevention services. Cross-border volume has been good too,

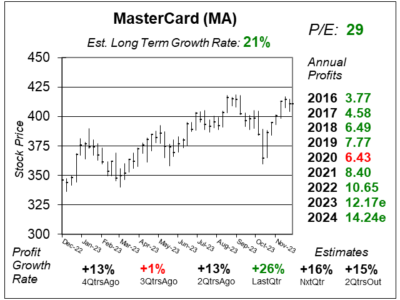

MasterCard (MA) thinks card spending will continue to be healthy in 2023 due to the strong labor market. Travel spending is high too,

A strong UD Dollar trimmed MasterCard’s (MA) revenue growth from 23% to 15%. Now the dollar is falling, and that’s good news.

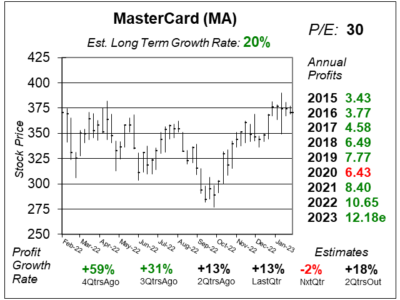

MasterCard (MA) saw robust consumer spending last qtr, especially with cross-border spending as volumes rose 58% year-over-year.

MasterCard (MA) is seeing strong spending in retail and travel, as Cross-border travel is above 2019 levels, and above expectations.

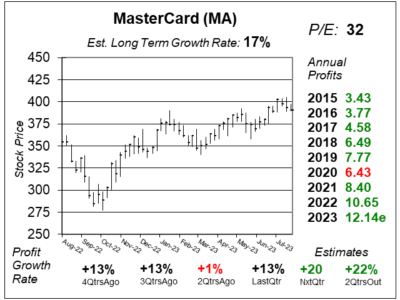

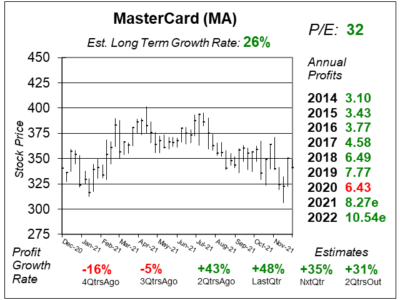

MasterCard (MA) stock could be a market leader in 2022 as people want to travel while borders relax COVID restrictions.

MasterCard’s (MA) profits are expected to climb from around $8 in 2021 to maybe $20 in 2025 as travel spending resumes.

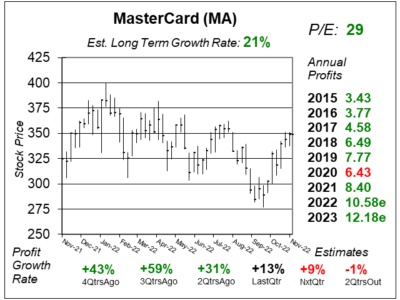

MasterCard’s (MA) profit growth ramped up to 43% last qtr. And the good growth looks to continue for years to come.

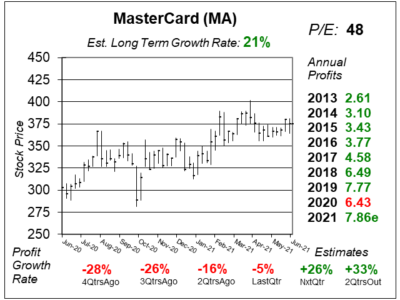

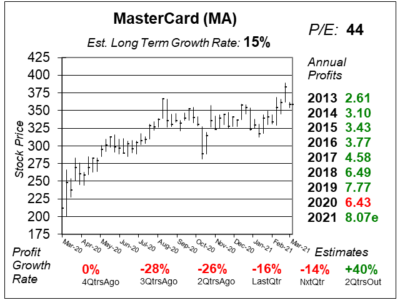

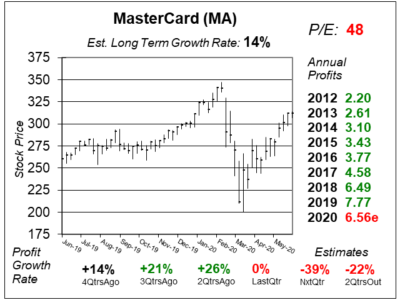

MasterCard’s (MA) profits have declined in each of the last 4 qtrs, but are expected to turn up next qtr. But the P/E is high.

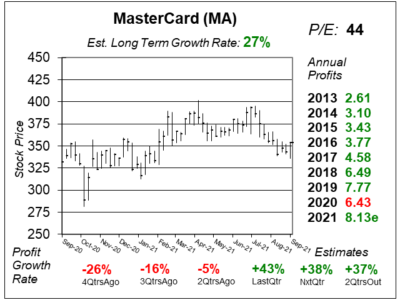

MasterCard (MA) stock has been rising while profits are declining. Let’s take a look at the stock, as its P/E of 44 is high.

MasterCard (MA) stock is close to an All-Time high even though profit growth is weak as investors think ahead to 2021.

I’m seeing lots of stocks like MasterCard (MA) that could be around their current price a year from now.

MasterCard (MA) has rallied nicely off its Coronavirus Bear Market lows. Is there any upside when we look to 2021?

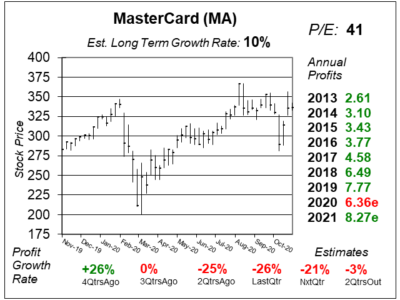

MasterCard (MA) warned revenue will come in below estimates this qtr as the Coronavirus slows cross-border travel.

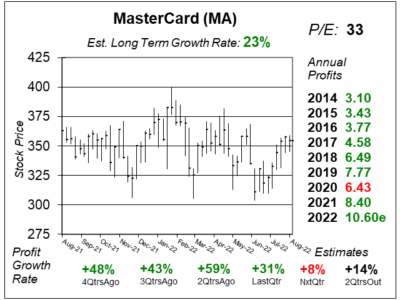

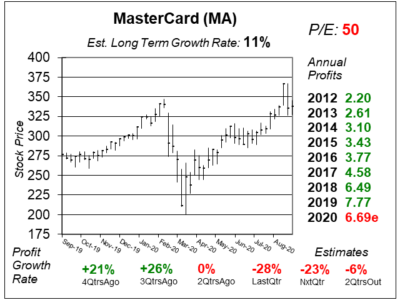

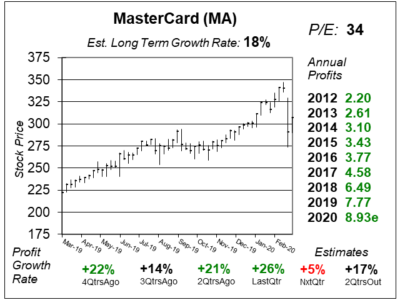

It’s truly remarkable that MasterCard (MA) is still growing profits faster than 20% a year. The stock deserves attention.

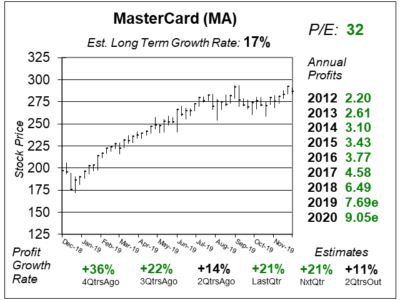

MasterCard’s (MA) qtrly profit growth has slid from 36% to 22% and most recently 14%. Let’s see what’s going on here.

MasterCard (MA) has been on a smooth ride higher as economies expand worldwide. But does MA have more room to run?

MasterCard (MA) has many great qualities, including a stock that’s grown faster than 20% a year during the past decade. It’s an underappreciated investment.

Worried about the stock market? Maybe you should take a look at MasterCard (MA), which continues to provide steady growth.

MasterCard (MA) was still able to grow profits a staggering 51% last qtr with help of acquisitions, lower taxes and stock buybacks. Here’s where I see MA going next.

MasterCard’s (MA) growth has just become masterful as a strong economy, low dollar, and tax law changes have boosted profit growth to 40%.

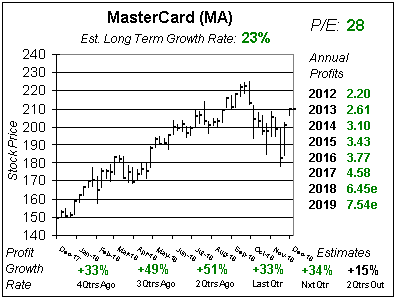

MasterCard (MA) is growing great. Profits surged 33% last qtr. But my concern with this stock is always the same — the P/E is high.

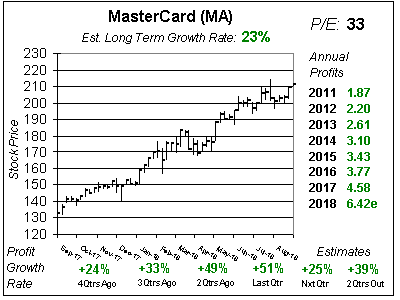

MasterCard (MA) has been fabulous in the last year as the stock’s gone from $110 to $150. And now profit growth just accelerated from 17% to 24% — with 30% growth expected next qtr.

MasterCard (MA) stock is at All-Time highs as International growth helped to push profits up 15% last qtr. But with a P/E of 30, this stock has a high price.

MasterCard (MA) shares continue to climb higher. Profits rose 17% last qtr as the number of transactions grew 17%. But with a 19 P/E is MA too high?

MasterCard’s (MA) around its all-time highs, and with global economies doing better than last year could MA’s profit growth return to the mid-teens?

For the third straight quarter MasterCard (MA) beat the street and analysts upped profit estimates. MA is on a roll right now, and 2017 looks good.

Shares of MasterCard (MA) continue to have a premium valuation, as its P/E of 28 is almost double the estimates long-term growth rate of 15% a year.

MasterCard (MA) stock is stuck in a rut even though volume and transactions grew 13-14% last qtr. Let’s see if MA is a good buy.

MasterCard’s (MA) only expected to have 3% profit growth this year as the dollar is hurting results. Plus, at 27x profits the stock is high.

MasterCard (MA) is growing profits in the mid-single digits and I would like to see better growth or a lower price before buying in.

With the market in a steep decline, MasterCard (MA) is one stock in need of a correction. It’s just too high.

For the 2nd year in a row it looks like MasterCard (MA) is dead money, thus I will sell it from the Growth Portfolio.

MasterCard (MA) has lots of momentum right now, but I don’t see the stock doing much in 2015.

MasterCard (MA) stock jumped 70% in 2013. In 2014 MA’s digesting those gains.

Analysts are trimming estimates for MasterCard (MA), and I’m trimming my Fair Value on MA as well.

Shares of MasterCard (MA) have risen 50% during the last year, and MA fairly valued with profit growth slipping its time to take a breather.

MasterCard (MA) is splitting 10-for-1 and buying back $3.5 billion in stock. Still, my view on MA stock isn’t as rosey you may think

MasterCard (MA) is on a roll with solid momentum that’s tough to slow. The stock is in maximum overdrive, even though its more expensive than its been in years.

MasterCard (MA) is going to have slower growth through 2013. With the stock up from $400 to $550 within a year, I expect MA to track the market.

Mastercard’s (MA) got a great business. It can grow profits 20% with just 10% sales growth. That deserves a P/E of 25.

Mastercard (MA) is losing its green. Quarterly growth has dipped below 20% and estimates show more of that ahead.

I’m turning my nose up to Mastercard (MA) and will sell it from the Aggressive Growth Portfolio because I don’t like it as I used to.

MasterCard (MA) is proving to be a Steady Eddie in the current stock market correction. MA’s certainty, consistency and growth opportunity make it a top four stock.

MasterCard (MA) is touching $400. Although the company just went from rapid-profit-growth to moderate-profit-growth, $500 and $600 look to be on the horizon.

One year ago I pegged Mastercard’s (MA) 2011-2012 Fair Value at $329-393 (midpoint $361). This quarter the stock is $361 and I see MA’s future as…

MasterCard (MA) has been climbing this year even though stocks — and Financials in particular — have had a tough go of things in 2011. This stick is very timely now, but the move higher has taken away some upside.

Mastercard (MA) has some serious growth ahead, as this financial is expected to pump out 30% profit growth the next two quarters. With a P/E of only 16, MA has solid upside.

You wouldn’t guess Mastercard (MA) could be worth $400 a share. The stock’s not even getting talked about as a growth stock. But simple calculations show four-bills is be achievable within a year or two.

MasterCard (MA) looks like one of the best Financial stocks to own in 2011 as the low P/E of 14 and good profit growth ahead give this stock solid upside in both 2011 and 2012 — you just have to deal with the politics.

Mastercard (MA) expectes profit growth of more than 20% for the next three years. With a P/E of 16, this stock is undervalued and has good upside potential. Here’s when I expect MA to eclipse its all-time high.

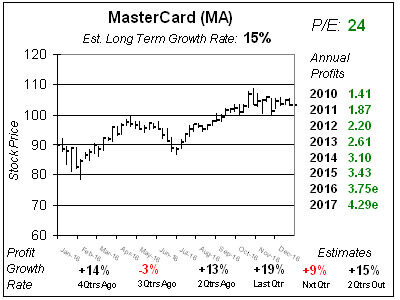

Left: MA’s ten-year chart shows the company has growth profits consistently even through tough economic times.

Mastercard (MA) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $3.24 vs. $2.80 = +16%

Revenue Est: +10%