About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

MA is a technology company in the global payments industry. MA connects consumers, financial institutions, merchants, Governments and businesses around the world, enabling them to use electronic forms of payment instead of cash and checks. MA brands include MasterCard, Maestro and Cirrus. It provides offerings, such as loyalty and reward programs, information services and consulting. The Company focuses on segments, including Government programs, such as Social Security payments, unemployment benefits; commercial programs, such as payroll, health savings accounts, employee benefits and others, and consumer reloadable programs for individuals without formal banking relationships and non-traditional users of electronic payments. MA provides a variety of products and solutions that support payment products that customers can offer to their cardholders. Source: Thomson Financial

MA is a technology company in the global payments industry. MA connects consumers, financial institutions, merchants, Governments and businesses around the world, enabling them to use electronic forms of payment instead of cash and checks. MA brands include MasterCard, Maestro and Cirrus. It provides offerings, such as loyalty and reward programs, information services and consulting. The Company focuses on segments, including Government programs, such as Social Security payments, unemployment benefits; commercial programs, such as payroll, health savings accounts, employee benefits and others, and consumer reloadable programs for individuals without formal banking relationships and non-traditional users of electronic payments. MA provides a variety of products and solutions that support payment products that customers can offer to their cardholders. Source: Thomson Financial MasterCard (MA) is on a roll as it has beaten the street and had annual profit estimates climb the past three qtrs. During the last three qtrs 2016 profit estimates have climbed from $3.54 to $3.63 and now $3.75. 2017’s estimate has risen from $4.14 to $4.20 and $4.29. These little differences make a big difference over the course of the year, and these bump-ups also signal a healthy business.

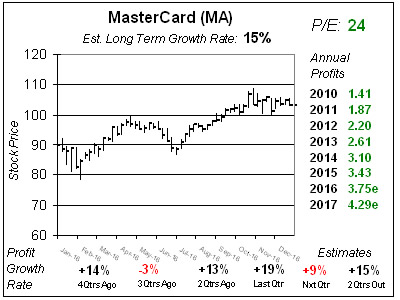

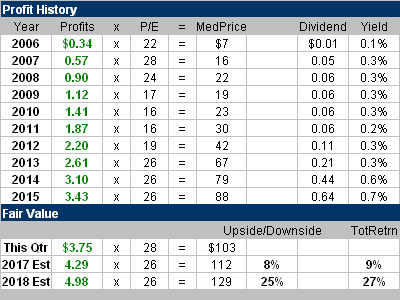

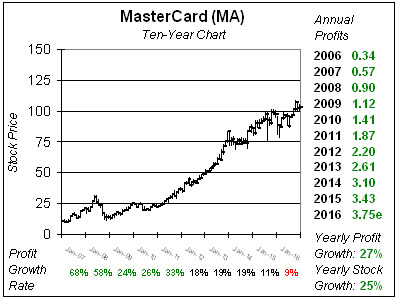

MasterCard (MA) is on a roll as it has beaten the street and had annual profit estimates climb the past three qtrs. During the last three qtrs 2016 profit estimates have climbed from $3.54 to $3.63 and now $3.75. 2017’s estimate has risen from $4.14 to $4.20 and $4.29. These little differences make a big difference over the course of the year, and these bump-ups also signal a healthy business.