The stock market gained further on Thursday as 10-year Treasury yield fell below 4%. Investors were also confident as the Federal Reserve indicated on Wednesday that they may cut interest rate three times next year.

The stock market gained further on Thursday as 10-year Treasury yield fell below 4%. Investors were also confident as the Federal Reserve indicated on Wednesday that they may cut interest rate three times next year.

Overall, S&P 500 was up 0.3% to 4,720, while NASDAQ grew 0.2% to 14,762.

Tweet of the Day

Interested in this turn spot in $PLTR could be the low in the overall handle to the base. pic.twitter.com/IDEr69ivos

— Leif Soreide (@LeifSoreide) November 28, 2023

Chart of the Day

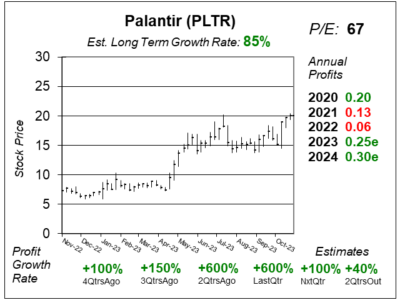

Here is the one-year chart of Palantir (PLTR) as of November 15, 2023, when the stock was at $20.

Here is the one-year chart of Palantir (PLTR) as of November 15, 2023, when the stock was at $20.

Palantir’s US commercial business showed impressive marks of growth last quarter. US Commercial revenue grew 33% year-over-year, and this was driven by the company’s AI Platform (AIP) which allows customers to activate AI models in their own private networks. AIP had a significant impact on Palantir’s commercial business in terms of new customer adoption and expanded use for existing customers. Customer count in this segment grew 37% year-over-year.

Looking at the bigger picture, US commercial customer count has grown tenfold in the past three years. In terms of the number of US commercial deals, this has grown 140% from a year ago, while total contract value grew 55%. Palantir also enjoyed its fourth consecutive quarter of GAAP profitability.

Palantir is on the radar for the Growth Portfolio. David Sharek, Founder of School of Hard Stocks, does not think that the stock has enough momentum to move higher right now.