Palantir (PLTR) is Seeing a Flood of Demand from US Commercial Customers

Palantir (PLTR) is doing bootcamps to show potential corporate customers use cases, and its creating a flood of demand.

Palantir (PLTR) is doing bootcamps to show potential corporate customers use cases, and its creating a flood of demand.

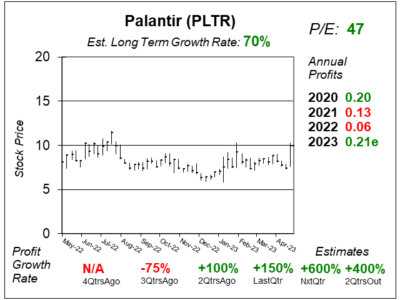

Last quarter, Palantir’s (PLTR) US commercial business grew 33% year-over-year driven by the company’s AI Platform (AIP).

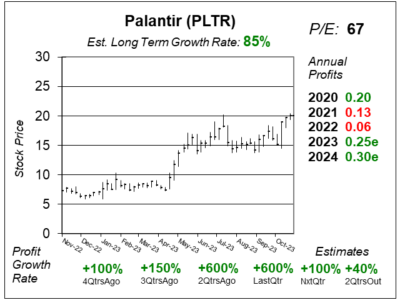

Palantir (PLTR) stock has been going sideways lately as revenue growth has slowed to 13% last qtr from 18% two quarters ago.

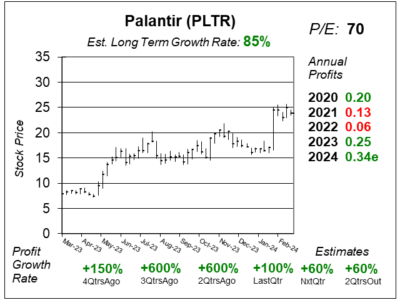

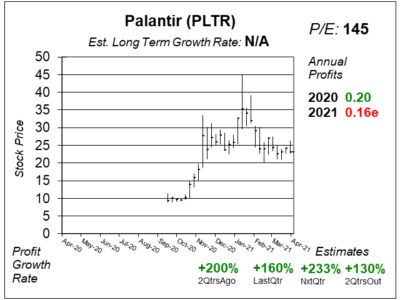

Palantir (PLTR) is one of the most admired stocks right now as the combination of company profits and AI have the shares surging.

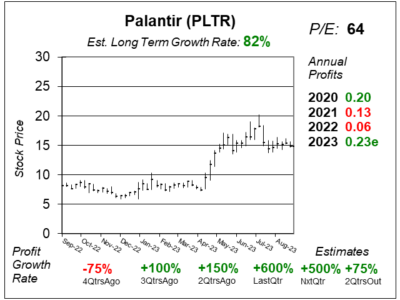

Palantir (PLTR) the company is growing briskly, but the stock hit a 52-week low today on high volume. Time to sell PLTR.

Palantir (PLTR) just announced a software offering for crypto exchanges, which is perfect timing as crypto in FinTech expands.

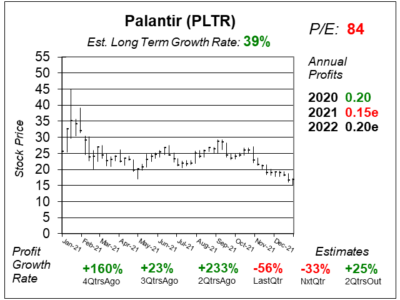

Software developer Palantir (PLTR) has a lot of great stuff going for it, but the stock still seems to be worth $23 in my opinion.

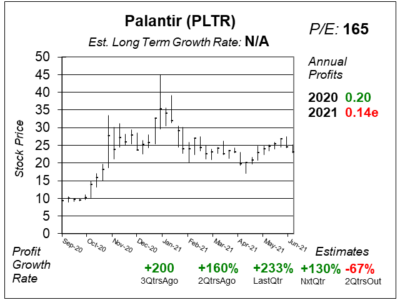

Palantir (PLTR) offers a central operating software that can control the production of goods from materials to delivery.

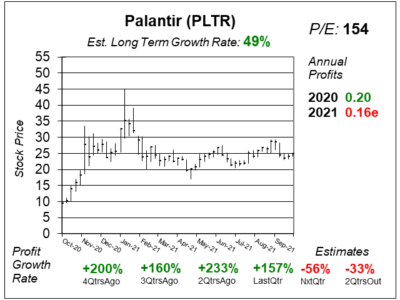

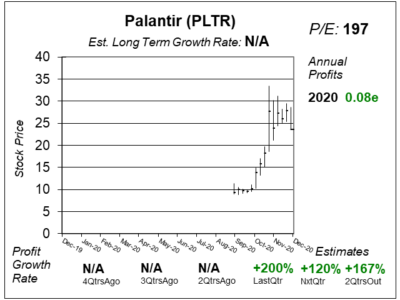

Palantir (PLTR) has a super-sophisticated software that answers complex questions using data. But what’s the stock worth?

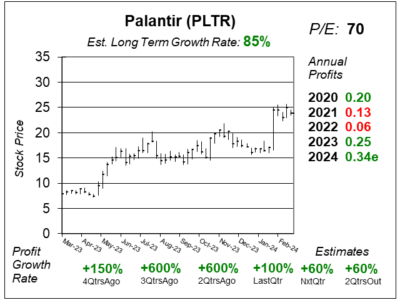

Palantir (PLTR) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.08 vs. $0.05 = +60%

Revenue Est: +19%