The stock market closed relatively flat on Monday as investors await the Federal Reserve’s meeting for its latest interest-rate decision.

The stock market closed relatively flat on Monday as investors await the Federal Reserve’s meeting for its latest interest-rate decision.

Overall, S&P 500 grew 0.1% to 4,454, while NASDAQ closed flat at 13,710.

Tweet of the Day

$SMCI should bounce off the 100 Day MA, but will watch for the next few days pic.twitter.com/CEyPT9x70k

— Mukund Mohan (@mukund) September 18, 2023

Chart of the Day

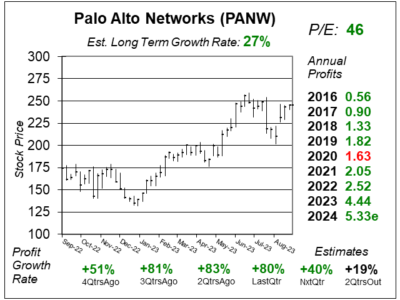

Here is the one-year chart of Palo Alto Networks (PANW) as of September 6, 2023, when the stock was at $245.

Here is the one-year chart of Palo Alto Networks (PANW) as of September 6, 2023, when the stock was at $245.

Palo Alto Networks has the industry’s most comprehensive platform for large organizations, and delivers both hardware and software to prevent and/or stop breaches. This company is the top cyber-security provider within the Network Security business, and has recently broadened its spectrum and developed next-generation security platforms in cloud security as well as data analysis to detect future events from occurring.

Palo Alto Networks continues its strong profit growth despite the challenging macro. Profit grew 80% — the third consecutive quarter in which profit grew in the 80s — while revenue grew 26%. Large deals are becoming an important contributor to growth, outpacing the growth of the overall business. Deals more than $10 million grew 37% year-over-year while deals more than $20 million grew 43%. The company even added the most annual recurring revenue out of all cybersecurity-focused companies last quarter.

The company expected the macro to be challenging this year so they got ahead by front-loading their sales hiring, preparing teams with tougher procurement, and applying more scrutiny to their pipeline. While overall, there was no significant impact to last quarter, the company saw customer budget scrutiny leading customers to hold on to their cash and seek deferred payment terms. Bookings that have deferred payments grew around 45% year-over-year.

PANW is part of the Growth Portfolio and Aggressive Growth Portfolio.