The stock market improved on Thursday as investors looked ahead to key inflation data next week as well as the Fed’s latest policy announcement.

The stock market improved on Thursday as investors looked ahead to key inflation data next week as well as the Fed’s latest policy announcement.

Overall, S&P 500 climbed 0.6% to 4,294, while NASDAQ rose 1.0% to 13,239.

Tweet of the Day

Heavy truck sales continue to increase.

Before the past 7 recessions we saw this decline well before the recession started.

You want to talk about leading indicators of a recession? I'll take this every time.

Yet another clue a recession isn't imminent like we keep hearing. pic.twitter.com/blLm0bLgiT

— Ryan Detrick, CMT (@RyanDetrick) June 8, 2023

Chart of the Day

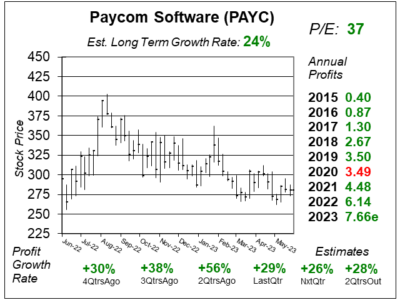

Here is the one-year chart of Paycom Software (PAYC) as of May 31, 2023, when the stock was at $280.

Here is the one-year chart of Paycom Software (PAYC) as of May 31, 2023, when the stock was at $280.

Paycom Software offers a complete cloud-based HR program for small and medium sizes businesses (50-10,000 employees) that human resource personnel can log into online to process payroll and benefits for employees.

Paycom Software remains an undervalued gem in today’s stock market. Last quarter, the payroll and HR software company delivered 29% profit growth as revenue climbed a solid 28%. That’s great growth for a stock with a P/E of only 37. The strong US labor market gives this stock more certainty than it had 6 months ago, when fears of a recession were on the minds of investors.

Paycom’s Beti platform is driving new client additions as it can automate payroll processes. Management attributes its growth to a continuing trend toward self-service options for payroll and human capital management. The company is also working to establish its International foothold, with its global products now available in 15 languages.

PAYC is part of the Growth Portfolio and Aggressive Growth Portfolio. This company has the ability to grow sales, profits, and perhaps its stock 25% a year.