The stock market rebounded on Wednesday as Federal Reserve Chair Jerome Powell said that interest rate cuts are still likely this year. Meanwhile, the number of U.S. job openings declined slightly to 8.9 million in January from 9.0 million in the previous month. It is believed that employers hesitate to open job vacancies due to uncertain economic outlook.

The stock market rebounded on Wednesday as Federal Reserve Chair Jerome Powell said that interest rate cuts are still likely this year. Meanwhile, the number of U.S. job openings declined slightly to 8.9 million in January from 9.0 million in the previous month. It is believed that employers hesitate to open job vacancies due to uncertain economic outlook.

Overall, S&P 500 was up 0.5% to 5,105, while NASDAQ increased 0.6% to 16,032.

Tweet of the Day

Both $SNOW and Databricks are winning share from traditional datawarehousing, but it's also clear a battle is brewing between the two. Databricks' advantage is that it is really built around data science and machine learning workloads, whereas SNOW is designed for traditional…

— Tech Fund (@techfund1) March 3, 2024

Chart of the Day

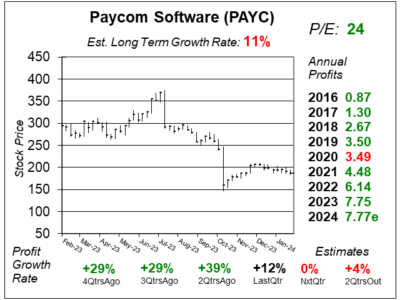

Here is the one-year chart of Paycom Software (PAYC) as of February 13, 2024, when the stock was at $187.

Here is the one-year chart of Paycom Software (PAYC) as of February 13, 2024, when the stock was at $187.

Paycom Software has had a real slowdown in terms of profit growth. Quarterly profits have slid from 39% two quarters ago to 12% last quarter and with 0% expected next quarter.

Last quarter, the stock dropped like a rock after the company lowered guidance and blamed the slowdown on the efficiency of its Beti app, which allows employees to make benefit changes via an app. In turn, however, such lowers Paycom Software’s billable hours.

The company’s revenue retention rate has ticked down to 90% in 2023 from 91% in 2022. This used to be 94%. Management blamed this on companies going out of business. Client count was up only 1% during 2024 to 36,820. During the past three quarters, 2024 profit estimates have slid from $9.27 to $8.38 to $7.77. That is not good.

PAYC is part of the Growth Portfolio. The chart is ugly, but at least the stock is basing here.