Stock (Symbol) |

Paycom Software (PAYC) |

Stock Price |

$280 |

Sector |

| Technology |

Data is as of |

| May 31, 2023 |

Expected to Report |

| July 31 |

Company Description |

Paycom Software, Inc. is a provider of cloud-based human capital management (HCM) solutions delivered as software-as-a-service (SaaS). Paycom Software, Inc. is a provider of cloud-based human capital management (HCM) solutions delivered as software-as-a-service (SaaS).

The Company provides functionality and data analytics that businesses need to manage the complete employment life cycle from recruitment to retirement. The Company’s applications streamline client processes and provide clients and their employees with the ability to directly access and manage administrative processes, including applications that identify candidates, on-board employees, manage time and labor, administer payroll deductions and benefits, manage performance, terminate employees and administer post-termination health benefits, such as COBRA. Its solution allows clients to analyze employee information to make business decisions. Its HCM solution offers a range of applications, including talent acquisition, time and labor management, payroll, talent management and human resources (HR) management applications. Source: Refinitiv |

Sharek’s Take |

Paycom Software (PAYC) remains an undervalued gem in today’s stock market. Last quarter the payroll and HR software company delivered 29% profit growth as revenue climbed a solid 28. That’s great growth for a stock with a P/E of only 37. The strong US labor market gives this stock more certainty than it had 6 months ago, when fears of a recession were on the minds of investors. Paycom’s Beti platform is driving new client additions as it can automate payroll processes. Management attributes its growth to a continuing trend toward self-service options for payroll and human capital management. The company is also working to establish its International foothold, with its global products now available in 15 languages. Paycom Software (PAYC) remains an undervalued gem in today’s stock market. Last quarter the payroll and HR software company delivered 29% profit growth as revenue climbed a solid 28. That’s great growth for a stock with a P/E of only 37. The strong US labor market gives this stock more certainty than it had 6 months ago, when fears of a recession were on the minds of investors. Paycom’s Beti platform is driving new client additions as it can automate payroll processes. Management attributes its growth to a continuing trend toward self-service options for payroll and human capital management. The company is also working to establish its International foothold, with its global products now available in 15 languages.

Paycom Software offers a complete cloud-based HR program for small and medium sizes businesses (50-10,000 employees) that human resource personnel can log into online to process payroll and benefits for employees. The company ended 2022 with approximately 36,600 clients, or just 5% of the addressable market. Its two largest competitors have around 1.7 million clients combined. Paycom’s software makes it easy to do talent acquisition and background checks, to payroll and time-off requests, as well as compliance tasks such as government registrations, benefits administration, COBRA and retirement. Competitors include (ranked by highest avg client size): Workday, Ceridian, Ultimate Software, Paycom, Paylocity, ADP and Paychex (source: Paylocity). Paycom has a new app called BETI which allows employees to do, review, and check their payroll. This is great because employees can adjust their tax deductions, move funds in their 401k, or adjust their healthcare without taking time from the HR department. The company also has an app called Manager-on-the-Go, which gives managers 24/7 accessibility to manager side functionality of Paycom’s existing mobile app. Paycom has a nice expansion model:

Paycom used to be a “rapid grower”, which in my eyes is a company growing profits at 65% a year or more. Now, I think this is a 30%-35% grower. Profit margins are HUGE with 2022’s around 85%. The stock currently has an Estimated Long-Term Growth Rate of 24%. I’m impressed with Paycom’s stock buyback plan. In 2022, management repurchased $100 million in stock. Last qtr, the company has $506 million in cash and $29 million in debt. On May 1, the Board of Directors approved a quarterly dividend program, the first dividend was paid this month, $0.375 per share. PAYC is part of the Growth Portfolio and Aggressive Growth Portfolio. This company has the ability to grow sales, profits, and perhaps its stock 25% a year Higher interest rates also help profits, as the company holds payroll funds for 2-3 days before checks are delivered, in addition to holding client taxes that are set to be paid. |

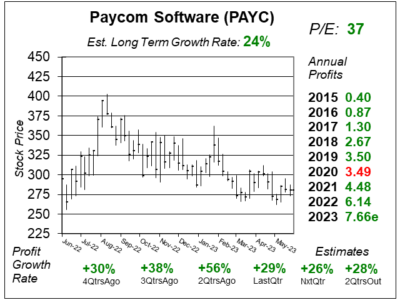

One Year Chart |

While profit grows an impressive 29% last qtr, the stock continues to trend lower. That’s fine with me. I feel the market is wrong. While profit grows an impressive 29% last qtr, the stock continues to trend lower. That’s fine with me. I feel the market is wrong.

The P/E has fallen from 40 to 37 since last qtr. Annual Profits have grown exceptionally well outside of 2020, when customers were laying off employees. The Est. LTG is 24%, unchanged since last qtr. The Est. LTG was between 25% and 27% before the pandemic period. |

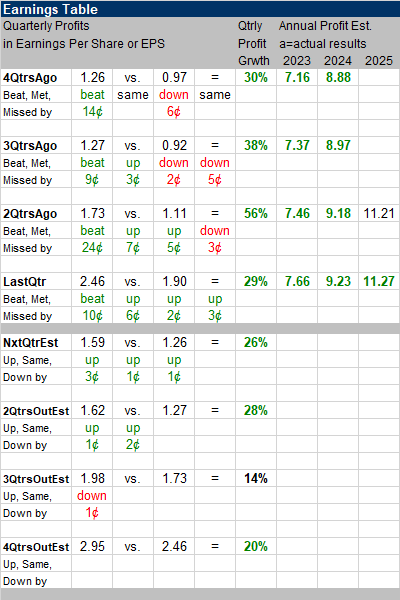

Earnings Table |

Last qtr, Paycom posted 29% profit growth and beat estimates of 24% growth. Revenue increased 28%, year-over-year , and beat estimates of 26%. Recurring revenue grew 28%, representing 98% of company sales. Last qtr’s 29% profit growth came on top of 32% growth in the year-ago period. Last qtr, Paycom posted 29% profit growth and beat estimates of 24% growth. Revenue increased 28%, year-over-year , and beat estimates of 26%. Recurring revenue grew 28%, representing 98% of company sales. Last qtr’s 29% profit growth came on top of 32% growth in the year-ago period.

Revenue growth was driven by new product offerings and strong demand for employee self-service options such as what the Beti app offers. The platform had 3,000 new clients last qtr. Management sees Beti as a key differentiator in the market as it allows employees to do their own payroll, thus automating payroll processes. Management also saw rapid growth with large organizations which comprise 95% of its revenue. Paycom is currently laying the groundwork for the international market. The company’s global product for human capital management now works in 15 languages across 180 countries. Annual Profit Estimates increased again this qtr These estimates keep climbing! For 2023, management expects revenue to grow 25%. Qtrly Profit Estimates are for 26%, 28%, 14%, and 20% the next 4 qtrs. For next qtr, management raised its outlook and expects revenue to grow 25%. Analysts think that PAYC revenue will grow 26%. |

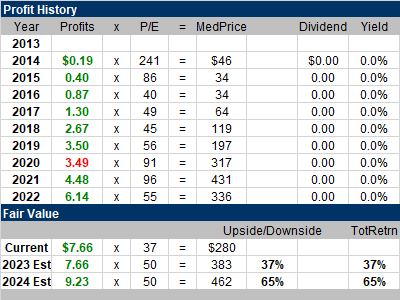

Fair Value |

From 2016 Q2 to 2020 Q1 (pre-COVID) PAYC had an average P/E of 57 according to my one-year charts. From 2016 Q2 to 2020 Q1 (pre-COVID) PAYC had an average P/E of 57 according to my one-year charts.

My Fair Value P/E remains at 50 this qtr. The stock has 37% upside to my 2023 Fair Value of $383 and 65% upside to 2024’s Fair Value of $462. |

Bottom Line |

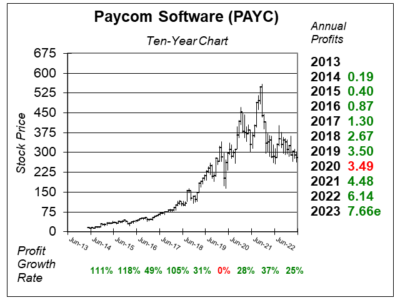

Paycom Software (PAYC) used to have a perfect ten-year chart. Unfortunately it was too perfect, and the stock proceeded to crash after going on a parabolic run higher in 2021. The stock is now building a new base. Paycom Software (PAYC) used to have a perfect ten-year chart. Unfortunately it was too perfect, and the stock proceeded to crash after going on a parabolic run higher in 2021. The stock is now building a new base.

This is one of the last remaining values in the stock market. The 37 P/E is the lowest P/E since I started following the stock. I originally purchased PAYC ~$44 after my 2016 Q4 report when the P/E was 42. PAYC jumps from 8th to 3rd in the Growth Portfolio Power Rankings. The stock stays at 4th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

3 of 29Aggressive Growth Portfolio 4 of 19Conservative Stock Portfolio N/A |