The stock market rebounded on Thursday and ended its three-day losing streak. The 10-year Treasury yield rose 4.1% as latest labor market data indicated tightness. Initial claims for unemployment benefits dropped to their lowest level since September 2022 to 187,000, down 16,000 from the previous period.

The stock market rebounded on Thursday and ended its three-day losing streak. The 10-year Treasury yield rose 4.1% as latest labor market data indicated tightness. Initial claims for unemployment benefits dropped to their lowest level since September 2022 to 187,000, down 16,000 from the previous period.

Today’s market rally was led by tech companies. NASDAQ increased 1.4% to 15,056. Meanwhile, S&P 500 was up 0.9% to 4,781.

Tweet of the Day

The market is extremely short term oversold here. In fact, we are more oversold than at the November 1, 2023 low. Additionally, the market avoided a distribution day as volume on the Nasdaq was 19% lower than yesterday and 8% less on the NYSE. We saw supportive action in semi's… pic.twitter.com/CuyQIFT4ad

— Roy Mattox (@RoyLMattox) January 18, 2024

Chart of the Day

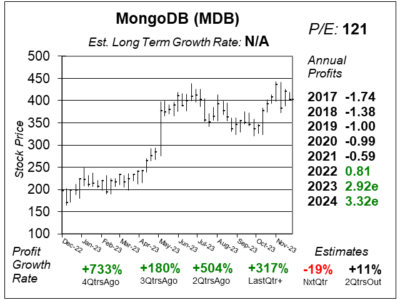

Here is the one-year chart of MongoDB (MDB) as of December 20, 2023, when the stock was at $402.

Here is the one-year chart of MongoDB (MDB) as of December 20, 2023, when the stock was at $402.

MongoDB (MDB) is a software platform that allows programmers to build apps and manage data. The company is now at a point where profits are rolling in. Last quarter, MongoDB delivered a $0.96 profit (in EPS) versus just $0.23 a year ago. That was 317% profit growth! Revenue increased 30%. Growth, however, might slow next quarter. Revenue is expected to climb just 21%. That is not much for a company that has gotten a 121 P/E. David Sharek, Founder of School of Hard Stocks, is concerned about this stock as slower growth might lead to a lower P/E ratio.

MongoDB claims its different than other software companies as it starts a new relationship with the first workload, then acquires more workloads over time. However, the stock is expensive with a 121 P/E, as investors are aware of this and are aware more revenue is coming. MDB is part of the Growth Portfolio.