Stock (Symbol) |

MongoDB (MDB) |

Stock Price |

$328 |

Sector |

| Technology |

Data is as of |

| September 27, 2023 |

Expected to Report |

| December 4 |

Company Description |

MongoDB is a modern, general-purpose database platform. MongoDB is a modern, general-purpose database platform.

The Company’s platform enables developers to build and modernize applications across a range of use cases in the cloud, on-premise or in a hybrid environment. The Company’s lead offerings are MongoDB Atlas and MongoDB Enterprise Advanced. MongoDB Atlas is its hosted multi-cloud database-as-a-service (DBaaS) offering that includes infrastructure and management of its database. MongoDB Enterprise Advanced is its commercial database server offering for enterprise customers that can run in the cloud, on-premise or in a hybrid environment. Its MongoDB application data platform’s complementary services and products include MongoDB Atlas Search, MongoDB Atlas Data Lake, MongoDB Charts and MongoDB Realm. The Company provides professional services to its customers, including consulting and training. It has over 33,000 customers spanning a range of industries in more than 100 countries around the world. Source: Refinitiv |

Sharek’s Take |

In last quarter’s earnings call, MongoDB (MDB) management was bullish on AI as the use of code generation can enable programmers to build applications faster. Data can be used by developers to create smarter applications that transform a business. AI apps are exceptionally demanding, and require a modern data platform like MongoDB. This company looks to be a benefactor of the advances in AI. Meanwhile, MDB delivered strong results last quarter as profit grew 504% while revenue increased 40%, both coming in above analyst expectations. In last quarter’s earnings call, MongoDB (MDB) management was bullish on AI as the use of code generation can enable programmers to build applications faster. Data can be used by developers to create smarter applications that transform a business. AI apps are exceptionally demanding, and require a modern data platform like MongoDB. This company looks to be a benefactor of the advances in AI. Meanwhile, MDB delivered strong results last quarter as profit grew 504% while revenue increased 40%, both coming in above analyst expectations.

Here are some highlights as of last qtr:

MongoDB is a database platform that helps software developers build internet applications that utilize vast volumes of data, while improving developer productivity (which developers like). MDB’s architecture makes it easy for developers to manage data and to build and maintain applications. So companies might decide to use this software at the IT guy’s request; it makes their job easier. During 2017-2020, developers ranked MDB as the #1 database they wanted to work with (Source: Stack Overflow Annual Developer Survey). As of April 30, 2022, MDB had over 40,000 customers spanning a wide range of industries in more than 100 countries around the world, and no single customer represented more than 10% of the company’s total revenue. MDB has business partnerships with all three major cloud providers (Amazon Web Service, Google Cloud Platform and Microsoft Azure), as well as with independent software vendors and global systems integrators including IBM, Accenture, Infosys, Confluent, and many others. MDB’s portfolio is based around cloud (Atlas) and non-cloud (Enterprise Advanced) products:

Last qtr, MDB launched several new offerings:

MongoDB claims its different than other software companies as it starts a new relationship with the first workload, then acquires more workloads over time. But the stock is expensive, as investors are aware of this and are aware more revenue is coming. The stock has a 166 P/E this quarter. On a price-to-revenue basis, the stock sells for 14x 2023 revenue estimates, or $328 per share. My Fair Value is 15x revenue or $340. MDB had one of the best quarters of any stock I follow and I will add the shares to the Growth Portfolio. I imagine the stock will rise at the rate annual revenue does moving forward. That may be 25% to 35% a year. |

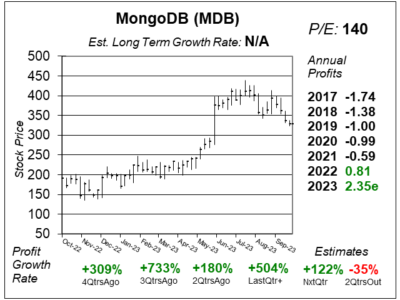

One Year Chart |

This stock is consolidating at higher levels after it jumped 2QtrsAgo. The stock has since pulled back a bit due to a correction in the stock market. I will use this weakness to pick up shares here. The stock market is trying to start a new rally today. This stock is consolidating at higher levels after it jumped 2QtrsAgo. The stock has since pulled back a bit due to a correction in the stock market. I will use this weakness to pick up shares here. The stock market is trying to start a new rally today.

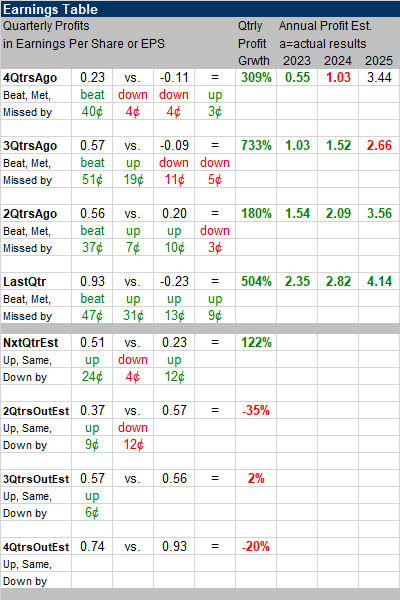

Quarterly profit growth has been excellent the past four quarters. Estimates for next quarter are great but comparisons get tougher 2QtrsOut. The P/E is high at 140, but profits are jumping so fast investors are thinking ahead. |

Earnings Table |

Last qtr, MongoDB delivered 504% profit growth and beat estimates of 300% growth. Revenue increased 40% against estimates of 29%. Gross profit margin expanded to 78% from 73% last year due to better-than-expected licensing revenues. Non-GAAP operating margin was also at a record 19%. Last qtr, MongoDB delivered 504% profit growth and beat estimates of 300% growth. Revenue increased 40% against estimates of 29%. Gross profit margin expanded to 78% from 73% last year due to better-than-expected licensing revenues. Non-GAAP operating margin was also at a record 19%.

Atlas revenue growth was driven by improved consumption while non-Atlas revenue growth, specifically for Enterprise Advance (EA), was driven by an increased number of multi-year deals and strong licensing revenues. MDB benefited from additional workload acquisitions from existing customers as well as new business wins with 1,900 new customers last qtr. Business wins include the adoption of companies such as Renault, Hootsuite, Ford, Cathay Pacific, Foot Locker, MarketAccess, Powerledger, Wells Fargo and System1. Annual Profit Estimates have been jumping higher. Management raised its revenue outlook for 2024 from $1.5 billion to $1.6 billion, representing 25% growth year-over-year. Management also raised their estimates for non-Atlas revenues for the rest of the year, but they expect growth to be offset by difficult comparisons. Qtrly Profit Estimates are for 122%, -35%, 2%, and -20% the next 4 qtrs. Management expects a sequential decline in non-Atlas revenues next qtr as they do not expect the same level of business activity, particularly with licensing deals. Last quarter MDB had a lot of licensing revenue. Licensing revenues contains large upfront, boosting margins, but management does not expect to repeat this performance in the next qtrs. Analysts expect revenue to grow 21% next quarter. |

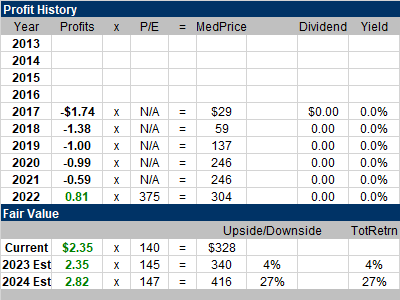

Fair Value |

This qtr, MDB sells for 14x 2023 revenue estimates. My Fair Value is 15x revenue, which is $339 a share: This qtr, MDB sells for 14x 2023 revenue estimates. My Fair Value is 15x revenue, which is $339 a share:

Current qtr: 2023 Fair Value: 2024 Fair Value: |

Bottom Line |

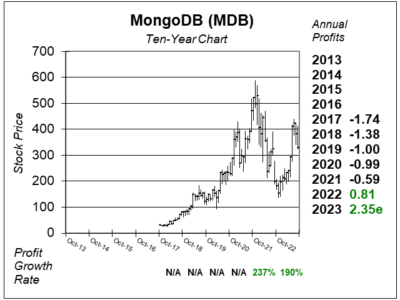

MongoDB (MDB) opened for trading at $33 in October 2017 and went parabolic. It eventually peaked at $590 in November 2021. Then the stock came tumbling down and bottomed at $135 in November 2022. The stock recently surged up to $400 and has settled back to the $330 range with the stock market in a correction. MongoDB (MDB) opened for trading at $33 in October 2017 and went parabolic. It eventually peaked at $590 in November 2021. Then the stock came tumbling down and bottomed at $135 in November 2022. The stock recently surged up to $400 and has settled back to the $330 range with the stock market in a correction.

MongoDB is the database platform programmers use. And AI will bring more business its way. This looks like one of the top tech stocks to own, but with a high P/E the shares can be especially volatile and perhaps risky. MDB will be added to the Growth Portfolio. The stock will rank 17th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

17 of 30Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |