The stock market grew on Monday as investors shrugged off the rise in Treasury yields, and focused on the series of corporate earnings to be released this week.

The stock market grew on Monday as investors shrugged off the rise in Treasury yields, and focused on the series of corporate earnings to be released this week.

The 10-year Treasury yield rose to 4.71%.

Overall, S&P 500 was up 1.1% to 4,374, while NASDAQ increased 1.2% to 13,568.

Tweet of the Day

https://twitter.com/StockSavvyShay/status/1713570519688306982

Chart of the Day

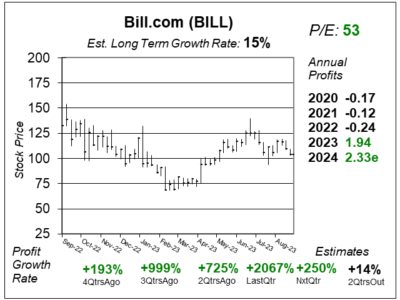

Here is the one-year chart of Bill.com (BILL) as of September 20, 2023, when the stock was at $104.

Here is the one-year chart of Bill.com (BILL) as of September 20, 2023, when the stock was at $104.

Bill.com is a leading provider of cloud-based software company that digitally automates complex back-office financial operations for small and medium businesses (SMB). Its customers use the platform to generate and process invoices, streamline approvals, make and receive payments, sync with their accounting system, and manage their cash.

Bill.com is partnering with Bank of America to work with the banks customer base. It has had a relationship with the bank, but that was just for the bank’s new customers. This new deal is for Bank of America’s existing SMB customers. As part of this move, Bill.com is restructuring its contractual minimums, thus reducing subscription fees for this year. This deal gives Bill.com a huge opportunity to gain new customers, and also helps in its competition against Intuit’s Quickbooks.

In other news, Quickbooks discontinued integrations with Bill.com and offered its mutual customers its own (beta) bill pay platform. In the past, Quickbooks tried to buy a bill pay platform and integrate it (which didn’t work). J.P. Morgan estimates removing the API affects 12,000 Bill.com customers and less than 1% of revenue. Meanwhile, profit grew a whopping 2067% last quarter, but this was because the company reported a loss in the same period last year. Revenue grew 48%.

BILL is part of our Growth Portfolio.