The stock market had another losing session on Monday amid a turmoil in the currency markets.

The stock market had another losing session on Monday amid a turmoil in the currency markets.

The British pound declined to an all-time low against the US Dollar, after the Britain’s government announced a tax cut to boost spending. This, coupled with the Federal Reserve’s aggressive rate hike campaign, caused the US dollar to surge.

Overall, S&P 500 dropped 1.0% to 3,655, while NASDAQ fell 0.6% to 10,803.

Tweet of the Day

The market is the second most oversold that it's ever been per the New York Stock Exchange McClellan Oscillator.

The first was the COVID crash.

Wow. pic.twitter.com/XNz8VUVbUz

— Markets & Mayhem (@Mayhem4Markets) September 24, 2022

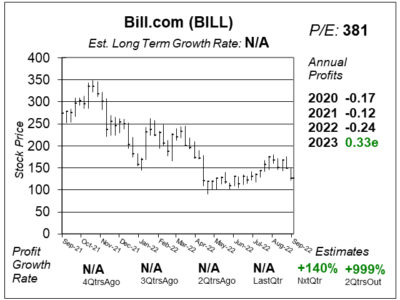

Meanwhile, Bill.com (BILL) looks to go profitable as soon as next qtr.

Chart of the Day

Our chart of the day is the one-year chart of BILL as of September 10, 2022, when the stock was at $167.

Our chart of the day is the one-year chart of BILL as of September 10, 2022, when the stock was at $167.

Bill.com is a leading provider of cloud-based software company that digitally automates complex back office financial operations for small and medium businesses (SMB). Its customers use the platform to generate and process invoices, streamline approvals, make and receive payments, sync with their accounting system, and manage their cash.

Note that the company is expected to make a profit next qtr. Still, the profit is expected to be small ($0.06 a share). Top stocks often have triple digit profit growth as they run higher.

In this case, the stocks high P/E makes it seem as though the stock’s next move depends on the stock market. If the market rallies, stock could shoot higher. If we head to new lows, this stock could rumble lower.

BILL is on the radar for the Aggressive Growth Portfolio.