The stock market rallied on Wednesday as the Federal Reserve signaled that there would be three rate cuts later this year. During its meeting, the central bank left interest rates unchanged.

The stock market rallied on Wednesday as the Federal Reserve signaled that there would be three rate cuts later this year. During its meeting, the central bank left interest rates unchanged.

Overall, S&P 500 increased 0.9% to 5,225, while NASDAQ was up 1.3% to 16,369.

Tweet of the Day

Federal Reserve Chair Jerome Powell said recent high inflation readings had not changed the underlying ‘story’ of slowly easing price pressures in the US as the central bank stayed on track for three interest rate cuts this year https://t.co/gzGt8031Iv pic.twitter.com/M9AiWxk57E

— Reuters (@Reuters) March 21, 2024

Chart of the Day

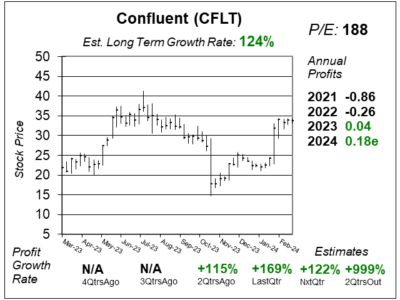

Here is the one-year chart of Confluent (CFLT) as of March 1, 2024, when the stock was at $34.

Here is the one-year chart of Confluent (CFLT) as of March 1, 2024, when the stock was at $34.

Confluent stock bounced back after the company reported solid earnings. Basically, the stock dropped from the low-$30s to the low-$20s after the company reported that they lost two big customers. Last quarter, however, was good, and the stock bounced right back into the low-$30s.

2023 was a tight year for IT budgets and management is now seeing normalization with large enterprises and the digital native space. Gross retention rate and win rates improved last quarter, which is positive.

CFLT is part of the Growth Portfolio. This is one software stock that seems to still have good upside after the recent stock market surge.