Stock (Symbol) |

Confluent (CFLT) |

Stock Price |

$33 |

Sector |

| Technology |

Data is as of |

| August 31, 2023 |

Expected to Report |

| October 31 |

Company Description |

Confluent, Inc. is engaged in designing data infrastructure to connect the applications, systems, and data layers around a real-time central nervous system. Confluent, Inc. is engaged in designing data infrastructure to connect the applications, systems, and data layers around a real-time central nervous system.

The Company is focused on developing a category of data infrastructure focused on data in motion for developers and enterprises. It enables enterprises to deliver customer experiences for their business functions, departments, teams, applications, and data stores to have connectivity. It is designed to have real-time data from multiple sources streamed across an enterprise for real-time analysis. Its offering enables organizations to deploy production-ready applications that run across cloud infrastructures and data centers, with features for security and compliance. Its platform provides the capabilities to fill the structural, operational, and engineering gaps in businesses. It enables software developers to build their applications to connect data in motion and enables enterprises to make data in motion to everything they do. Source: Refinitiv |

Sharek’s Take |

Confluent (CFLT) is on the cusp of becoming profitable. If profits begin to come in, the event could cause the stock to go on a run higher. CFLT had been delivering losses every quarter since its IPO in June 2021. Then last quarter the company broke even wit EPS of $0.00 per share (on a non-GAAP basis). Analysts think profits will be $0.00 next quarter, then $0.05 two quarters from now. I think a profit will be made this quarter as CLFT has been beating estimates. Since comparisons from the year-ago periods are losses, a profit would be recorded as triple-digit revenue growth, a key characteristic top stocks possess. Thus, a profit could cause the stock to make a run higher. Confluent (CFLT) is on the cusp of becoming profitable. If profits begin to come in, the event could cause the stock to go on a run higher. CFLT had been delivering losses every quarter since its IPO in June 2021. Then last quarter the company broke even wit EPS of $0.00 per share (on a non-GAAP basis). Analysts think profits will be $0.00 next quarter, then $0.05 two quarters from now. I think a profit will be made this quarter as CLFT has been beating estimates. Since comparisons from the year-ago periods are losses, a profit would be recorded as triple-digit revenue growth, a key characteristic top stocks possess. Thus, a profit could cause the stock to make a run higher.

Confluent’s (CFLT) is the heart of “data in motion” which is utilizing data in real time. No waiting for reports to congregate statistics. With Confluent, organizations can see what’s going on as its happening, then immediately react to changes in its business. Confluent builds on the open-source Apache Kafka platform which the company’s founders created for LinkedIn. Kafka is used to build real-time streaming applications. Kafka organizes data into sets of “topics” (such as posts, likes, and comments) which are stored and can be quickly retrieved and analyzed in a large scale (like Facebook). Speed is especially important with fraud detection with credit cards. The company’s main offerings include:

Here are some other stats from last qtr:

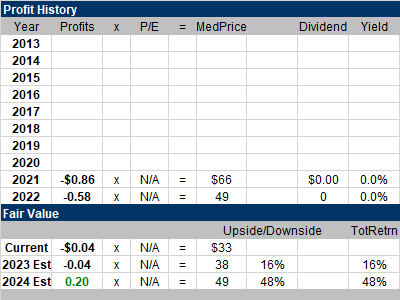

CFLT isn’t making profits yet, so I value the stock on a price-to-annual revenue basis. Management attributes losses on restructuring an the cost of acquiring Immerok (source: Investors.com). At $33, the stock sells for 13x 2023 revenue. My Fair Value is 15x, which is $38 for this year and $49 in 2024. That’s 48% upside when we look to next year. Since we are in mid-September now, I want to get ahead of the curve and buy the stock before year-end (and before profitability). CFLT will be purchased for the Growth Portfolio. tomorrow. With revenue expected to climb 32% this year and 28% next year, this company is growing pretty fast considering the slow economy. |

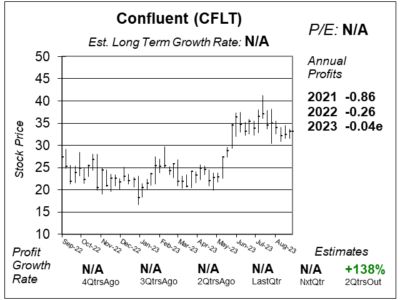

One Year Chart |

CFLT broke out after it reported earnings 2QtrsAgo. The stock has since turned resistance at $30 into support. Now the stock is building a new base. CFLT broke out after it reported earnings 2QtrsAgo. The stock has since turned resistance at $30 into support. Now the stock is building a new base.

No quarterly profits, yet. But profits are expected two quarters from now. I like that the annual losses have been getting smaller. There’s not an Est. LTG this quarter, but this figure was 100% last quarter. |

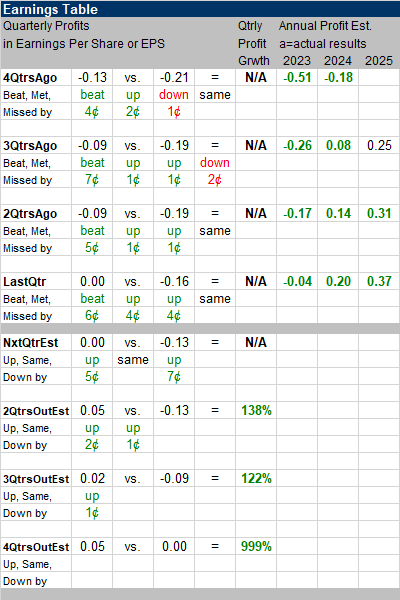

Earnings Table |

Last qtr, CFLT delivered $0.00 per share, and beat estimates of a $0.16 loss. Revenue grew 36% and beat estimates of 31%.The company’s profit margins are steadily improving. Operating Margin jumped to -9% last quarter from -34% a year ago driven by continued efficiencies, hardware optimizations, and increased server tenancy. Last qtr, CFLT delivered $0.00 per share, and beat estimates of a $0.16 loss. Revenue grew 36% and beat estimates of 31%.The company’s profit margins are steadily improving. Operating Margin jumped to -9% last quarter from -34% a year ago driven by continued efficiencies, hardware optimizations, and increased server tenancy.

Annual Profit Estimates continue to climb higher. Qtrly profit Estimates are for 138%, 122%, and 999% profit growth starting 2 qtrs from now. For next qtr, analysts think revenue will grow 29%. |

Fair Value |

My Fair Value is 15x 2023 revenue, giving us a Fair Value of $38 for 2023 and $49 for 2024. My Fair Value is 15x 2023 revenue, giving us a Fair Value of $38 for 2023 and $49 for 2024.

Currently: 2023 Fair Value: 2024 Fair Value: |

Bottom Line |

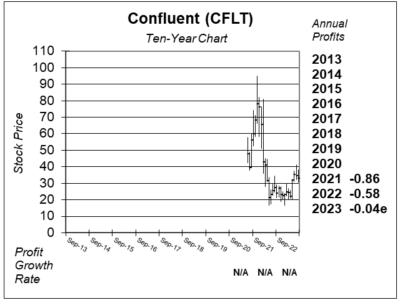

Confluent (CFLT) launched its IPO on June 2021 and the stock opened at $44 a share. This was during the late stages of the Bull Market, and the stock soared after it went public, then peaked at $93 on November 2021. The stock has since fallen, built a new base, and has broken out of that base. Confluent (CFLT) launched its IPO on June 2021 and the stock opened at $44 a share. This was during the late stages of the Bull Market, and the stock soared after it went public, then peaked at $93 on November 2021. The stock has since fallen, built a new base, and has broken out of that base.

CFLT is a new tech stock with lots of promise. I have the stock on my radar, but will pass on buying here as the stock’s just gone from the low-$20s to the mid-$30s. that’s a 50% gain in around a month. CFLT will start out at 19th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

19 of 30Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |