The stock market increased on Wednesday, as inflation continued to cool down.

The stock market increased on Wednesday, as inflation continued to cool down.

The consumer price index rose 3% year-over-year in June. Although such is the lowest rate since March 2021, the rate is still above the Federal Reserve’s target of 2%.

Investors hope that the cooler inflation data weakens the possibility of a rate hike by the central bank.

Overall, S&P 500 grew 0.7% to 4,472, while NASDAQ rose 1.2% to 13,919.

Tweet of the Day

Microsoft is entering the network security business with its SSE product suite. Here is what you need to know:

– The new products are under the newly created Microsoft Entra brand.

– $MSFT core Identity product Azure AD is renamed as Entra ID.

– Two new network security… pic.twitter.com/GhvMXgWOsZ

— Convequity (@convequity) July 12, 2023

Chart of the Day

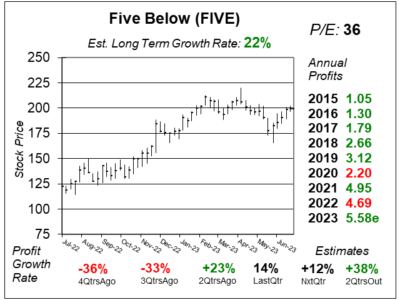

Here is the one-year chart of Five Below (FIVE) as of June 28, 2023, when the stock was at $199.

Here is the one-year chart of Five Below (FIVE) as of June 28, 2023, when the stock was at $199.

Five Below is a dollar-store concept for kids and teens, that sells merchandise such as toys, games, party items, sports gear, clothes, candy & electronics for between $1 and $5.55 each. This company has the fastest dollar-store concept of all the dollar stores (including Dollar Tree and Dollar General).

Five Below is receiving a high-five from investors as its earnings and guidance last quarter surpassed expectations. Although the “fun dollar store” only reported 14% profit growth on 14% sales growth, the dollar store environment is tough right now as American consumers do not have a lot of extra cash to spend. Interest rates are high, especially credit card rates. In addition, government stimulus checks are a thing of the past. The company’s results were helped by strong demand for its trend-right merchandise, including Squish, Hello Kitty, anime, collectibles, and consumables. Management stated it continued to attract and retain new customers, as transactions increased 4%, the highest since 2017.

FIVE has an Estimated Long Term Growth Rate of 22% per year, but David Sharek, Founder of School of Hard Stocks, thinks that this is more of a 25% growth long-term.

FIVE is part of the Growth Portfolio. The stock seems fairly valued here.