The stock marked inched lower on Friday and recorded its second consecutive losing week. Investors continued to weigh if latest inflation data could be a basis of interest rate movement.

The stock marked inched lower on Friday and recorded its second consecutive losing week. Investors continued to weigh if latest inflation data could be a basis of interest rate movement.

Overall, S&P 500 fell 0.1% to 4,464, while NASDAQ declined 0.6% to 13,645.

Tweet of the Day

1. Zillow signed rents declining

2. Vacancy rates rising

3. Apt supply booming“.. suggest that further declines in rental inflation are barreling down the pipe.”@bespokeinvest #CPI pic.twitter.com/GxDp9SOlzw

— Carl Quintanilla (@carlquintanilla) August 10, 2023

Chart of the Day

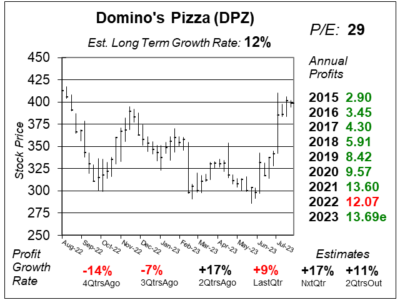

Here is the one-year chart of Domino’s Pizza (DPZ) as of August 2, 2023, when the stock was at $398.

Here is the one-year chart of Domino’s Pizza (DPZ) as of August 2, 2023, when the stock was at $398.

Domino’s is the world’s #2 pizza chain and #1 pizza delivery chain, with more than 18,800 locations in over 90 markets around the world. Around 98% of stores are owned and operated by franchisees. The company generates sales and profits by charging franchisees royalties and fees as well as selling them food, equipment, and supplies. Domino’s is the largest pizza company in the world, based on global retail sales.

DPZ popped after the company announced its deal with Uber to allow orders to be taken on the Uber Eats platform. This could add an additional $1 billion in US sales for Domino’s. The company’s International franchises have already developed $1 billion in business from aggregators. Outside the US, Domino’s and Uber Eats operate in 27 of the same markets, and this new deal will bring Uber Eats customers to 70% of Domino’s stores worldwide. Most importantly, orders placed via Uber Eats will be delivered by Domino’s drivers.

DPZ is part of the Conservative Growth Portfolio. This stock had been down-and-out for a long time, and now the Uber Eats deal could be a turning point for the stock.