Domino’s (DPZ) is Delivering the Profits Again as Customers are Hungry for MORE

Domino’s (DPZ) is out with a Hungry for MORE strategy that includes a better tasting NY pizza and more loyalty rewards.

Domino’s (DPZ) is out with a Hungry for MORE strategy that includes a better tasting NY pizza and more loyalty rewards.

Domino’s (DPZ) is offering its customers MORE bang for their buck with $20 meal deals which include pizza, bread sticks, and more.

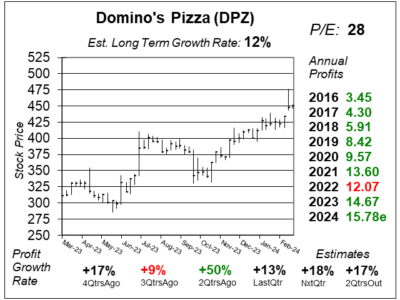

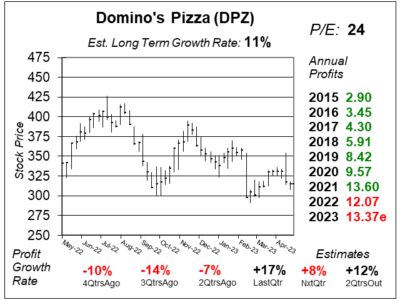

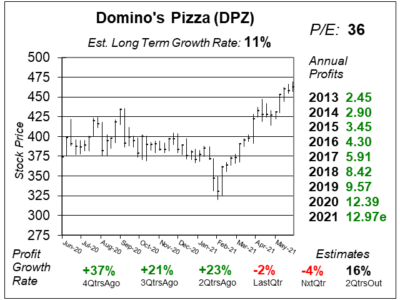

Domino’s (DPZ) delivered mixed results last qtr as profits grew a sparkling 50%. But revenue growth of -4% was uninspiring.

Domino’s (DPZ) stock sparked higher after it announced a deal that will allow its customers to place orders on Uber Eats.

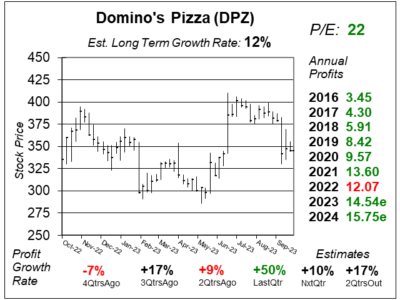

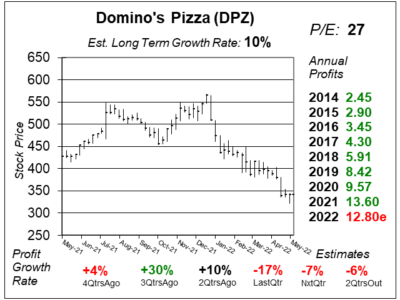

Domino’s (DPZ) used to be a nice growth stock. Then shares flew higher during COVID stay-at-home times. Now its got a hangover.

Domino’s (DPZ) is hurting from competition in the food delivery space from the likes of UberEats, GrubHub and DoorDash.

Domino’s (DPZ) is dealing with high inflation in the supply chain and at its US company owned stores. Now, higher prices may help.

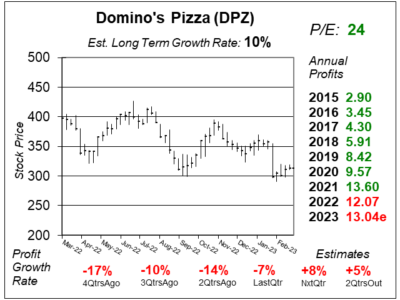

Domino’s (DPZ) is posting poor results as it laps strong results the past two years. The company also has staffing shortages.

Domino’s (DPZ) poor results are due in part to tough comparisons to Spring 2021 when Americans got stimulus checks. Think ahead.

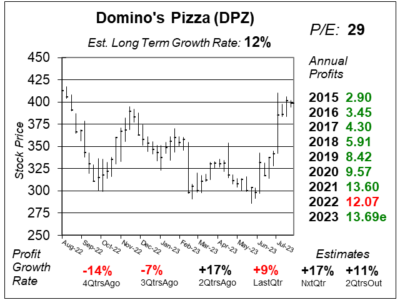

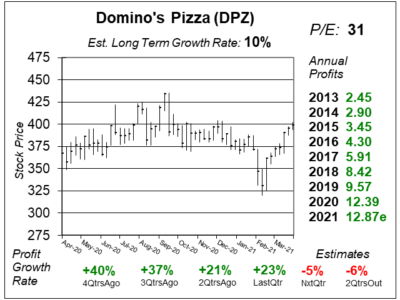

Domino’s Pizza (DPZ) is having trouble hiring drivers, and that’s taking a toll on sales & profits. 2022 looks like a tough year.

Domino’s (DPZ) International business is larger than the U.S. business, and the company continues to expand the lead overseas.

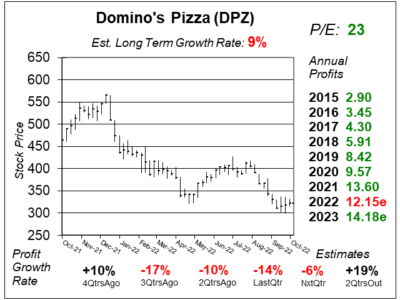

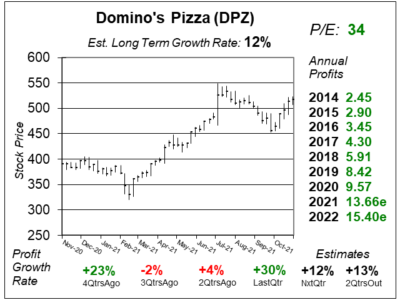

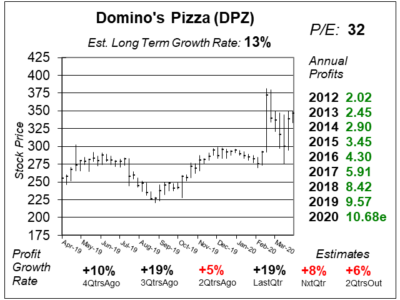

Domino’s (DPZ) had stellar results a year-ago duet pandemic lockdowns. Surprisingly, that momentum has continued.

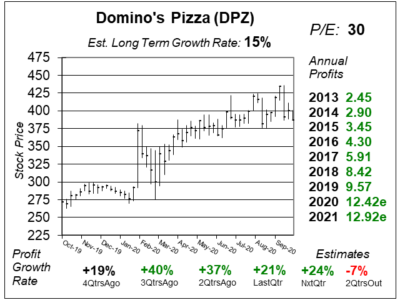

Domino’s (DPZ) got some extra business during COVID-19, and last qtr’s strong results suggest that business is here to stay.

Domino’s (DPZ) has a catalyst on the way with self-driving deliveries. But in the meantime, profit growht looks slow.

Domino’s (DPZ) delivered yet another solid qtr with profits up 21%, revenue up 18% and same store sales up 14%.

Domino’s (DPZ) is up more than 50% in the last year as people stay home. Let’s analyze where the stock might be next year.

Domino’s (DPZ) just had a great qtr profitwise, but sales growth wasn’t great. Have the stores maxed out?

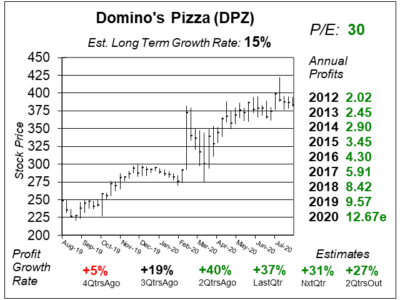

One company that continues to operate during the Coronavirus is Domino’s (DPZ), which continues to deliver.

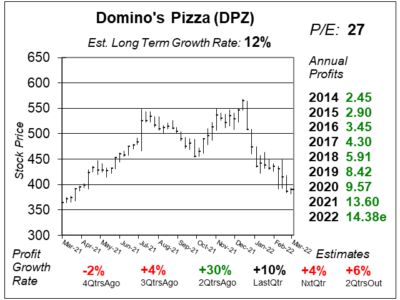

Domino’s Pizza (DPZ) bounced back this qtr as the food delivery companies are having trouble making money.

With rising competition from food delivery apps, is Domino’s Pizza (DPZ) still delivering? Let’s look inside the numbers.

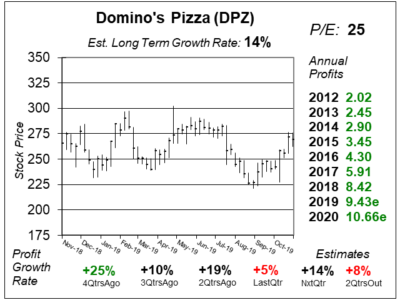

Domino’s (DPZ) is going through a slower growth period right now as qtrly profit growth just declined from 25% to 10%.

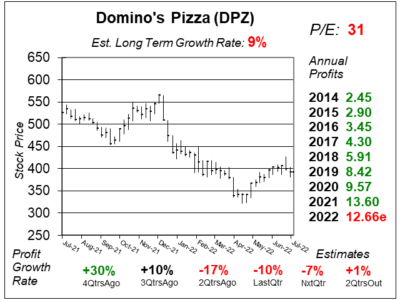

Domino’s Pizza (DPZ) has been one of the stock market’s best stocks the past decade, but DPZ missed profit estimates last qtr. Is the run done?

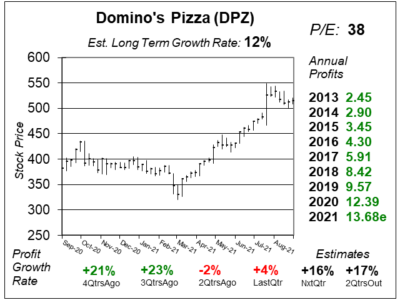

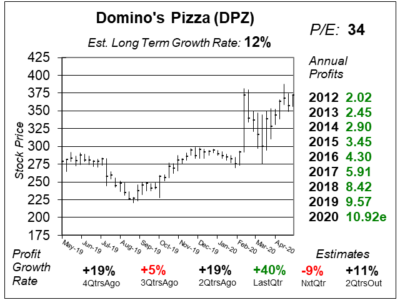

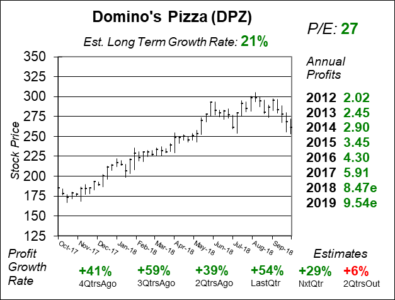

Domino’s (DPZ) continues to deliver the goods, as profits rose 54% last qtr. But Sharek thinks profit growth could slow to 21% next year.

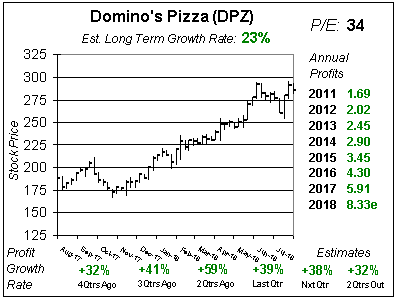

Domino’s Pizza (DPZ) is one of the top stocks in the last decade, making investors more than 20x their money — and still delivering.

Domino’s Pizza (DPZ) continues to deliver — big time! Profits soare 59% last qtr — fifty nine percent! DPZ just broke out and looks to go higher.

Domino’s (DPZ) stock has been on a serious roll for seven years. Now Domino’s Hotspots will deliver hot food to beaches, parks and stadiums — giving DPZ yet another catalyst.

Domino’s (DPZ) continues to deliver the goods as profits surged 32% last qtr. With this dip in the stock, DPZ now has 41% upside.

Domino’s (DPZ) has gone up ten-fold in six years. But the stock is off its highs on news International sales growth has slowed. But the P/E ratio is still high.

Domino’s Pizza (DPZ) is delivering piping-hot profit growth — and the stock is up ten-fold in just six years. Let’s see if DPZ is now too high to buy.