The stock market closed the week in the green, which was led by tech stocks. Indexes were up despite a higher-than-expected inflation components of the Personal Spending and Outlays report released this morning.

The stock market closed the week in the green, which was led by tech stocks. Indexes were up despite a higher-than-expected inflation components of the Personal Spending and Outlays report released this morning.

Overall, S&P 500 rose 1.4% to 4,130, while NASDAQ increased 1.9% to 12,391.

In other news, Square (SQ) is spending like wild. Management is blowing money left-and-right, which is sad as the core Square and Cash App products are good.

Tweet of the Day

$SQ Cash App reached 34M downloads in the US in H1 2022, according to Apptopia.

More than PayPal and Venmo combined $PYPL. pic.twitter.com/iZjymw0apu

— App Economy Insights (@EconomyApp) July 21, 2022

Chart of the Day

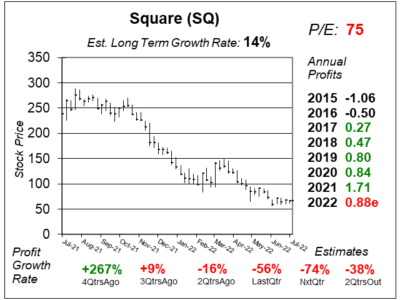

Our chart of the day is the one-year chart of SQ as of July 16, 2022 when the stock was at $66.

Our chart of the day is the one-year chart of SQ as of July 16, 2022 when the stock was at $66.

Electronic payment processor SQ pioneered credit card processing for mobile payments, then expanded its reach to bring new technologies and business lines to retailers around the world. The company is a well-rounded payment processor with various tools for getting business done. Square Banking offers financial products such as deposit accounts, Square savings, Square checking, Square Loans, and Square Payroll.

Last year, management rebranded the company name from Square to Block, to dedicate the Square brand for enterprise (Seller) operations. Block now has four businesses: Seller, Cash App, Music label Tidal, and its new Bitcoin hardware wallet named TBD.

Last qtr, revenue declined by 22%, while Operating Expenses surged 70%. On a non-GAAP basis, the company went from making a $0.08 per-share profit a year ago to losing $0.38 last qtr. And what pisses me off, is in the beautifully done earnings release, the company kept comparing numbers to the same qtr two years ago.

Nevertheless, SQ has so much potential as its disrupting the banking industry. Traditional banks are inefficient with their expensive branches and banking is starting to go digital. Last qtr, I reduced my Fair Value P/E from 125 to 45. This qtr, my Fair Value figure stays the same. I think SQ stock should be $40.