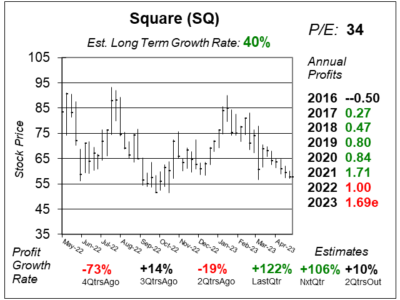

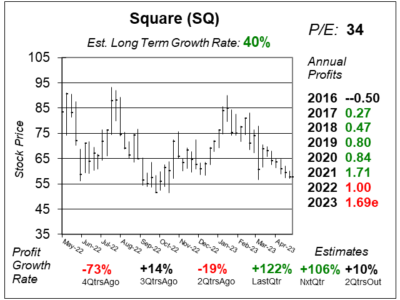

Square (SQ) Brags About Gross Profit But Delivered a GAAP Loss Last Quarter

Block (SQ) managment was bragging about its Gross Profits in last quarter’s earnings call. Meanwhile, the company lost money.

Block (SQ) managment was bragging about its Gross Profits in last quarter’s earnings call. Meanwhile, the company lost money.

Square’s (SQ) management team is blowing money while revenue declines AND they pay themselves double the stock options.

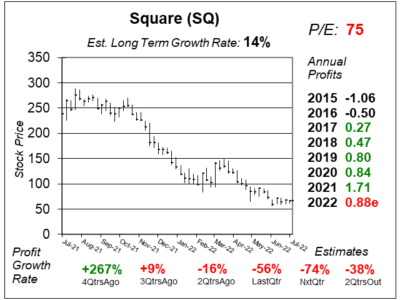

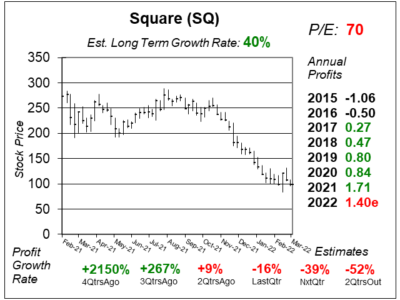

Square (SQ) stock was around $250 for much of 2021. Now around $100, does SQ still have further to fall? Yes, maybe to the $60s.

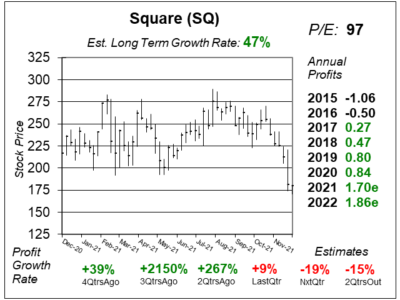

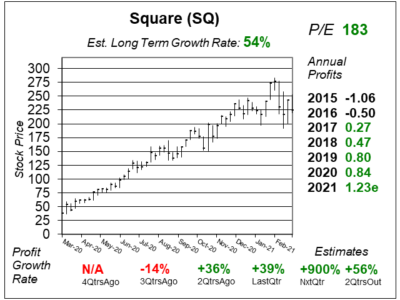

Square’s (SQ) profit growth slowed from 267% to 9% last qtr. But with stock down from $272 to $180 since last qtr, its a good buy.

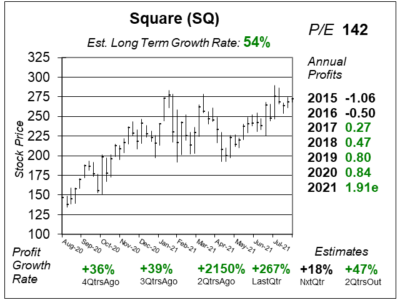

Square (SQ) already had two catalysts in the Cash App and Bitcoin trading. Now, it has a third catalyst with Afrerpay.

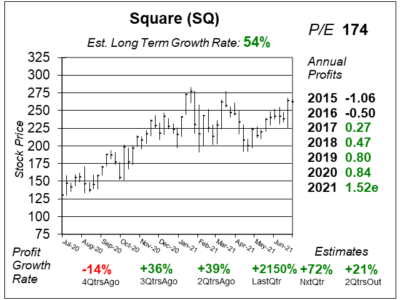

Square (SQ) Has two catalysts in its Cash App and the ability to trade Bitcoins on the app. BTC was 70% or revenue last qtr.

Square (SQ) is rolling with its Cash App as Bitcoin transactions have soared. But this stock is expensive, as always.

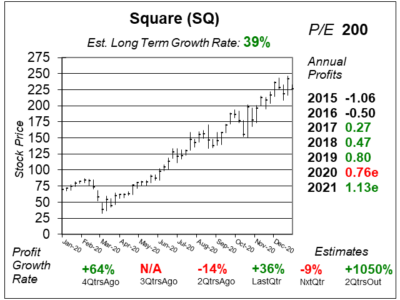

Square’s (SQ) business is booming due to the growth of Cash App, and the ability to trade Bitcoin is a nice perk as well.

Square’s (SQ) Cash app is being used for direct deposit for paychecks, stimulus checks, unemployment checks, and tax refunds.

Square’s (SQ) business model has so many facets that it could do to the banking what Tesla did to the auto industry.

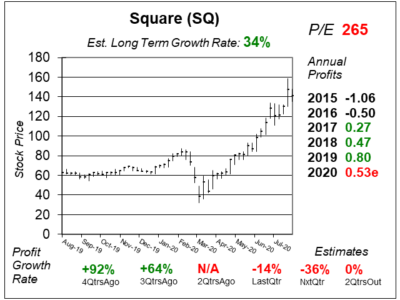

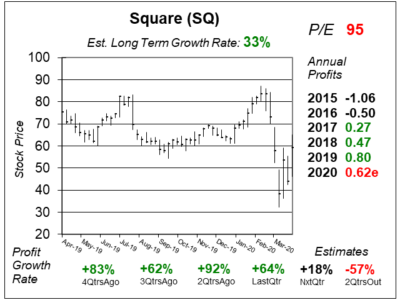

Square (SQ) has a couple catalysts in its Cash App — which is doing great in a Corona-world — and small business loans.

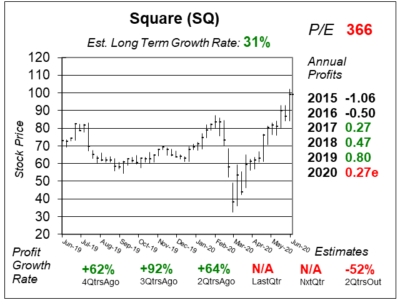

Square (SQ) has been a laggard stock since management lowered 2020 estimates. Has this company lost its uniqueness?

Square (SQ) used to be one of the hottest stocks in the market. Now SQ sucks. But the profit numbers remain strong.

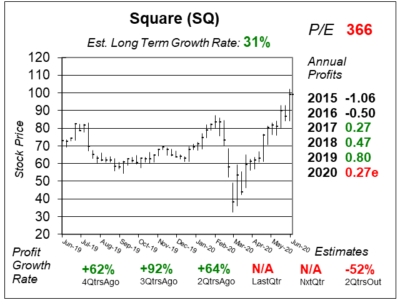

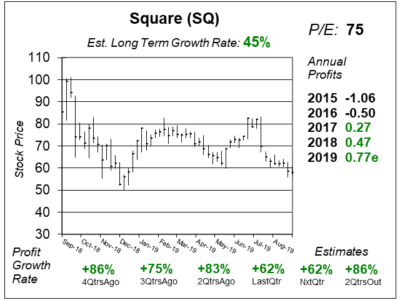

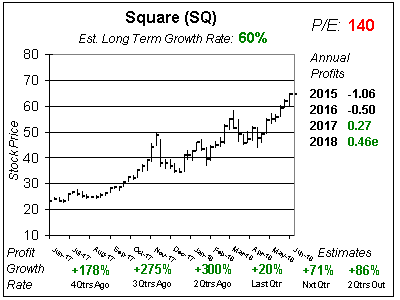

Payment processor Square (SQ) has been digesting its 2018 gains for the last 6 months. Is SQ now ready to move higher?

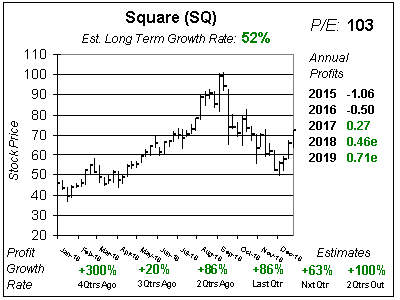

Square (SQ) has amazing products that have the ability to keep SQ’s sales and profits growing strong for the long term. But what about the 102 P/E?

Square (SQ) has been on a roller coaster ride the past two years as its gone from $15 to $100, down to $50 and back up to $72. Here’s what I think SQ stock is worth.

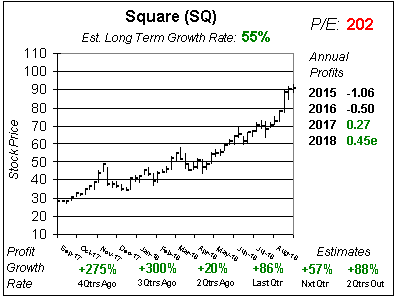

Shares of payment processor Square (SQ) seem really overvalued with a P/E of 202 — unless you value SQ on potential.

Electronic payment processor Square (SQ) has a lot of good things going for it, but doesn’t possess one key trait top stocks have.

Payment processor Square (SQ) lets people buy and sell Bitcoin. But the future is allowing people an avenue to spend Bitcoin on goods and services. Is Square the answer?