The stock market today was down as inflation accelerated 9.1% in June from 8.6% recorded in May. The latest data was a new 40-year high.

The stock market today was down as inflation accelerated 9.1% in June from 8.6% recorded in May. The latest data was a new 40-year high.

This could increase the chance for a Fed rate hike at the end of July 26-27 meeting.

Overall, S&P 500 fell 0.5% to 3,802, while NASDAQ declined 0.2% to 11,248.

In other news, Disney (DIS) partnered with The Trade Desk (TTD) as the former expands to targeted automated ads.

Tweet of the Day

$TTD $DIS

Exclusive: Disney inks major advertising deal with The Trade Desk https://t.co/hihc0mdshB— Ophir Gottlieb (@OphirGottlieb) July 12, 2022

Chart of the Day

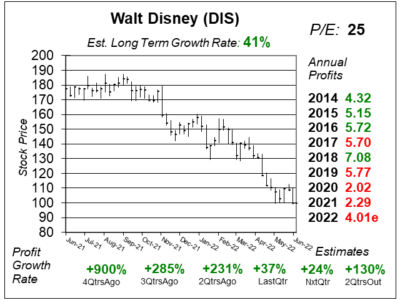

Our chart of the day is the one-year chart of DIS from June 11 when the stock was $99.

Our chart of the day is the one-year chart of DIS from June 11 when the stock was $99.

Founded as a cartoon studio in the 1923, DIS is the world’s largest media company, consisting of theme parks such as Disneyland and Walt Disney World, and media distribution including ABC, ESPN, 20th Century Studios, and Pixar. In November 2019, the company launched Disney+, a subscription based video streaming service with Disney, Pixar, Star Wars, Marvel and National Geographic content.

DIS is a well-oiled machine that produces blockbuster titles which produce incredible sales over multiple divisions, including merchandise sales and content for digital delivery. However, stock growth and profit growth have been erratic. Analysts give DIS profits an Estimated Long-Term Growth Rate of 41%, but that’s because profits have declined from ~$7 in 2018 to ~$2 last year, and they are expected to rebound higher in the next 3-5 years. I used to think of this stock as a 10% grower in terms of potential total return, but now it may be a 12-15% grower with the Disney+ side. But right now theme parks are making money, while Disney+ is losing money, and investors aren’t happy as the stock is sliding to new lows. DIS is part of the Conservative Growth Portfolio.

With DIS’ recent agreement with TTD, brands across DIS properties can now target automated ads, and such automation allows DIS to sell more ads.