Buying 21st Century Fox Has Crippled Walt Disney (DIS) Financially

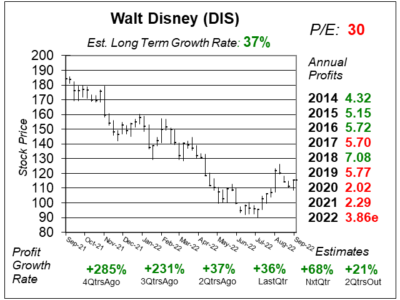

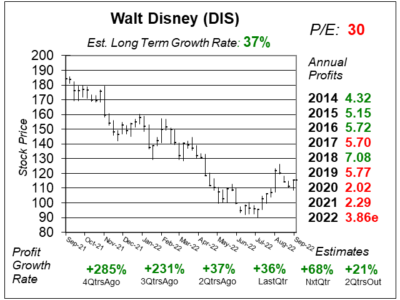

Disney (DIS) bought 21st Century Fox in 2019 for $71b. From Fiscal 2018 to 2021, DIS debt $21b to $52b, Free Cash Flow $10b to $2b.

Disney (DIS) bought 21st Century Fox in 2019 for $71b. From Fiscal 2018 to 2021, DIS debt $21b to $52b, Free Cash Flow $10b to $2b.

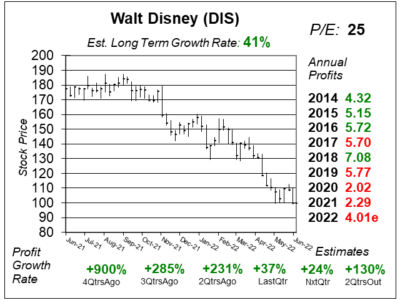

Disney (DIS) theme parks are doing great — especially in he US. But the direct-to-consumer streaming channels are losing money.

Walt Disney (DIS) achieved 100% revenue growth in its Parks, Experiences and Products segment as COVID restrictions died down.

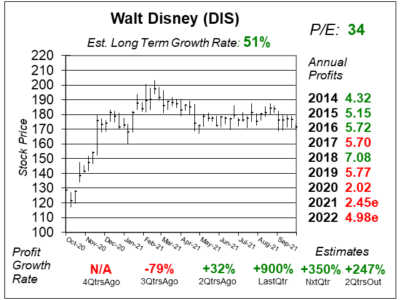

Disney (DIS) is expected to have profits rise in the coming years as theme parks return to capacity and its cruise lines expand.

Walt Disney (DIS) stock ran up as Disney+ took hold. Now with the channel thriving, the stock isn’t moving. Time to sell?

Disney+ has reached 100 million subscribers in its first 16 months. But we don’t know what that will do for profits.

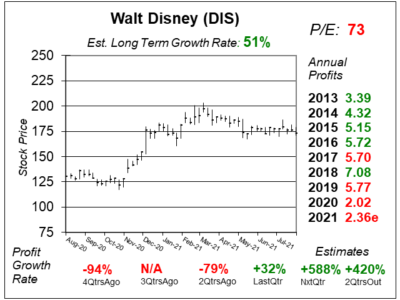

Disney (DIS) has quickly achieved 120 million paid subscribers to its digital platforms, and results should shine when parks open.

Disney’s (DIS) direct-to-consumer streaming channel Disney+ is a huge hit with 60 million paid subscribers since November.

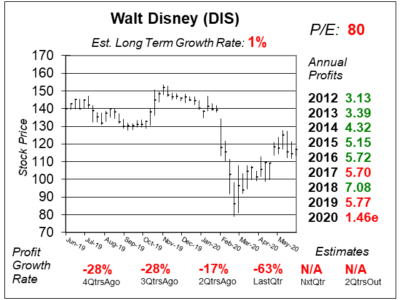

COVID-19 infections have been climbing recently, and that could mean a cruel summer for Disney (DIS) theme parks.

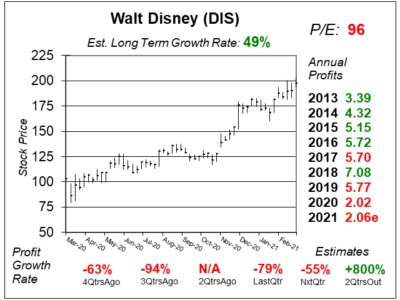

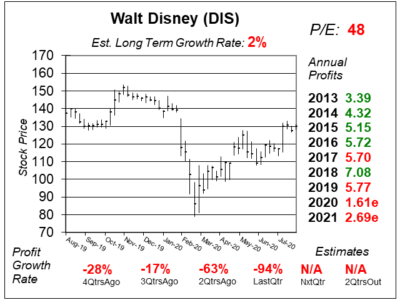

Disney (DIS) theme parks are closing temporarily and the stocks been crushed. Is this the bottom for DIS stock?

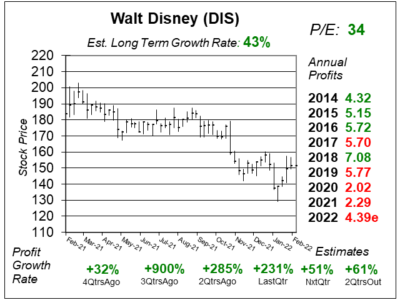

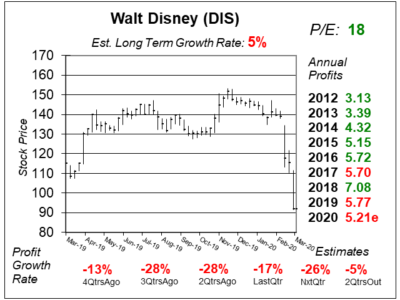

Shares of Walt Disney (DIS) broke out to an All-Time high after it announces Disney+ subscribers are above estimates.

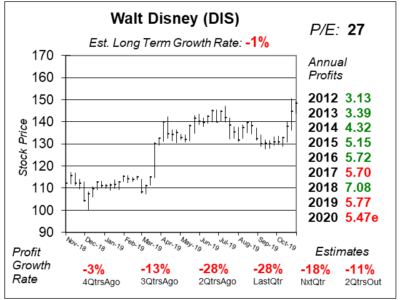

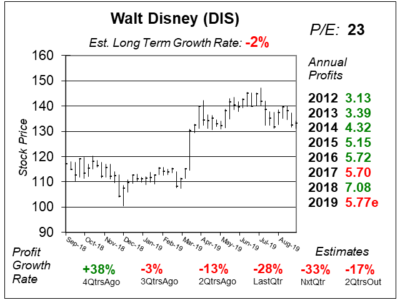

Disney’s (DIS) Disney+ subscription streaming platform is set to come out in November, so why is the stock faltering?

We have to look to the future of Walt Disney (DIS) to see the stock’s real potential as Disney+ will be a catalyst for growth.

Get your popcorn ready! Shares of Disney (DIS) are breaking out as its Direct to Consumer product is a catalyst.

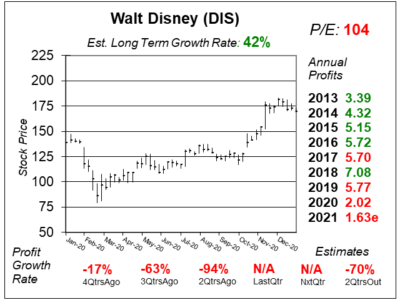

Disney (DIS) is embarking on a new frontier of direct to consumer (DTC) subscription programming, with its ESPN+, Disney+ and Hulu platforms.

Shares of Disney (DIS) dropped after the company missed/lowered earnings estimates. Who cares? The subscription service can be huge.

Disney (DIS) is in a bidding war with Comcast over 21st Century Fox — and Disney should prevail because it’s bid includes stock.

Walt Disney (DIS) stock is an outstanding value in the age of new media as years from now I expect DIsney & ESPN to dominate the Internet like Netflix does today.

Disney (DIS) is expected to launch its streaming video service later this year, and now it’s acquired 21st Century Fox to add the content it needs to be more like Netflix.

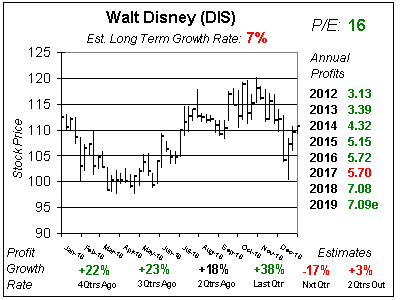

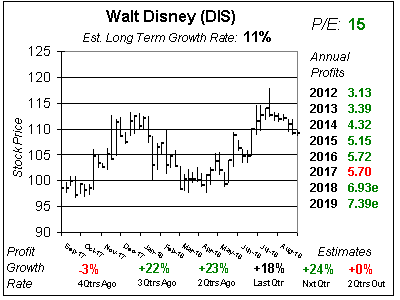

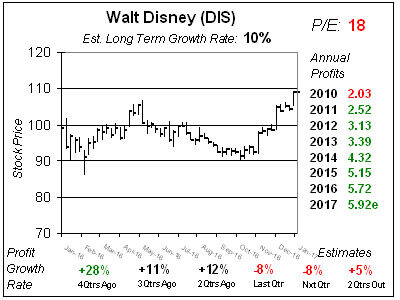

Disney (DIS) is expected to have 2017 profits roughly in line with 2016’s as the company plans for the future with its app and Star Wars lands, which are both due in 2019.

Disney (DIS) surprised investors with 10% profit growth last qtr, but the stock hasn’t been going anywhere lately as it digests its gains from 2012-2015.

Disney (DIS) is transforming itself into a company that provides digital content via subscription — and that gives the stock a bright future.

In just three months shares of Disney (DIS) have gone from $92 to $109 — and from undervalued to slightly overvalued. Here’s my take on DIS.

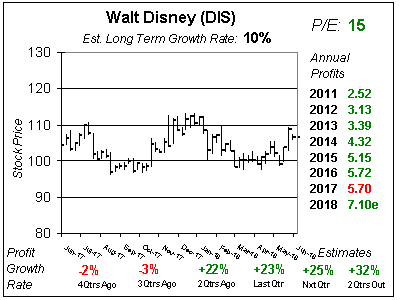

Disney (DIS) is at one of the lowest valuations in years. But people cutting the cord with cable is hurting ESPN, and thus profits are expected to be rather flat in 2017.

Walt Disney (DIS) is 20% off its All-Time high set last year. Is now the time to buy? Let’s take a look.