The stock market ended the week lower and snapped its four-day winning streak. Nevertheless, Wall Street posted weekly gains for the second consecutive week after Friday’s session.

The stock market ended the week lower and snapped its four-day winning streak. Nevertheless, Wall Street posted weekly gains for the second consecutive week after Friday’s session.

Investors took some profit to end a solid week. They also weighed President Trump’s sentiments on US interest rates, oil prices and taxes which boosted market optimism.

Overall, S&P 500 fell 0.3% to 6,101, while NASDAQ declined 0.5% to 19,954.

Tweet of the Day

Is this the reason behind AMD's $AMD recent decline? I bought the stock for my Growth Portfolio last year, and its gone down since. Yet the fundamentals suggest the stock should be going up, which tells me I'm missing something. Also note Annual Profit Estimates have been… https://t.co/b0L9OB9TG2 pic.twitter.com/hRt48G0Unj

— David Sharek (@GrowthStockGuy) January 19, 2025

Chart of the Day

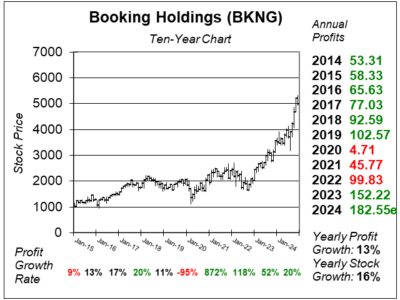

Here is the ten-year chart of Booking Holdings (BKNG) as of December 30, 2024, when the stock was at $4,991.

Here is the ten-year chart of Booking Holdings (BKNG) as of December 30, 2024, when the stock was at $4,991.

Booking posted modest growth last quarter as the company saw a surge in airline tickets. Air tickets booked accelerated 39% year-over-year (YoY), driven by strong growth in flight offerings on Booking.com and Agoda. Management continued to see growth in alternative accommodations with 10% YoY growth in listings, resulting in 14% room night growth. This could improve customers’ travel experience which could lead to more bookings. Booking.com’s alternative accommodation room nights now account for 35% of its listings worldwide. Overall, BKNG delivered 16% profit growth on 9% revenue growth last quarter.

BKNG is part of our Conservative Growth Portfolio.