The stock market pulled back on Monday to begin the week, as investors braced for key earnings releases this week, including NVIDIA (NVDA), and awaited a long-delayed U.S. jobs report.

The stock market pulled back on Monday to begin the week, as investors braced for key earnings releases this week, including NVIDIA (NVDA), and awaited a long-delayed U.S. jobs report.

Overall, S&P 500 was down 0.9% to 6,672, while NASDAQ fell 0.8% to 22,708.

Tweet of the Day

This is Bearish for Vertiv $VRT, which has been a story of rising profit margins and increased liquid cooling. https://t.co/V9uXApvaSP

— David Sharek (@GrowthStockGuy) November 17, 2025

Chart of the Day

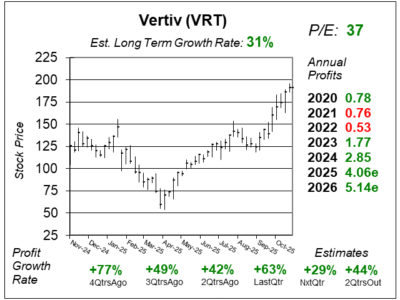

Here is the one-year chart of Vertiv (VRT) as of October 28, 2025, when the stock was at $191.

Here is the one-year chart of Vertiv (VRT) as of October 28, 2025, when the stock was at $191.

Last quarter, the company reported 63% profit growth and crushed estimates of 30%. Revenue grew 29%. Orders were up 60% year-over-year, and the company now has a record backlog up 28% year-over-year — meaning plenty of work ahead.

Vertiv stock has been hot lately, and recently hit an All-Time high. With cooling systems an important aspect of datacenters, David Sharek, Founder of School of Hard Stocks, thinks Vertiv is a great growth stock for those looking to ride the AI wave.

VRT is part of our Growth Portfolio and Aggressive Growth Portfolio.