Vertiv’s (VRT) Liquid Cooling Capabilities Improve With its Acquisition of CoolTera

Vertiv (VRT) makes infrastructure for AI datacenters. Its acquisition of CoolTera allows VRT to grow its liquid cooling exponentially.

Vertiv (VRT) makes infrastructure for AI datacenters. Its acquisition of CoolTera allows VRT to grow its liquid cooling exponentially.

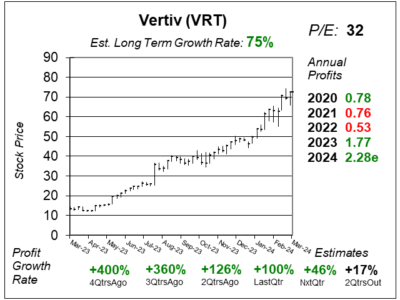

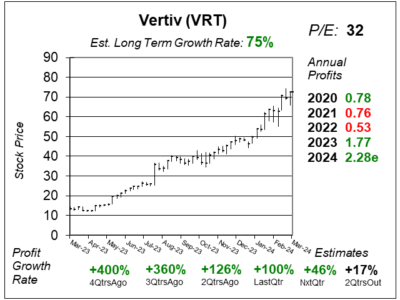

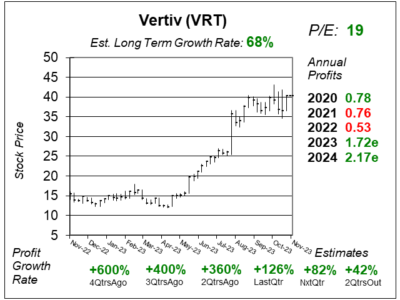

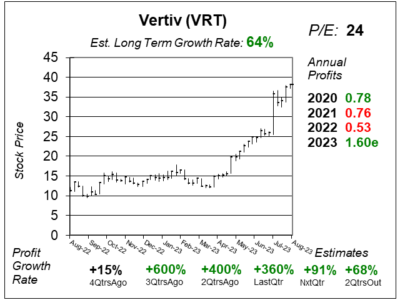

Vertiv (VRT) is seeing seeing robust market demand as more infrastructure is needed to meet the computer capacity needed for AI.

Vettiv (VRT) is a company that makes rack setups for holding and operating AI datacenters, and that’s a nice industry right now.