The stock market fell on Wednesday amid signs that the U.S. economy is weakening.

The stock market fell on Wednesday amid signs that the U.S. economy is weakening.

Based on the latest ADP private payroll report, U.S. private employers hired far fewer workers than expected in March. Such followed Tuesday’s poor job openings data.

The weak economic data deepened worries that the Federal Reserve’s aggressive rate hikes might trigger the U.S. economy into a recession.

Overall, S&P 500 declined 0.3% to 4,090, while NASDAQ sank 1.1% to 11,997.

Tweet of the Day

This chart of money market mutual fund assets is breathtaking.. it's not just the angle of the slope but the size too, they've grown by $460b this year, that's >6x what all ETFs combined have taken in. pic.twitter.com/M851Cz6WLO

— Eric Balchunas (@EricBalchunas) April 3, 2023

Chart of the Day

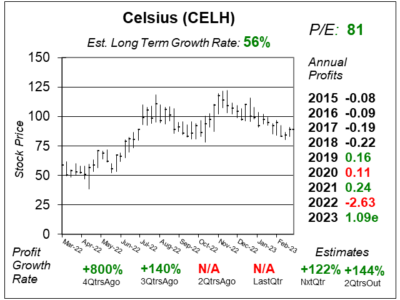

Here is the one-year chart of Celsius (CELH) as of March 22, 2023, when the stock was at $89.

Here is the one-year chart of Celsius (CELH) as of March 22, 2023, when the stock was at $89.

Celsius has a proprietary calorie-burning formulation called MetaPlus, while being as natural as possible, without the artificial preservatives found in many energy drinks and sodas. Management claims drinking the product can help people lose weight.

Energy drink maker Celsius is thriving with its new distribution relationship with PepsiCo (PEP). Revenue surged a whopping 71% last qtr.

In the earnings call, management stated that a primary factor behind North American sales growth was the integration of the Pepsi distribution system. David Sharek, Founder of The School of Hard Stocks, looks forward to the growth opportunity of international sales, which made up just 6% of total revenue last quarter.

CELH has great growth opportunity for the future and the stock is richly priced with a P/E of 81. The Estimated Long-Term Growth Rate of 56% is outstanding. CELH is a top ranked stock is our Aggressive Growth Portfolio.