The stock market closed generally higher on Tuesday, as investors shook off a hawkish move by the Bank of Japan that raised its interest rates.

The stock market closed generally higher on Tuesday, as investors shook off a hawkish move by the Bank of Japan that raised its interest rates.

The move to adjust the cap on its 10-year government bond yield added more worries to investors as aggressive monetary tightening from central banks might lead to a global recession.

Overall, S&P 500 grew 0.1% to 3,822, while NASDAQ was flat at 10,547.

Tweet of the Day

The Bank of #Japan blinked and pivoted in the opposite direction. After artificially holding the 10-year JGB yield at .25%, the BOJ just raised the target rate to .5%. More hikes are coming. In the U.S. this means the #dollar and asset prices will fall and #inflation will rise.

— Peter Schiff (@PeterSchiff) December 20, 2022

Chart of the Day

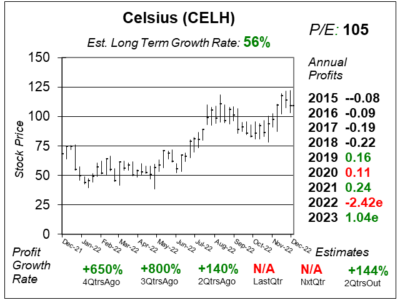

Our chart of the day is the one-year chart of Celsius (CELH) as of December 17, 2022, when the stock was at $109.

Our chart of the day is the one-year chart of Celsius (CELH) as of December 17, 2022, when the stock was at $109.

CELH has a proprietary calorie-burning formulation called MetaPlus, while being as natural as possible, without the artificial preservatives found in many energy drinks and sodas. Management claims drinking the product can help people lose weight.

Energy drink maker Celsius saw its revenue surge 98% last qtr. However, the company posted a one-time loss due to surge in operating expenses (779% increase from last year) related to termination of prior distributors as Celsius partners up with PepsiCo to gain better distribution.

On August 1, 2022 PepsiCo made a $550 million investment in CELH convertible stock at $75 per share that makes it Celsius’ primary distributor in the US and the preferred partner internationally as of October 1, 2022. This distribution deal is set to boost sales for Celsius.

CELH is a top ranked stock in the Aggressive Growth Portfolio.