On Monday, the stock market fell and broke its four-week winning streak as investors took a breather.

On Monday, the stock market fell and broke its four-week winning streak as investors took a breather.

Meanwhile, some US retailers warned that consumer spending is weakening. This is despite the 7.5% growth in Black Friday e-commerce spending from a year earlier.

Overall, S&P 500 was down 0.2% to 4,550, while NASDAQ fell 0.1% to 14,241.

Tweet of the Day

Money Market Funds All-Time High 🚨: Cash parked in Money Market Funds hits all-time high of $5.73 Trillion. Could serve as a possible tailwind to stocks if this cash finds its way into the equity markets. pic.twitter.com/cD1EJzUWWV

— Barchart (@Barchart) November 27, 2023

Chart of the Day

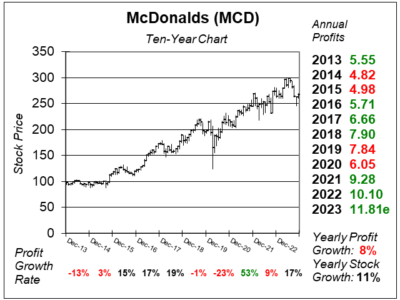

Here is the ten-year chart of McDonald’s (MCD) as of November 8, 2023, when the stock was at $267.

Here is the ten-year chart of McDonald’s (MCD) as of November 8, 2023, when the stock was at $267.

McDonald’s is the world’s leading global food service retailer with over 40,000 locations in over 100 countries. In a typical franchise arrangement, McDonald’s owns the real estate, long-term lease on the land, and building with the franchisee paying for equipment, signs, seating, and decor. Currently, franchised restaurants represent 95% of McDonald’s restaurants worldwide.

McDonald’s posted impressive results last quarter with profits up 19% on 14% revenue growth. Sales increased 11% while same-store sales jumped 9%. Same-store sales increased 11% a year ago, so last quarter’s feat was impressive.

Inflation continues to challenge consumers, particularly those from the low-income group. Management noted that industry-wide traffic from low-income consumers has been down compared to the previous quarters, but they continued to gain share with middle- and higher-income consumers.

Pricing is varied across markets, but in the US, management projects a 10% increase in pricing for the full year of 2023. To counteract increased pricing, McDonald’s has introduced several affordable options such as better bundles and smaller servings in Germany, cheaper breakfast pairings in Canada, and the D123 Everyday Value menu in the US.

In other news, digital sales now represent more than 40% of system-wide sales in McDonald’s top 6 markets. This growth was boosted by digital promotions such as the Monopoly campaign, which allows customers to win prizes from their purchases.

MCD is part of the Conservative Growth Portfolio. The company has good momentum here, but with a P/E of just 21, the stock has very good upside.