The stock market finished lower on Tuesday as growing concerns over a potential AI bubble weighed on investor sentiment. S&P 500 fell 0.8% to 6,617, while NASDAQ dropped 1.2% to 22,433.

The stock market finished lower on Tuesday as growing concerns over a potential AI bubble weighed on investor sentiment. S&P 500 fell 0.8% to 6,617, while NASDAQ dropped 1.2% to 22,433.

Investors are now turning their attention to NVIDIA’s (NVDA) upcoming earnings report and the long-awaited U.S. jobs data.

Tweet of the Day

This tweet is impressive. @davey_juice goes over the differences between Credo $CRDO and Astera Labs $ALAB.

I own lots of CRDO for clients, its been a big winner. But I missed out on ALAB because I didn’t understand the technology.

ALAB stock broke out last July at $100. I saw… https://t.co/lLOsb0FdMG

— David Sharek (@GrowthStockGuy) November 17, 2025

Chart of the Day

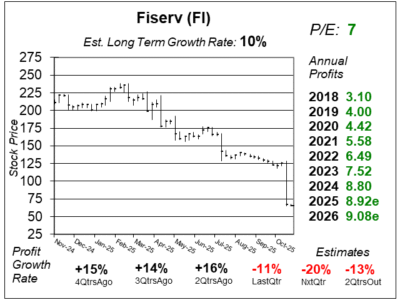

Here is the one-year chart of Fiserv (FI) as of November 3, 2025, when the stock was at $65.

Here is the one-year chart of Fiserv (FI) as of November 3, 2025, when the stock was at $65.

Last quarter, the company devastated investors when it reported -11% profit growth and missed analyst estimates of 16%. Analysis showed that past results were boosted by unusual factors, especially from its fast growing Argentina business.

Last year, Argentina’s inflation reached 211% with interest rates near 98%, which temporarily inflated Fiserv’s results. However, in FY24, inflation dropped to 118% and rates to 58%, and by 2025 so far, they have fallen further to 22% and 43%, respectively, reducing that tailwind.

In simple terms, in 2023 and 2024, high inflation and interest rates in Argentina made its payments business grow much faster than normal, giving big but temporary lift to revenue.

Management stated four things affected last quarter’s results: slower growth in Argentina, overly optimistic forecasts, delayed investments that limited performance, and a shift away form short-term revenue pushes. With these issues now identified, Fiserv is refocusing on steady, sustainable growth instead of chasing short-term wins, rebuilding around reliable income and stronger client relationships.

FI was recently sold from our Conservative Growth Portfolio and Growth Portfolio. This business is off the tracks and it will take years for the stock to recover.