The stock market declined on Monday on fears of more interest rate hikes in 2023 due to a strong labor market. Payroll rose 263,000 in November, significantly higher than the 200,000 increase expected by economists.

The stock market declined on Monday on fears of more interest rate hikes in 2023 due to a strong labor market. Payroll rose 263,000 in November, significantly higher than the 200,000 increase expected by economists.

Overall, S&P 500 dropped 1.8% to 3,999, while NASDAQ fell 1.9% to 11,240.

Tweet of the Day

Some Twitter CFA rando who thinks he's important is calling for a crash yet I see the $HYG with a trend-follow Buy signal

No idea if it sticks but IMO it's hard to crash when Junk Bonds are moving up pic.twitter.com/zW3VI3disQ

— ModifiedDarvasBox🔲 (@DarvasBoxGuru) December 5, 2022

According to David Sharek, Founder of The School of Hard Stocks,

High yield bonds are risky bonds, from companies that might not pay it back (in simple terms).

If high yield bonds go down, that could mean bad things ahead. Smart money is in the bond business, bonds usually tell the story of the stock markets trend before stocks do.

So high yield bonds stabilizing is great news for the stock market.

Chart of the Day

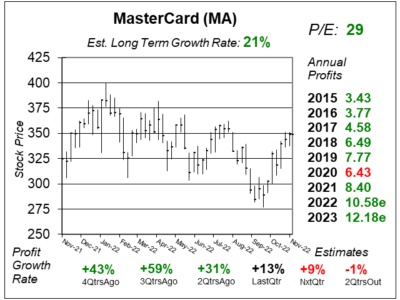

Our chart of the day is the one-year chart of MasterCard (MA) as of November 25, 2022, when the stock was at $349.

Our chart of the day is the one-year chart of MasterCard (MA) as of November 25, 2022, when the stock was at $349.

MasterCard is a technology company in the global payments industry that connects consumers, financial institutions, merchants, governments, digital partners, businesses and other organizations worldwide, enabling them to use electronic forms of payment instead of cash and checks.

MasterCard is feeling pressure from the strong US dollar, as currency exchange cut revenue growth from 23% to 15% last qtr. But this is a good thing, as the dollar has been weakening lately and that could mean profits might come in better than expected in the upcoming qtrs. Despite the cut in revenue, profits still rose a decent 13%. Management saw notable strength in airline, lodging and restaurant spending with weakness in home furnishings and appliances.

Qtrly Profit Estimates are poor, but the weakening USD could allow the company to beat the street.

MA is part of the Conservative Portfolio and Growth Portfolio. David Sharek’s Fair Value P/E moves down to 32 this qtr from 35 last qtr, as profits are becoming more normalized.