The stock market closed higher on Tuesday as investors looked ahead to the Federal Reserve’s upcoming rate decision and assessed latest corporate earnings and developments in AI.

The stock market closed higher on Tuesday as investors looked ahead to the Federal Reserve’s upcoming rate decision and assessed latest corporate earnings and developments in AI.

Overall, S&P 500 rose 0.2% to 6,891, while NASDAQ climbed 0.8% to 23,827.

Tweet of the Day

The lead story on CNBC this morning is tariffs aren’t hurting the consumer as much as expected. Trump was right, again. pic.twitter.com/KeYyBxKt0x

— David Sharek (@GrowthStockGuy) October 24, 2025

Chart of the Day

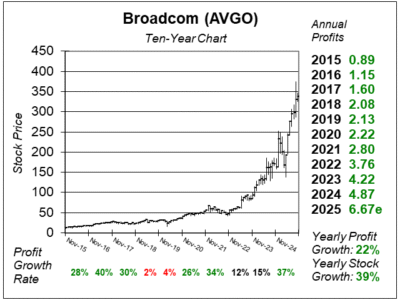

Here is the ten-year chart of Broadcom (AVGO) as of October 2, 2025, when the stock was at $338.

Here is the ten-year chart of Broadcom (AVGO) as of October 2, 2025, when the stock was at $338.

Broadcom stock has soared recently as its AI products are in high demand. The stock went from $244 to $338 since our last research report.

Last quarter, Broadcom delivered 36% profit growth on 22% revenue growth, driven by its expanding role in powering global AI infrastructure. Fueling the stock has been a strength in its custom built AI accelerators.

AI revenue jumped 63% last quarter as AI semiconductor revenue had its 11th consecutive quarter of growth. Broadcom already supplies these chips to three major tech giants and recently added a fourth large customer, believed to be OpenAI, the creator of ChatGPT. That new partnership brought in roughly $10 billion in AI hardware orders, setting the stage for even faster AI revenue growth in fiscal 2026, with profit estimates jumping to $9.20 a share from $7.99 a quarter ago.

Beyond chips, Broadcom also builds the networking hardware that connects massive AI data centers. The company recently launched two major products: Tomahawk 6 (an Ethernet switch chip) and Jericho4 (a super-fast Ethernet router that links lots of computers across multiple data centers). These devices make it easier for hyperscalers like Google (GOOGL), Microsoft (MSFT), and Amazon (AMZN) to move data faster and more efficiently between thousands of AI processors.

AVGO is part of our Growth Portfolio and Aggressive Growth Portfolio. Broadcom is a key contributor to the AI movement, and its stock should be a core holding for growth stock investors.