Software stocks were the leaders in the stock market today, Tuesday June 7, 2022.

Software stocks were the leaders in the stock market today, Tuesday June 7, 2022.

Overall, the S&P 500 was up 1.0% to close at 4161 while the NASDAQ rose 0.9% to close at 12175.

Standouts on the day were high growth-high valuation software stocks, including:

- Atlassian (TEAM) +6% to $201

- MongoDB (MDB) +8% to $296

- Bill.com (BILL) +5% to $136

- Datadog (DDOG) +5% to $108

- Gitlab (GTLB) +28% to $51

Gitlab reported earnings and jumped on hte news. GTLB is a top stock we do not yet cover at The School of Hard Stocks, and we will work on a research report this weekend.

Chart of the Day

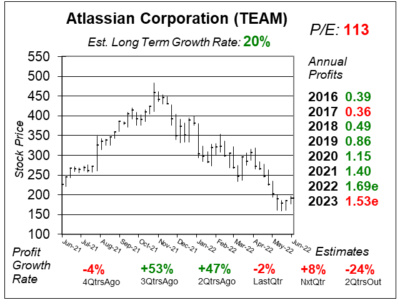

Our Chat of the Day is this one-year chart of Atlassian (TEAM) made June 4. Atlassian’s Jira and Confluent are two of the most widley used software platforms for programmers.

Our Chat of the Day is this one-year chart of Atlassian (TEAM) made June 4. Atlassian’s Jira and Confluent are two of the most widley used software platforms for programmers.

But the stock isn’t holding up well in this Bear Market, as investors are looking for “real profits”. Atlassian makes money in a non-GAAP basis. But the company then issues lots of stock options to employees, which then dilutes the shares.

Last qtr, the company delivered Net income of -$31 million, down from $160 million in the year ago period. And last qtr the company had share-based payment expense of $187 million, which is up from $98 million in the year-ago period. So overall, the reported profit from last qtr was $0.47 per share last qtr. But if you subtract employee stock options of $0.53 per share, the company lost $0.06 a share. You can see more on the company’s stock based compensation here. No wonder the stock’s fallen from $336 to $191 since my report last qtr. And now qtrly profit growth has slowed dramatically (-2% last qtr).

TEAM stock is admired by Wall Street as the company has grown revenue (and customers) every qtr since the IPO back in December 2015. Atlassian is cash flow positive, and management sometimes uses some of its cash to buy back stock. During Fiscal 2021 the company made $2 billion in revenue and generated $765 million in free cash flow.

TEAM is part of the Aggressive Growth Portfolio. But with a high P/E of 113 and loads of stock options being given out, I might sell the shares.