Stock (Symbol) |

Snowflake (SNOW) |

Stock Price |

$263 |

Sector |

| Technology |

Data is as of |

| January 26, 2022 |

Expected to Report |

| March 1 |

Company Description |

Snowflake Inc. is a cloud data platform provider. The Company’s platform enables customers to consolidate data into a single source to drive business insights, build data-driven applications and share data. The Company’s platform supports a multi-cloud strategy, including a cross-cloud approach to mix and match clouds. Its multi-cluster shared data architecture enables governed and secure data sharing in real-time. It enables to create own private data exchange to share and collaborate with business partners, suppliers, and employees in a centrally managed data hub. The Company, by leveraging the performance of the public cloud, its platform enables customers to unify and query data to support a variety of use cases. It also provides frictionless and governed data access so users can securely share data inside and outside of their organizations, generally without copying or moving the underlying data. Source: Refinitiv. Snowflake Inc. is a cloud data platform provider. The Company’s platform enables customers to consolidate data into a single source to drive business insights, build data-driven applications and share data. The Company’s platform supports a multi-cloud strategy, including a cross-cloud approach to mix and match clouds. Its multi-cluster shared data architecture enables governed and secure data sharing in real-time. It enables to create own private data exchange to share and collaborate with business partners, suppliers, and employees in a centrally managed data hub. The Company, by leveraging the performance of the public cloud, its platform enables customers to unify and query data to support a variety of use cases. It also provides frictionless and governed data access so users can securely share data inside and outside of their organizations, generally without copying or moving the underlying data. Source: Refinitiv. |

Sharek’s Take |

Snowflake (SNOW) provides organizations one platform for all their data, then provides managed secure access to it to company users or perhaps other organizations, without the client having to manage infrastructure. Snowflake enables demand, it allows it to happen, while billing clients by time. Snowflake (SNOW) provides organizations one platform for all their data, then provides managed secure access to it to company users or perhaps other organizations, without the client having to manage infrastructure. Snowflake enables demand, it allows it to happen, while billing clients by time.

Snowflake separates storage and computing. Storage is where the data sits. Computing is what’s actually doing the work on your data. Then, data can be shared with other organizations securely. The company works with almost half the Fortune 500. In January 2021 Snowflake processed an average of 777 million daily data queries, up from 364 million the prior year. Last qtr, the company announced two industry data clouds so customers can launch products, build platforms on Snowflake. Financial Services Data Cloud includes BlackRock, Capital One, New York Stock Exchange, Refinitiv, Square, and more. Media Data Cloud enables media and advertising companies to share data for audiance measurements, and includes Disney Advertising Sales, Xperian, Horizon Media and The Trade Desk. Now, ABC and NBC can share information through Snowflake’s Data Cloud to compile industry data without violating privacy laws. Snowflake even works with federal agencies to import and export defense technical data. Here’s an example of Snowflake working with Citi Bike:

Stats from last qtr include:

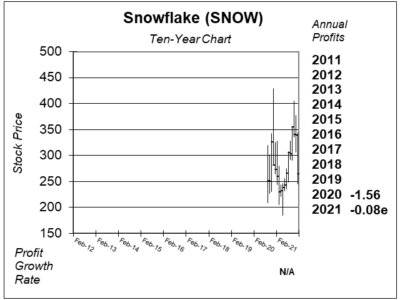

Snowflake was an expensive stock a year ago, as it sold for around 100x revenue (2021 estimates) at its highs around $400. But now we are in a Bear Market for growth stocks, so the stock is now $263 and sells for a more reasonable 39x revenue (2022 estimates). During the prior three years, revenue has jumped from $97 million to $265 million and then $600 million. 2021’s revenue est. is $1.2 billion, 2022’s is $2 billion, and 2024’s is $3.1 billion. Management envisions $10 billion in annual revenue someday. With the stock around 6-months lows, SNOW will be added to the Aggressive Growth Portfolio. The company just started making profits, and I expect profitability to increase moving forward. Operating Expenses as a Percent of Revenue are dropping rapidly, from 163% in 2020, to 103% in 2021, and 76% this year. Adjusted Free Cash Flow as a Percent of Revenue has gone from -75% to -12% and +6% during that span. This is one of the most impressive companies around, but stocks with little-to-no profits and high price-to-sales ratios have been getting clobbered so investors should brace themselves as the stock might continue lower in the short-term. |

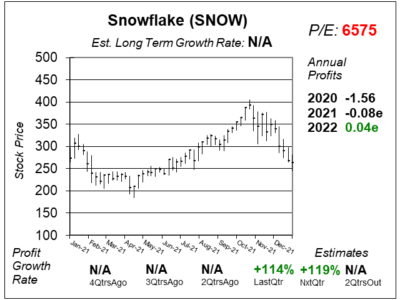

One Year Chart |

SNOW stock was around this price last Spring. That’s a good thing, because the revenue is now much higher (around double). This stock is in a downtrend, and could go lower. I belive this is a top growth stock long-term, and I want to be invested. If I wait, the stock might leave me behind for years to come. SNOW stock was around this price last Spring. That’s a good thing, because the revenue is now much higher (around double). This stock is in a downtrend, and could go lower. I belive this is a top growth stock long-term, and I want to be invested. If I wait, the stock might leave me behind for years to come.

The company did make a profit last qtr, with triple-digit profit growth. That’s a goos sign. And profit growth could be triple-digit again this qtr. There is no Est. LTG. The P/E is really big as profits are just starting to materialize. |

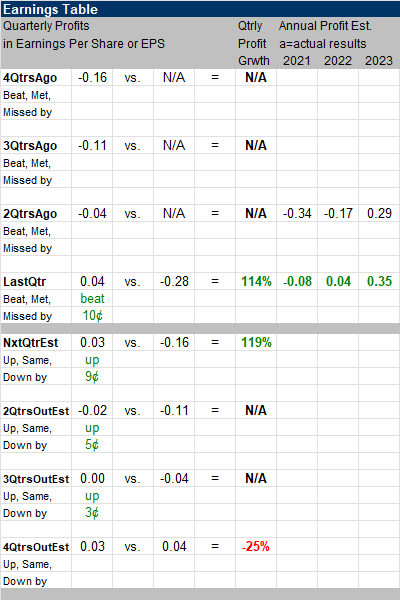

Earnings Table |

Last qtr, Snowflake posted its first profit as a publicly traded company. It earned $0.04 per share, and beat estimates of -$0.06. Revenue jumped 110% as that was the 5th straight qtr of triple-digit revenue growth. Revenue of $334 million beat estimates of $304 million. Revenue beat estimates by $30 million. And the prior qtr, managment guided up this number to $283 million. Does that mean annual revenue estimates are too low? Last qtr, Snowflake posted its first profit as a publicly traded company. It earned $0.04 per share, and beat estimates of -$0.06. Revenue jumped 110% as that was the 5th straight qtr of triple-digit revenue growth. Revenue of $334 million beat estimates of $304 million. Revenue beat estimates by $30 million. And the prior qtr, managment guided up this number to $283 million. Does that mean annual revenue estimates are too low?

Annual Profit Estimates are for slight profits in 2022 and 2023. Qtrly profit Estimates are for 119%, N/A, N/A and -25% growth the next 4 qtrs. I like the triple-digit growth estimate for next qtr. And there are slight losses predicted for 2QtrsOut and 3QtrsOut. Its concieable the company can continue to beat the street and continue to grow profits in the triple-digits. +100% or better profit growth is a hallmark of a great stock. Management sees 95% revenue growth this qtr. |

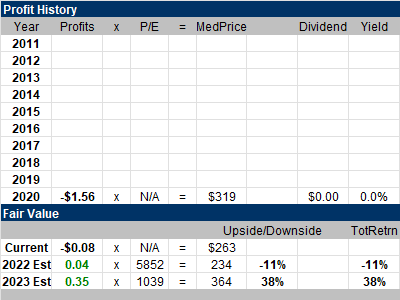

Fair Value |

M y Fair Value is a robust 35x annual revenue (which other brokerage firms are using as they have similar 2023 proce targets). Notice below that the stock is (was) expensive when looking at 2021 revenue. It currently sells for 66x 2021 estimates (we are now in Q4). When we look at 2022 Fair Value, the stock seeems reasonable. When we look to 2023, estimates are for 38% upside. That’s the joy of growth stocks. Even if you overpay for the stock, the revenue and or profits can grow so rapidly that it can make the stock undervalued so quickly, and perhaps push the stock back up: y Fair Value is a robust 35x annual revenue (which other brokerage firms are using as they have similar 2023 proce targets). Notice below that the stock is (was) expensive when looking at 2021 revenue. It currently sells for 66x 2021 estimates (we are now in Q4). When we look at 2022 Fair Value, the stock seeems reasonable. When we look to 2023, estimates are for 38% upside. That’s the joy of growth stocks. Even if you overpay for the stock, the revenue and or profits can grow so rapidly that it can make the stock undervalued so quickly, and perhaps push the stock back up:

Current: 2022 Fair Value: 2023 Fair Value: |

Bottom Line |

Snowflake (SNOW) has been a volatile stock since it was the largest software IPO ever in September 2020. But that’s a good thing for us as it gives us the opportunity to buy on a dip. Snowflake (SNOW) has been a volatile stock since it was the largest software IPO ever in September 2020. But that’s a good thing for us as it gives us the opportunity to buy on a dip.

Snowflake has been an admired company. But the issue had always been the high price. This Bear Market in growth stocks has given us an amazing opportunity to collect them in at reasonable prices. SNOW will be added to the Aggressive Growth Portfolio and rank 3rd in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 3 of 31Conservative Stock Portfolio N/A |