Stock (Symbol) |

Shopify (SHOP) |

Stock Price |

$633 |

Sector |

| Technology |

Data is as of |

| February 22, 2022 |

Expected to Report |

| April 26 |

Company Description |

Shopify Inc. (Shopify) provides a cloud-based, multi-channel commerce platform designed for small and medium-sized businesses. The Company offers subscription solutions and merchant solutions. The Company’s software is used by merchants to run their business across all of their sales channels, including Web and mobile storefronts, physical retail locations, social media storefronts and marketplaces. The Shopify platform provides merchants with a single view of their business and customers across all of their sales channels and enables them to manage products and inventory, process orders and payments, ship orders, build customer relationships and leverage analytics and reporting all from one integrated back office. The Shopify platform includes a mobile-optimized checkout system, which is designed to enable merchants’ consumers to buy products over mobile Websites. Its merchants are able to offer their customers the ability to check out by using Apple Pay. Source: Thomson Financial Shopify Inc. (Shopify) provides a cloud-based, multi-channel commerce platform designed for small and medium-sized businesses. The Company offers subscription solutions and merchant solutions. The Company’s software is used by merchants to run their business across all of their sales channels, including Web and mobile storefronts, physical retail locations, social media storefronts and marketplaces. The Shopify platform provides merchants with a single view of their business and customers across all of their sales channels and enables them to manage products and inventory, process orders and payments, ship orders, build customer relationships and leverage analytics and reporting all from one integrated back office. The Shopify platform includes a mobile-optimized checkout system, which is designed to enable merchants’ consumers to buy products over mobile Websites. Its merchants are able to offer their customers the ability to check out by using Apple Pay. Source: Thomson Financial |

Sharek’s Take |

Shopify (SHOP) is expected to have profits decline from $6.41 last year to $4.56 this year as it spends to grow. The company is expected to have higher sales and marketing expenses in 2022 as well as $200 million in capital spending. Shopify is building out its U.S. fulfillment infrastructure to warehouse and ship products for merchants on its platform. But that number seems so low considering Amazon is spending tens-of-billions to compete. With a P/E of 139, this stock could continue to tumble lower. Shopify (SHOP) is expected to have profits decline from $6.41 last year to $4.56 this year as it spends to grow. The company is expected to have higher sales and marketing expenses in 2022 as well as $200 million in capital spending. Shopify is building out its U.S. fulfillment infrastructure to warehouse and ship products for merchants on its platform. But that number seems so low considering Amazon is spending tens-of-billions to compete. With a P/E of 139, this stock could continue to tumble lower.

Shopify is an e-commerce platform for merchants to sell their goods both online and in-store. Management is focused on building an operating system that will shape the future of retail by allowing people to start and manage online and even physical stores. SHOP basically saw the obstacles e-commerce stores face when selling online, then tackled them one-by-one. What makes the company special is it helps the small business owner in many ways, including advertising, product storage, and shipping. The company allows more than 1 million merchants to have a sharp-looking online store (and/or physical store), process orders and payments, manage inventory, and see analytics. The company even has a set of hardware owners can purchase, including cash drawers, receipt printers, iPad stands, and barcodes as well as barcode readers. Pricing for Shopify is: Basic $29 a month, Shopify $79 a month, Advanced $299 a month, of Shopify Plus $2000+ a month. No setup fees. Here’s a brief overview of some of the options Shopify offers to merchants:

Here are some financial highlights from last qtr:

Shopify was founded in 2006 and headquartered in Ottawa, Canada. The stock had its IPO in June 2015 at $27. Last qtr the stock was $1524 and this qtr its fallen all the way to 633. But now that growht is gone, the P/E of 139 seems very high. SHOP is part of the Growth Portfolio. With the stock in a severe downturn, I will sell the shares today. |

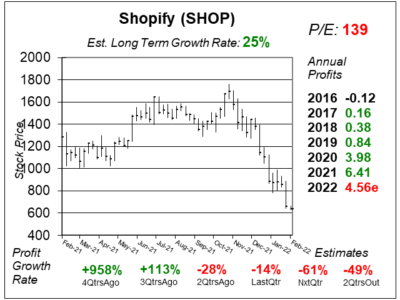

One Year Chart |

This stock broke down after it reported earnings just last week. This chart needs work, the stock needs to base then break out before its investable in my eyes. This stock broke down after it reported earnings just last week. This chart needs work, the stock needs to base then break out before its investable in my eyes.

Note the profit picture has been poor for the last two qtrs. That’s expected to continue. This P/E of 139 is down from last qtr’s P/E of 227. The P/E is high for this kind of growth. The Est. LTG of 25% is down from 29% 2QtrsAgo. |

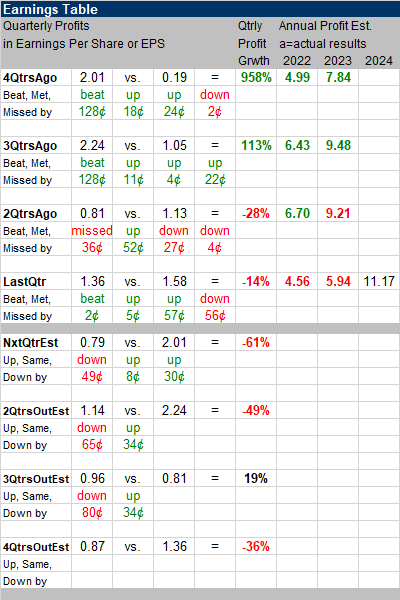

Earnings Table |

Last qtr, Shopify had profit growth of -14% and barely beat estimates of -15%. Revenue increased 41%, year-over-year, which was slowing growth from 46% a qtr earlier. Last qtr, Shopify had profit growth of -14% and barely beat estimates of -15%. Revenue increased 41%, year-over-year, which was slowing growth from 46% a qtr earlier.

Annual Profit Estimates are mixed this qtr. And there are big numbers on the horizon. It’s hard to make an argument this stock has a high P/E when looking out to what the company might earn in 3-5 years. Qtrly Profit Estimates are for -61%, -49%, 19% and -36% profit growth the next 4 qtrs. |

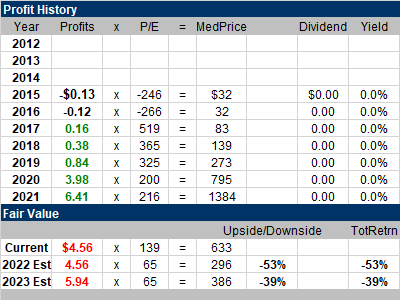

Fair Value |

My Fair Value is a P/E of 65 (which is high) and that still gets us a $300 or so stock, around half the current price. My Fair Value is a P/E of 65 (which is high) and that still gets us a $300 or so stock, around half the current price. |

Bottom Line |

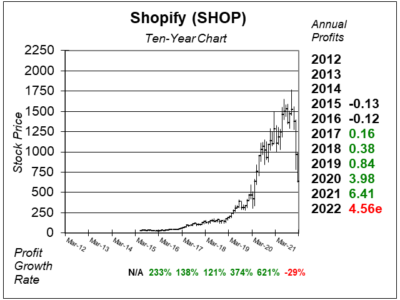

Shopify (SHOP) had established itself as a true franchise of a stock. It was really similar to Amazon in many ways (including the stock’s exceptional performance). SHOP originally broke out in January 2017 at $50, and since it would go on to make $0.16 that year, the stock sold for 313 times future earnings. That’s a high P/E, and conservative investors might have passed on buying (I did). The stock broke out a second time in February 2019 at around $175. I added a small position of SHOP to my Growth Portfolio on November 19, 2019 at ~$323. Shopify (SHOP) had established itself as a true franchise of a stock. It was really similar to Amazon in many ways (including the stock’s exceptional performance). SHOP originally broke out in January 2017 at $50, and since it would go on to make $0.16 that year, the stock sold for 313 times future earnings. That’s a high P/E, and conservative investors might have passed on buying (I did). The stock broke out a second time in February 2019 at around $175. I added a small position of SHOP to my Growth Portfolio on November 19, 2019 at ~$323.

Today, Shopify has to build expensive warehouses to compete with Amazon. SHOP is planning $200 million in capex this year while Amazon is north of $60 billion (including AWS). Maybe AMZN spends $20-30 billion in fulfillment? I think Shopify will have to spend a ton more, and that could pull profits even lower. SHOP will be sold from the Growth Portfolio today. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |