Stock (Symbol) |

Shopify (SHOP) |

Stock Price |

$1478 |

Sector |

| Technology |

Data is as of |

| September 8, 2021 |

Expected to Report |

| October 27 |

Company Description |

Shopify Inc. (Shopify) provides a cloud-based, multi-channel commerce platform designed for small and medium-sized businesses. The Company offers subscription solutions and merchant solutions. The Company’s software is used by merchants to run their business across all of their sales channels, including Web and mobile storefronts, physical retail locations, social media storefronts and marketplaces. The Shopify platform provides merchants with a single view of their business and customers across all of their sales channels and enables them to manage products and inventory, process orders and payments, ship orders, build customer relationships and leverage analytics and reporting all from one integrated back office. The Shopify platform includes a mobile-optimized checkout system, which is designed to enable merchants’ consumers to buy products over mobile Websites. Its merchants are able to offer their customers the ability to check out by using Apple Pay. Source: Thomson Financial Shopify Inc. (Shopify) provides a cloud-based, multi-channel commerce platform designed for small and medium-sized businesses. The Company offers subscription solutions and merchant solutions. The Company’s software is used by merchants to run their business across all of their sales channels, including Web and mobile storefronts, physical retail locations, social media storefronts and marketplaces. The Shopify platform provides merchants with a single view of their business and customers across all of their sales channels and enables them to manage products and inventory, process orders and payments, ship orders, build customer relationships and leverage analytics and reporting all from one integrated back office. The Shopify platform includes a mobile-optimized checkout system, which is designed to enable merchants’ consumers to buy products over mobile Websites. Its merchants are able to offer their customers the ability to check out by using Apple Pay. Source: Thomson Financial |

Sharek’s Take |

Shopify (SHOP) could be on the verge of breaking out to new All-Time highs and making a run higher as management continues to improve the platform, and take the company to the next level of ecommerce. The company is developing Store 2.0 which added new updates like features and functionality in their online platform to help merchants build the future of e-commerce. These were more flexible and customizable storefronts, faster and customizable checkout, and economic model update. The company added new features to Shop like analytics dashboard, automated marketing tools, in-app cart, and checkout. Shopify already has a buy-now, pay-later option (with Affirm) and is now focused on improving International ecommerce by helping merchants with legal issues and taxation when selling within other countries (like what Global-E does for big companies). Shopify (SHOP) could be on the verge of breaking out to new All-Time highs and making a run higher as management continues to improve the platform, and take the company to the next level of ecommerce. The company is developing Store 2.0 which added new updates like features and functionality in their online platform to help merchants build the future of e-commerce. These were more flexible and customizable storefronts, faster and customizable checkout, and economic model update. The company added new features to Shop like analytics dashboard, automated marketing tools, in-app cart, and checkout. Shopify already has a buy-now, pay-later option (with Affirm) and is now focused on improving International ecommerce by helping merchants with legal issues and taxation when selling within other countries (like what Global-E does for big companies).

Shopify is an e-commerce platform for merchants to sell their goods both online and in-store. Management is focused on building an operating system that will shape the future of retail by allowing people to start and manage online and even physical stores. SHOP basically saw the obstacles e-commerce stores face when selling online, then tackled them one-by-one. What makes the company special is it helps the small business owner in many ways, including advertising, product storage, and shipping. The company allows more than 1 million merchants to have a sharp-looking online store (and/or physical store), process orders and payments, manage inventory, and see analytics. The company even has a set of hardware owners can purchase, including cash drawers, receipt printers, iPad stands, and barcodes as well as barcode readers. Pricing for Shopify is: Basic $29 a month, Shopify $79 a month, Advanced $299 a month, of Shopify Plus $2000+ a month. No setup fees. Here’s a brief overview of some of the options Shopify offers to merchants:

Here are some financial highlights from last qtr:

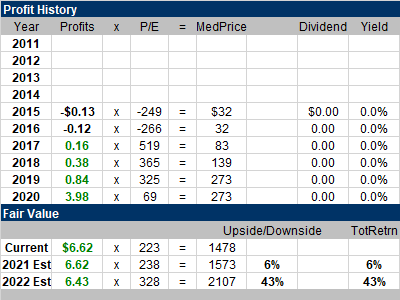

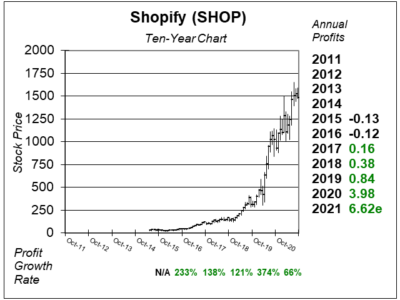

Shopify is a young company. It was founded in 2006 and headquartered in Ottawa, Canada. The stock had its IPO in June 2015 at $27. This qtr, with SHOP around $1478, the stock’s growth has been rapid. But so have profits, which went from -$0.13 per share in 2015 to $3.98 in 2020. The P/E is 223, which sounds high, but profits are expected to climb from $3.98 last year to $35.84 in 2025. We have to understand this might be the tip of the iceberg in terms of profitability. SHOP is part of the Growth Portfolio. The stock has around 40% upside to my 2022 Fair Value of $2107. |

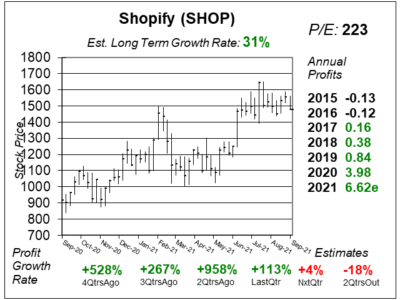

One Year Chart |

This looks like a cup-and-handle chart pattern. Notice the U shaped formation from February to June, then the stock saw a surge higher from $1250 to $1500. In July, the stock broke out and pushed past $1600, but has since fallen back into the base. Note that this is the price the stock was at after the jump in June. The only thing that would make the chart better is if the stock continued to retreat slowly below $1400. That would shake out some weak shareholders. A close over $1600 would be a break out and that would be a buy signal. This looks like a cup-and-handle chart pattern. Notice the U shaped formation from February to June, then the stock saw a surge higher from $1250 to $1500. In July, the stock broke out and pushed past $1600, but has since fallen back into the base. Note that this is the price the stock was at after the jump in June. The only thing that would make the chart better is if the stock continued to retreat slowly below $1400. That would shake out some weak shareholders. A close over $1600 would be a break out and that would be a buy signal.

This P/E of 223 is much lower than last qtr’s P/E of 346. The P/E was 306 3QtrsAgo, and 263 4QtrsAgo. But I think this figure isn’t really relevant as the stock is selling for a multiple-of-revenue. The Est. LTG of 31% is up from 28% 2QtrsAgo. This figure was 38% 3QtrsAgo. I think SHOP as a 50-65% profit grower over the next 3-5 years. |

Earnings Table |

Last qtr, Shopify delivered 113% profit growth which beat estimates of -9%. Total revenue climbed 57%, which was decelerating growth from 110% 2QtrsAgo. This was a record qtr for the company as it reached $1 billion the first time. Shopify has two sources of revenue: Merchant Solutions (payment processing fees from Shopify Payments, transaction fees, referral fees, POS hardware) and Subscription Solutions. Merchant revenue grew 52% primarily due to GMV growth (52%). Subscription revenue grew 70%, primarily due to strong growth in monthly recurring revenue (up 67%). Last qtr, Shopify delivered 113% profit growth which beat estimates of -9%. Total revenue climbed 57%, which was decelerating growth from 110% 2QtrsAgo. This was a record qtr for the company as it reached $1 billion the first time. Shopify has two sources of revenue: Merchant Solutions (payment processing fees from Shopify Payments, transaction fees, referral fees, POS hardware) and Subscription Solutions. Merchant revenue grew 52% primarily due to GMV growth (52%). Subscription revenue grew 70%, primarily due to strong growth in monthly recurring revenue (up 67%).

Management commented “strong growth in merchant sales, combined with increased GMV penetration of Shopify Payments, merchant adoption of Shopify Capital and Shipping drove revenue” (source Shopify Earnings call). Annual Profit Estimates continue to climb higher. And there are big numbers on the horizon. It’s hard to claim this stock has a high P/E when looking out to what the company might earn in 3-5 years. Qtrly Estimates are for 4%, -18%, -40%, and -35% profit growth the next 4 qtrs. Profit estimates for these next 4 qtrs seem too low. |

Fair Value |

3QtrsAgo this stock sold for 37x 2021 revenue estimates. 2QtrsAgo it sold for 43x sales. Now it sells for 39x sales. Thus, my Fair Value is 42x revenue. 3QtrsAgo this stock sold for 37x 2021 revenue estimates. 2QtrsAgo it sold for 43x sales. Now it sells for 39x sales. Thus, my Fair Value is 42x revenue.

Also, during the past three qtrs, 2021 revenue estimates rose from $4.1 billion to $4.4 billion to $4.6 billion, while 2022 estimates increased from $5.4 billion to $5.9 billion to $6.2 billion. Increasing estimates is good because we may be underestimating a company’s potential. It also makes it hard to claim the valuation is too high, as we don’t really know what the company is capable of. Current: 2021 Fair Value: 2022 Fair Value: |

Bottom Line |

Shopify (SHOP) has established itself as a true franchise of a stock. It’s really similar to Amazon in many ways (including the stock’s exceptional performance). Within Annual Profits, note the company has been profitable since 2017. SHOP originally broke out in January 2017 at $50, and since it would go on to make $0.16 that year, the stock sold for 313 times future earnings. That’s a high P/E, and conservative investors might have passed on buying (I did). The stock broke out a second time in February 2019 at around $175. I added a small position of SHOP to my Growth Portfolio on November 19, 2019 at ~$323. Shopify (SHOP) has established itself as a true franchise of a stock. It’s really similar to Amazon in many ways (including the stock’s exceptional performance). Within Annual Profits, note the company has been profitable since 2017. SHOP originally broke out in January 2017 at $50, and since it would go on to make $0.16 that year, the stock sold for 313 times future earnings. That’s a high P/E, and conservative investors might have passed on buying (I did). The stock broke out a second time in February 2019 at around $175. I added a small position of SHOP to my Growth Portfolio on November 19, 2019 at ~$323.

This company has multiple catalysts. This time its buy-now, pay-later and enhanced International ecommerce abilities. What’s next? We likely don’t know. It could be something that could push these far-out profit estimates above where they are now. And that’s why this stock should have the premium validation that it does (~40x revenue). SHOP moves up from 17th to 11th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

11 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |