About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

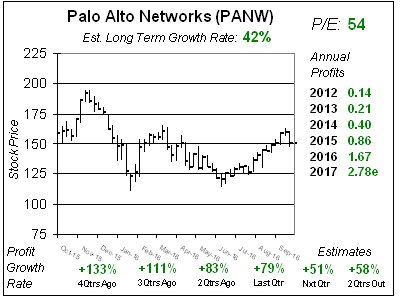

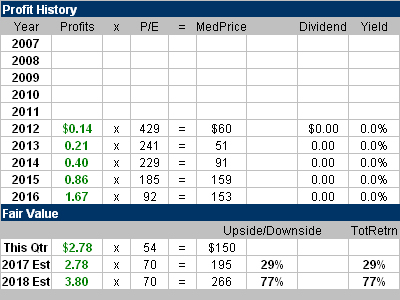

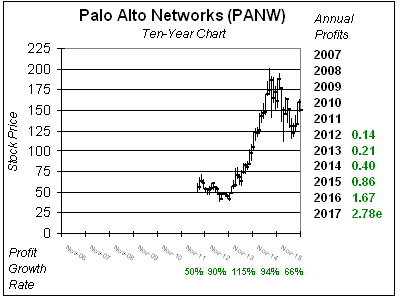

Palo Alto Networks (PANW) is growing so rapidly it will soon past Cisco as the #1 cyber-security company. Right now Cisco is a much larger player in the cyber-security space but Palo Alto is growing by leaps-and-bounds and Cisco is growing its cyber business moderately. Thus PANW could be the largest cyber-security company in the world in 2-to-3 years. The cyber-security market could grow 15% this year, so market conditions are good. PANW’s profits are superb, and rank with the best stocks of All-Time. Profits the last 8 qtrs have gone from $0.15 to $0.19, 0.23, 0.28, 0.35, 0.40, 0.42 and $0.50. Analysts were down on the stock after the company lowered next qtr’s estimate to $0.53, but that would still be a record! Plus, PANW has beaten the street by a penny the last 3 qtrs. Profit Estimates for the next 4 qtrs are now: $0.53, 0.63, 0.72 and $0.90. Keep in mind the July 2017 qtr estimate is for $0.90, which is PANW’s Q4. So by next fall the company could be making more than $1 a qtr. Here’s what most investors can’t envision: Profits are estimated to climb from $1.67 last year to $2.78 in 2017, $3.80 in 2018 and $4.97 in fiscal year ending July 2019. So if PANW keeps its 54 P/E and makes $5 in profits would mean a $270 stock.

Palo Alto Networks (PANW) is growing so rapidly it will soon past Cisco as the #1 cyber-security company. Right now Cisco is a much larger player in the cyber-security space but Palo Alto is growing by leaps-and-bounds and Cisco is growing its cyber business moderately. Thus PANW could be the largest cyber-security company in the world in 2-to-3 years. The cyber-security market could grow 15% this year, so market conditions are good. PANW’s profits are superb, and rank with the best stocks of All-Time. Profits the last 8 qtrs have gone from $0.15 to $0.19, 0.23, 0.28, 0.35, 0.40, 0.42 and $0.50. Analysts were down on the stock after the company lowered next qtr’s estimate to $0.53, but that would still be a record! Plus, PANW has beaten the street by a penny the last 3 qtrs. Profit Estimates for the next 4 qtrs are now: $0.53, 0.63, 0.72 and $0.90. Keep in mind the July 2017 qtr estimate is for $0.90, which is PANW’s Q4. So by next fall the company could be making more than $1 a qtr. Here’s what most investors can’t envision: Profits are estimated to climb from $1.67 last year to $2.78 in 2017, $3.80 in 2018 and $4.97 in fiscal year ending July 2019. So if PANW keeps its 54 P/E and makes $5 in profits would mean a $270 stock.