Stock (Symbol) |

NVIDIA (NVDA) |

Stock Price |

$168 |

Sector |

| Technology |

Data is as of |

| September 8, 2025 |

Expected to Report |

| November 19 |

Company Description |

NVIDIA Corporation is a full-stack computing infrastructure company. NVIDIA Corporation is a full-stack computing infrastructure company.

The Company is engaged in accelerated computing to help solve the challenging computational problems. The Company’s segments include Compute & Networking and Graphics. The Compute & Networking segment includes its Data Center accelerated computing platforms and artificial intelligence (AI) solutions and software; networking; automotive platforms and autonomous and electric vehicle solutions; Jetson for robotics and other embedded platforms, and DGX Cloud computing services. The Graphics segment includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems, and Omniverse Enterprise software for building and operating industrial AI and digital twin applications. Source: Refinitiv |

Sharek’s Take |

NVIDIA (NVDA) is winning the Datacenter and Gaming industries, and now, the spotlight turns to Robotics and Autonomous Vehicles with its new Thor chip. Last qtr, NVIDIA’s Datacenter revenue grew 56% year-over-year, Gaming revenue grew 52% year-over-year, and its Automotive revenue grew 69% year-over-year. What is NVIDIA’s Thor? It is the newest supercomputer-on-a-chip made for cars and robots. Thor can run visual models and interpret the world around them. In last qtr’s earnings call, management stated Thor is the most successful robotics and AV computer the company ever created. They added Thor’s arrival coincides with the industry’s accelerating shift to vision language model architecture generative AI and higher levels of autonomy. NVIDIA has already begun shipments of NVIDIA Thor SoC. Thor is a nice story, but Auto & Robotics revenue is only 1-2% of revenue right now, so the focus is still on Datacenter, which is around 90% of revenue. NVIDIA (NVDA) is winning the Datacenter and Gaming industries, and now, the spotlight turns to Robotics and Autonomous Vehicles with its new Thor chip. Last qtr, NVIDIA’s Datacenter revenue grew 56% year-over-year, Gaming revenue grew 52% year-over-year, and its Automotive revenue grew 69% year-over-year. What is NVIDIA’s Thor? It is the newest supercomputer-on-a-chip made for cars and robots. Thor can run visual models and interpret the world around them. In last qtr’s earnings call, management stated Thor is the most successful robotics and AV computer the company ever created. They added Thor’s arrival coincides with the industry’s accelerating shift to vision language model architecture generative AI and higher levels of autonomy. NVIDIA has already begun shipments of NVIDIA Thor SoC. Thor is a nice story, but Auto & Robotics revenue is only 1-2% of revenue right now, so the focus is still on Datacenter, which is around 90% of revenue.

NVIDIA was originally focused on the computer graphics market, and invented the first graphics processing unit (GPU) in 1999 which made the company the leader in computer graphics. The company introduced its CUDA programming model in 2006 and ushered in parallel processing of its GPU for high-performance computing that could be used in fields including aerospace, biotechnology, and energy exploration. NVDA has since expanded its architecture to scientific computing, artificial intelligence, data science, autonomous vehicles, robotics, and virtual reality (or AR). NVIDIA’s rapid growth is driven by its Data Center segment, due to the strong demand for Generative AI platforms. The NVIDIA DGX platform is the world’s first AI supercomputer. Here’s how it works:

NVDA has four operating segments : Gaming, Data Center, Professional Visualization and Auto. Here are segment stats from last qtr:

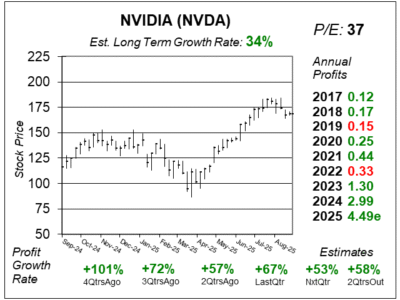

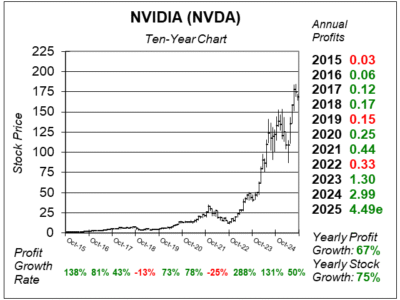

NVIDIA is in a golden era of a universal upgrade in computing. The company breaks down the four previous eras as (1) PC lead by IBM, (2) Internet, (3) Mobile & Cloud lead by the iPhone, and (4) AI. Analysts give NVDA an Estimated Long Term Growth Rate (Est. LTG) of 34%. I consider NVDA a rapid grower, which in my opinion is a company growing year-over-year profits 65% or greater. Management even buys back stock and pays a small dividend. In 2024, management spend $10 billion to repurchase its stock and spent another $400 million in dividends. NVIDIA is the top holding in my Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

NVIDIA has been hanging around $175. NVIDIA has been hanging around $175.

This stock has a P/E of 37. That’s a nice P/E and around where I think it should be. The P/E was 32 last quarter. Note, my Fair Value is a P/E of 40. The Est. LTG is 34% is down from 50% 2QtrsAgo. The Est. LTG is analysts’ 3-5 year guess of annual profit growth (not stock growth). Quarterly profit growth has been rapid the past 4 qtrs. And Estimates are for rapid growth to continue. |

Earnings Table |

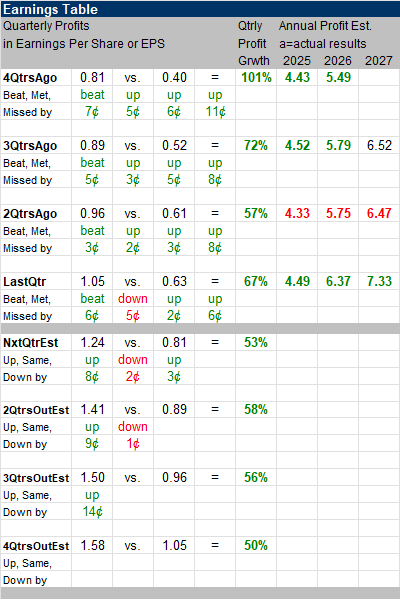

Last qtr, NVIDIA reported 67% profit growth and beat estimates of 57%. Revenue grew 56% and beat analyst’s estimates of 51%. Gross margin was 72.3%, down from 75.7% year ago. Last qtr, NVIDIA reported 67% profit growth and beat estimates of 57%. Revenue grew 56% and beat analyst’s estimates of 51%. Gross margin was 72.3%, down from 75.7% year ago.

Annual Profit Estimates increased this qtr, but 2025 estimates have been rather stable the past year. From $4.43 4QtrsAgo to $4.49 this qtr. That’s not impressive. Note, estimates fell last qtr due to US restrictions on sending chips to China. Qtrly Profit Estimates for the next 4 qtrs are 53%, 58%, 56%, and 50%. That’s impressive. For next qtr, analysts predict revenue will climb 56% year-over-year. |

Fair Value |

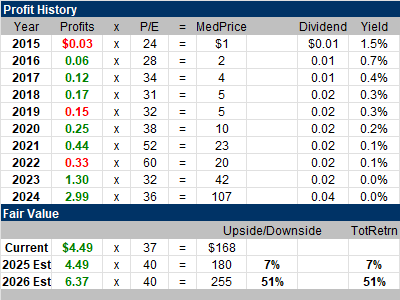

NVDA has a P/E of 37. My Fair Value is a P/E of 40. NVDA has a P/E of 37. My Fair Value is a P/E of 40.

My Fair Value for this stock is $180, giving the stock 7% upside from the recent quote of $168. There’s ample upside for 2026 — 51% — as my guess is the stock could be $255 by then. |

Bottom Line |

NVIDIA (NVDA) stock has had a rocky decade. In 2016, the NVDIA GeForce video processor created a surge in revenue and profits and helped the stock soar from $0.82 to $2.67 that year (after accounting for stock-splits). NVIDIA continued to rise into 2018 and peaked at $7. Then the stock fell to $3 in late-2018 as the company had lots of returns of its high-end processors as the price of Bitcoin declined and crypto miners returned their gear back to NVIDIA. Note profits fell in 2019. NVIDIA (NVDA) stock has had a rocky decade. In 2016, the NVDIA GeForce video processor created a surge in revenue and profits and helped the stock soar from $0.82 to $2.67 that year (after accounting for stock-splits). NVIDIA continued to rise into 2018 and peaked at $7. Then the stock fell to $3 in late-2018 as the company had lots of returns of its high-end processors as the price of Bitcoin declined and crypto miners returned their gear back to NVIDIA. Note profits fell in 2019.

Meanwhile, the 2022 slump was due to a downturn in sales in the Gaming division as (1) businesses were flush with cash in 2021 and had already upgraded computers and (2) Bitcoin miners found it unprofitable to mine with lower crypto prices combined with high electricity costs. In January 2023 the stock pushed past $20 and ended that year at $50 as Datacenter sales pushed higher due to AI investments. 2024 was also great as the shares went from $50 to 134. NVIDIA is still the top stock in my universe. It’s a large company that’s at the center of AI buildouts. And buildouts have been strong lately. Looking ahead, NVIDIA sees the next big opportunity in Robots. NVDA ranks first in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

1 of 33Aggressive Growth Portfolio 1 of 13Conservative Stock Portfolio N/A |