Some of the top growth stocks in the stock market have fallen heavily from their highs. Is this the time to buy?

Some of the top growth stocks in the stock market have fallen heavily from their highs. Is this the time to buy?

To know if these are a buy, we need to calculate price targets, and see what the stocks are really worth. So today we go through some of the market’s former high-flyers and see what these stocks are really worth.

Most of the rapid growers of the past few years have little-to-no profits. This makes it difficult to find a fair value on the stock using a price-to-earnings or P/E ratio.

These companies are purposely spending-to-grow, and sacrifice short-term profits to grow revenue and solidify their leadership in their space.

These rapid growers are often analyzed on a price-to-revenue basis, or a number of years worth of sales. To calculate this we take the company’s market capitalization (what all the shares are worth) and divide by the company’s estimated revenue for this upcoming year.

Rapid growth (50%-plus revenue growth) might be worth 20x-35x revenue. But this ranges are just my opinion. The stocks go up-and-down in these ranges depending on stock market conditions.

Below are one-year charts of these stocks. I cover 100 stocks, and write research reports on each every qtr. Thus, these charts aren’t current, but are a picture of what the stock looked like at that time. Enjoy!

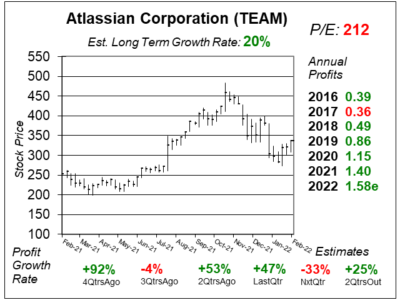

Atlassian (TEAM)

One good thing about this growth stock Bear Market we’ve been in the past three months is we get to find out exactly who the real leaders are in technology stocks.

Within team collaboration software, Atlassian (TEAM) is the best. Atlassian develops software that is used by thousands of development teams worldwide to plan software projects, collaborate on code, then test and deploy products.

Atlassian is cash flow positive, and management sometimes uses some of its cash to buy back stock. TEAM stock is admired by Wall Street as the company has grown revenue (and customers) every qtr since the IPO back in December 2015. Last qtr, revenue grew 37%, which was the slowest growth within this set of stocks.

During the past three fiscal years, TEAM has sold for a price-to-revenue of 26x, 27x and 31x. This qtr (February 9 with TEAM at $339) the stock sold for 32x 2022 revenue estimates.

Since this stock has a long history of trading around 30x revenue, My Fair Value on TEAM is 30x revenue, or $319 this year (2022) and $393 next year (2023).

Cloudflare (NET)

Cloudflare (NET) is an amazing company that’s getting compared to Amazon Web Services.

Cloudflare built one of the world’s largest networks in 200 cities across 100 countries to store data and stop attacks for its clients, while keeping things flowing swiftly online.

The company is a consistent rapid grower, with revenue growth of 50% or greater the past five years. Last qtr, revenue grew 54%.

But the stock is pricey, as this qtr (3/25) with the stock at $120 it sold for 42x 2022 revenue estimates. Wow! You think that’s high? Last year when NET was $165 it sold for 82x 2021 revenue estimates. * Note when people say “the stock market was in a bubble” this stock was a prime example, with the reasoning being the multiple was too high.

Notice the stock briefly got down to $75 during the last stock market selloff. To me that means I should buy more NET when it gets down to 25x revenue, as that seems to be the floor for the stock.

My Fair Value on NET is 25x revenue, which is $72 a share this year, $98 next year.

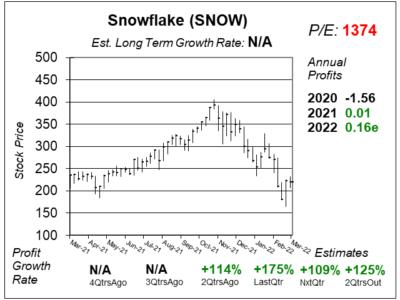

Snowflake (SNOW)

Snowflake (SNOW) is the top choice for large enterprises to store their data. It’s a fantastic company that’s growing revenue 100% with a huge market to address (I mean data is only getting bigger).

Still, the stock just went from ~$400 to ~$200, so not everything its good. But last year with the stock was $400 it was selling for 100x revenue estimates. That was too high.

SNOW stock recently hit a low of $164 or 25x revenue during the growth stock Bear Market selloff. Since then, the stock’s bounced above $200. But if we put our Fair Value on the stock at 25x revenue, then we can feel comfortable buying there as it that’s the recent floor on the stock.

Last qtr, SNOW delivered 101% revenue growth. That was the best of this bunch.

My Fair Value on SNOW is 25x revenue or $168 this year and $259 next year. I would look to buy if the stock got back down ~$170, as 25x revenue seem to be the floor for the stock.

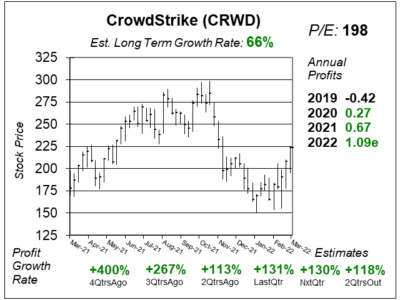

CrowdStrike (CRWD)

Cybersecurity stock CrowdStrike (CRWD) has excellent fundamentals. Last qtr the company delivered 131% profit growth which whipped analyst estimates of 54% as revenue jumped 63%. The company added 1638 new subscription customers to bring its total to 16,325, which was an increase of 65% year-over-year. The robust revenue growth allows the company to increase investments in new technologies and expand overseas.

CrowdStrike is crowd-sourced security, that’s learning from other cyber attacks. The company has a threat intel platform that is spying on customer traffic. When one customer gets hit by an attempted cyber attack, CrowdStrike sees this 1st attack and can strike the threat for all its customers. CrowdStrike is about endpoint protection for PCs, laptops, iPads and mobile phones. On the other hand, Zscaler (below) protects the traffic that flows.

CRWD jumped from $175 to $300, down to $150, then back to $225 during the past year. When it was around its lows, the stock sold for 16x revenue.

Last qtr, the company delivered 63% revenue growth. Also note profit growth has grown at triple-digit rates the past four qtrs. CRWD has some of the best fundamentals of the stocks in this group. It grows revenue and profits.

My Fair Value on CRWD is 25x revenue, or $233 this year and $315 next year.

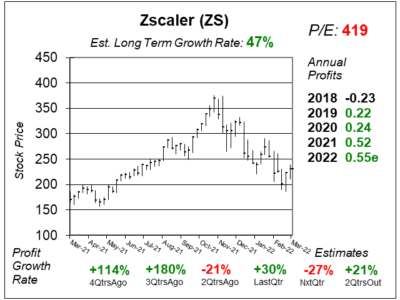

Zscaler (ZS)

Cybersecurity company Zscaler (ZS) is the biggest provider of cloud-based web security gateways that inspect data traffic for malware. When compared to Crowdstrike, Zscaler protects traffic that’s flowing while Crowdstrike is about endpoint protection (computers, phones).

Management says its the clear market leader in zero trust applications and that no one comes close to the capabilities of its platform.

Last qtr, the company delivered 63% revenue growth.

When we look at these shares, 25x revenue is $187. Note the recent low was $190. So 25x seems to be a support level for this stock. 30x revenue is $225, around where the stock is now.

My Fair Value on ZS is 25x revenue, or $187 this year and $254 next year. Since the stock seems to have support at $190, I would look to buy if the stock got back down there.

Sharek's Take

Overall, there has been a lot of bearishness in regards to these rapid growth stocks. One thing to keep in mind is if a stock gets to a fair multiple, and keeps that multiple, then the stock could grow as fast as revenue in the years to come (fi the share count stays the same).

For example, say a stock sells for around 25x revenue for the next 3-5 years. If revenue then grows 40% a year into the future, the stock could keep up with that growth rate, and compound 40% as well (if the price-to-sales multiple stays the same). That’s why these rapid growth stocks are coveted among investors.

Within this list, NET seems the most overvalued, with SNOW perhaps having the most upside long-term as its growing revenue 100%. CRWD and ZS are a great one-two-punch in cybersecurity. Between the two I like CRWD better as its growing sales and profits.