The stock market closed mixed on Friday as robust corporate earnings reports offset uncertainty over the Federal Reserve’s next rate policy move. In addition, Treasury yield kept rising to 4.23%, closer to its three-month high of 4.25%.

The stock market closed mixed on Friday as robust corporate earnings reports offset uncertainty over the Federal Reserve’s next rate policy move. In addition, Treasury yield kept rising to 4.23%, closer to its three-month high of 4.25%.

Overall, S&P 500 was flat at 5,808, while NASDAQ was slightly up 0.6% to 18,519.

Tweet of the Day

Tesla $TSLA stock is up after hours after the company reported earnings of $0.72 per share and beat my estimates of $0.63.

Investors are impressed profit margins increased to 19.8% from 17.9% in the year ago period. This shows the company can cut prices and still make money.…

— David Sharek (@GrowthStockGuy) October 23, 2024

Chart of the Day

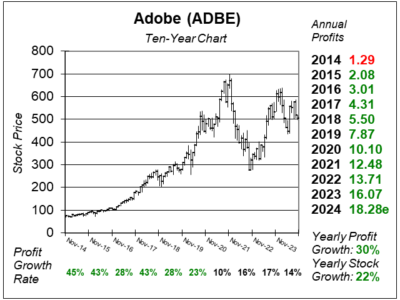

Here is the ten-year chart of Adobe (ADBE) as of October 3, 2024, when the stock was at $504.

Here is the ten-year chart of Adobe (ADBE) as of October 3, 2024, when the stock was at $504.

Adobe delivered good results last quarter driven by AI integration across Creative Cloud, Document Cloud, and Experience Cloud. Last quarter, the company recorded 14% profit growth on 11% revenue growth. New features like Generative Fill and AI-assisted Image Removal in Photoshop, Illustrator, and Lightroom were popular.

Adobe users used AI to create over 12 billion Firefly-powered designs. The company’s subscription model boosted Digital Media Annualized Recurring Revenue by 13%.

ADBE is part of our Conservative Growth Portfolio. David Sharek, Founder of School of Hard Stocks, thinks that profits — and perhaps the stock — could grow 12% to 15% a year in the long run.