Stock (Symbol) |

Meta Platforms (META) |

Stock Price |

$312 |

Sector |

| Technology |

Data is as of |

| November 1, 2023 |

Expected to Report |

| January 31 |

Company Description |

Meta Platforms Inc., formerly Facebook, Inc., builds technologies that help people find communities and grow businesses. Meta Platforms Inc., formerly Facebook, Inc., builds technologies that help people find communities and grow businesses.

The Company’s products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) headsets, wearables, and in-home devices. The Company operates through two segments: Family of Apps (FoA) and Reality Labs (RL). FoA includes Facebook, Instagram, Messenger, WhatsApp, and other services. RL includes augmented and virtual reality-related consumer hardware, software, and content. Facebook enables people to connect, share, discover and communicate with each other on mobile devices and personal computers. Instagram is a place where people can express themselves through photos, videos, and private messaging, and connect with and shop from their favorite businesses and creators. Messenger is a messaging application for people to connect with friends, family, groups, and businesses across platforms and devices. |

Sharek’s Take |

Meta Platforms (META) is cranking out the profits once again as the combination of expense cuts and AI improvements has boosted productivity big time. Last quarter the Facebook, Instagram and WhatsApp conglomerate grew profits a whopping with 168% on just 23% revenue growth. Revenue has been accelerating the past four quarters from -4% to +3%, +11%, and now +23%. Expense cuts in last quarter”s income statement include Marketing & Sales to $2.9 billion from $3.8 billion a year ago as well as General & Administrative expenses to $2.1 billion from $3.4 billion during the same quarter last year. Meta Platforms (META) is cranking out the profits once again as the combination of expense cuts and AI improvements has boosted productivity big time. Last quarter the Facebook, Instagram and WhatsApp conglomerate grew profits a whopping with 168% on just 23% revenue growth. Revenue has been accelerating the past four quarters from -4% to +3%, +11%, and now +23%. Expense cuts in last quarter”s income statement include Marketing & Sales to $2.9 billion from $3.8 billion a year ago as well as General & Administrative expenses to $2.1 billion from $3.4 billion during the same quarter last year.

Meta Platforms, formerly Facebook, builds applications that enable people to connect and share with friends and family through mobile devices, personal computers, reality headsets and in-home devices. The company has around 3.9 billion monthly users within its Family of Apps. On Facebook, the company had 2 billion Daily Active Users and 3 billion Monthly Active Users at the end of last year. Meta apps include:

In last quarter’s earnings call, management said engagement and monetizing that engagement are the two primary drivers of revenue growth, and AI is helping to improve both:

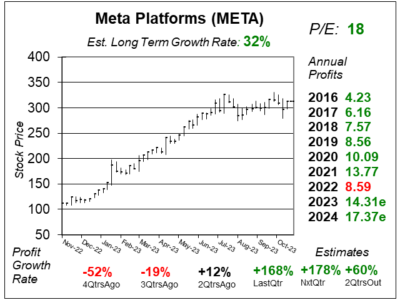

Meta’s stock has been on a wild ride the past year couple of years. It hit an All-Time high of $384 in September 2021, the fell to a low of $88 in November 2022. It then jumped to $326 in July 2023 and has been basing since. The stock currently has an outstanding Estimated Long-Term Growth Rate of 32% and a P/E of just 18. This stock seems like a screaming value. I think the P/E should be 26 and the shares are worthy of a S$452 price. That’s 45% upside when I look to next year. META is part of the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

The stock has been basing for the past four months between $285 and $327. The shares were $312 when these charts & tables were made. The stock has been basing for the past four months between $285 and $327. The shares were $312 when these charts & tables were made.

This qtr’s remarkable profit growth of +168% looks good because profits were down 49% in the year-ago period. This quarter the P/E is 18, down from 23 last qtr. This quarter I’m using 2024 profit estimates to calculate the P/E as we are in Meta’s Fiscal Q4 now. The Est. LTG is 32% this qtr, up from 31% last qtr. That’s analyst estimate of what profits could grow the next 3-5 years, not estimated stock growth. |

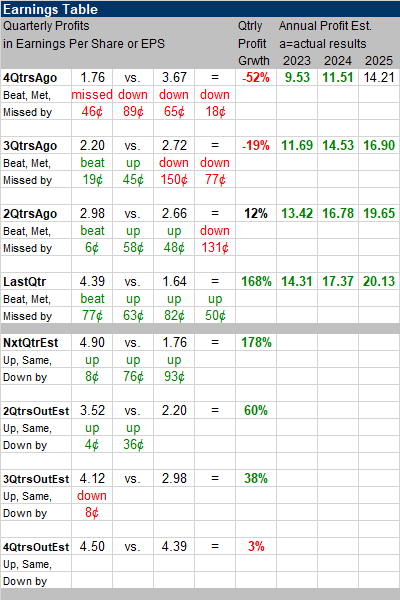

Earnings Table |

Last qtr, Meta generated 168% profit growth and beat estimates of 121% growth. Revenue increased 23%, year-on-year versus estimates of 21%. Total costs and expenses fell 7% due to lower employee headcount (-24%), lower marketing and sales costs (-24%), and lower G&A costs (-39%). R&D, which was 55% of expenses, only increased 1%. Last qtr, Meta generated 168% profit growth and beat estimates of 121% growth. Revenue increased 23%, year-on-year versus estimates of 21%. Total costs and expenses fell 7% due to lower employee headcount (-24%), lower marketing and sales costs (-24%), and lower G&A costs (-39%). R&D, which was 55% of expenses, only increased 1%.

Here are some other stats from last qtr:

Revenue growth was led by +24% growth in advertising revenues from the Family of Apps segment. Growth was driven by the online commerce vertical followed by consumer packaged goods and gaming. The online commerce and gaming verticals benefited from strong ad spend in China. Family of Apps other revenue grew 53% due to strong business messaging revenue growth from WhatsApp Business. Annual Profit Estimates are up this qtr. AI will be Meta’s biggest investment area in 2024 in compute sources and engineering. The 2024 budget calls for increased headcount in AI, infrastructure, Reality Labs, and monetization. Management expects CapEx to rise from around $28 billion this year to around $33 billion net year. Qtrly Profit Estimates are for 178%, 60%, 38%, and 3% profit growth in the next 4 qtrs. Analysts think Meta revenue will grow 21% next qtr. |

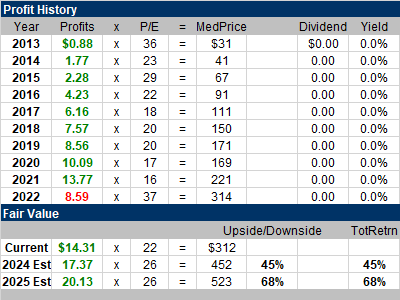

Fair Value |

My Fair Value P/E stays at 26 this qtr. My Fair Value for 2024 is $452, giving the stock 45% upside according to my calculations. My Fair Value P/E stays at 26 this qtr. My Fair Value for 2024 is $452, giving the stock 45% upside according to my calculations.

Note 2025’s Fair Value is $523, which is around 68% higher than the recent quote. 2024 profit estimates have increased the past four quarters from $10.19 to $11.51, $14.53 and $16.78. Following this trend, the company might have the ability to earn $20 in profits next year. $20 in profits x a 25 P/E would send these shares to $500. That would be a nice jump from around $300 now. |

Bottom Line |

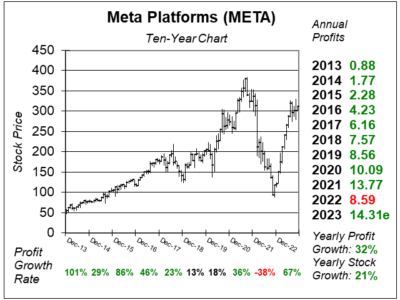

Meta Platforms’ (META) ten-year chart is ugly. The company got off track for a bit and was throwing money at metaverse spending. Then management focused more on cutting expenses and shareholders rejoiced. Then the stock rebounded. 2022 was the first year it didn’t hit a record high in profits as a publicly traded company. Meta Platforms’ (META) ten-year chart is ugly. The company got off track for a bit and was throwing money at metaverse spending. Then management focused more on cutting expenses and shareholders rejoiced. Then the stock rebounded. 2022 was the first year it didn’t hit a record high in profits as a publicly traded company.

Meta has a lot of momentum now, as profits are rolling in again. AI is helping boost time and ad spending on Facebook and Instagram, and gives the company growth opportunity. Advertising has been in a Bear Market the past two years. Ad spend could accelerate in 2024. META jumps from 12th to 4th in the Growth Portfolio Power Rankings. The stock moves up from 9th to 4th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

4 of 30Aggressive Growth Portfolio 4 of 17Conservative Stock Portfolio N/A |