Stock market ended the week on a red as fears of a global recession heightened due to surging interest rates and foreign currency turmoil. S&P 500 plunged 1.7% to 3,693, while NASDAQ fell 1.8% to 10,868.

Oil prices dropped sharply 5.5% to $79 per barrel – its lowest trading price since January.

Meanwhile, Olaplex (OLPX) is expected to keep growing at a solid rate for years to come.

Tweets of the Day

ICYMI: Wharton Professor Jeremy Siegel fired up on @HalftimeReport over the Fed. We're going to break it all down on Overtime. Tune in at 4PM ET! pic.twitter.com/ONe0cqDwcy

— CNBCOvertime (@CNBCOvertime) September 23, 2022

Jeremy Siegel of the Wharton School ripping apart Powell and the Fed…

“They Know Nothing” 2.0 pic.twitter.com/6F1NDHVh55

— Stephen Geiger (@Stephen_Geiger) September 23, 2022

Chart of the Day

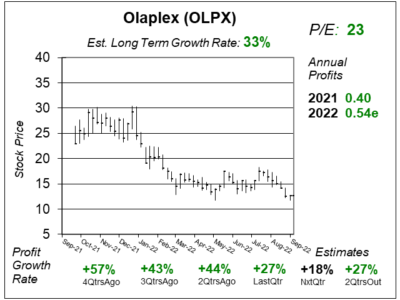

Our chart of the day is the one-year chart of OLPX as of September 10, 2022, when the stock was at $13.

Our chart of the day is the one-year chart of OLPX as of September 10, 2022, when the stock was at $13.

Founded in 2014, Olaplex manufactures premium hair care products that work on a molecular level to repair damaged and broken bonds in the hair, which are caused by hair coloring products and blow dryers.

OLPX continues to post solid results in the face of a recession. Last qtr, the company delivered 27% profit growth as sales jumped 39%.

The only blemish was the company’s gross profit margin declined to 74.2% from 79.2% in the same period last year, due to higher logistics and input costs pressures. Management believes that their business is “extremely profitable with high cash generation” due to their products being replenishable goods.

OLPX stock has a chance to become one of the new leaders of the new Bull Market when it arrives. The stock is part of the Aggressive Growth Portfolio.

The Estimated Long Term Growth Rate of 33% per year is very high for a Food & Necessities stock. The P/E of 23 is reasonable for that type of growth.