In the stock market today, stocks rose as investors look for bargains.

In the stock market today, stocks rose as investors look for bargains.

Overall, the S&P 500 rose 2.4% today, Tuesday June 21, 2022, while the NASDAQ grew 2.5% to 11069. 80% of the stocks on the NYSE had an upside day. Another 80% day tomorrow would be considered a bullish sign.

But right now it seems this is a Bear Market rally as inflation persists. But there are some bright spots to consider when gauging inflation. Used car prices are down 6% during the past 6 months. In addition, Copper, Corn, Lumber and Iron Ore are also off their highs.

The S&P is around 3750, and a 10% decline would bring it to ~3375, which is around where large investors said they would be buying earlier this year. Now, some are saying 3000 is a number to wait for, as higher inflation could cause a recession.

Tweet of the Day

Our tweet of the day is an instant classic from California’s Ross Gerber, reminding everyone to stay positive:

Absolute meltdown (h/t @ChrisTayeh) pic.twitter.com/MPYK9btQWh

— Quoth the Raven (@QTRResearch) June 21, 2022

Chart of the Day

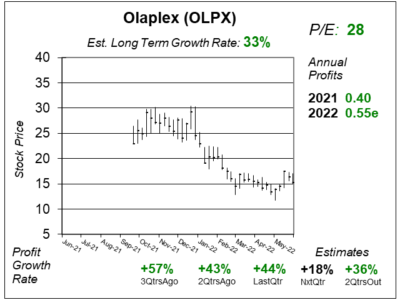

Our chart of the day is a doozy of Olaplex (OLPX). Olaplex just delivered a solid quarter with profit growth of 44% year-over-year on 58% sales growth.

Our chart of the day is a doozy of Olaplex (OLPX). Olaplex just delivered a solid quarter with profit growth of 44% year-over-year on 58% sales growth.

I bought OLPX for clients a while back at $21, thinking the stock had support there. Then the Bear Market took hold and now the stock is $14 (this one-year chart is from 6/11 when the stock was $15).

Founded in 2014, OLPX manufactures premium hair care products that work on a molecular level to repair damaged and broken bonds in the hair, which are caused by hair coloring products and blow dryers.

My Fair Value on the stock is 45x earnings or $25 a share.