Stock (Symbol) |

Ecolab (ECL) |

Stock Price |

$220 |

Sector |

| Industrials & Energy |

Data is as of |

| December 01, 2021 |

Expected to Report |

| February 15 |

Company Description |

A trusted partner at nearly three million customer locations, Ecolab (ECL) is the global leader in water, hygiene and energy technologies and services that protect people and vital resources. With annual sales of $14 billion and 48,000 associates, Ecolab delivers comprehensive solutions, data driven insights and on-site service to promote safe food, maintain clean environments, optimize water and energy use, and improve operational efficiencies for customers in the food, healthcare, energy, hospitality and industrial markets in more than 170 countries around the world. Source: Ecolab A trusted partner at nearly three million customer locations, Ecolab (ECL) is the global leader in water, hygiene and energy technologies and services that protect people and vital resources. With annual sales of $14 billion and 48,000 associates, Ecolab delivers comprehensive solutions, data driven insights and on-site service to promote safe food, maintain clean environments, optimize water and energy use, and improve operational efficiencies for customers in the food, healthcare, energy, hospitality and industrial markets in more than 170 countries around the world. Source: Ecolab |

Sharek’s Take |

Ecolab (ECL) cleaning supplies are in demand as the economy rebounds from COVID-19 closures. ECL’s Institutional & Specialty segment had the strongest growth of all its divisions last qtr, as sales increased 19%. This division includes cleaners and sanitizers for washing dishes and floors as well as other janitorial supplies in the foodservice, lodging, pool, and educational industries. For example, Manchester United football club uses Ecolab disinfection stations, floor cleaning products and seat cleaning. With lower COVID-19 fears, traveling should increase in 2022, which should mean more demand for hotels, theme parks, stadiums, and restaurants. Ecolab (ECL) cleaning supplies are in demand as the economy rebounds from COVID-19 closures. ECL’s Institutional & Specialty segment had the strongest growth of all its divisions last qtr, as sales increased 19%. This division includes cleaners and sanitizers for washing dishes and floors as well as other janitorial supplies in the foodservice, lodging, pool, and educational industries. For example, Manchester United football club uses Ecolab disinfection stations, floor cleaning products and seat cleaning. With lower COVID-19 fears, traveling should increase in 2022, which should mean more demand for hotels, theme parks, stadiums, and restaurants.

Ecolab was founded in 1923 as Economics Laboratory and its 1st product was Absorbit which cleaned carpets on the spot and eliminated the need for hotels to be shut down to be cleaned. The company went public in 1957, eventually changed its name to Ecolab in 1986, and has increased its dividend each year since. Today it boasts 6000 patents and 1500 scientists who continue to innovate, creating new and better products. Ecolab’s chemical business produces consistent revenues and profit growth. The company stays on the cutting edge with its plethora of scientists who not only develop better cleaning products, but cheaper ones too. Ecolab serves the following industries:

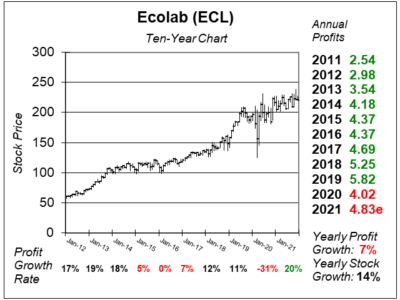

Ecolab stock is one of the most beloved in the investment community because it is safe and provides consistent profit growth, often at double-digit rates. It is one of the safest stocks in America and has had only one year of negative profits growth since 1992 (which was 2001). The company sports 90% recurring revenue each year with reported sales increased 10% this year. Due to the high levels of certainty and consistency this stock always has a high P/E. ECL also pays a dividend — the yield is around 1% — and management has increased the dividend every year since 1986. This year the company has increased its dividends 6% to $0.51 er share and the company has paid dividends every year since 1936. Ecolab is a great buy-and-hold stock for risk averse investors who desire double-digit returns. The stock is part of the Conservative Growth Portfolio. I think the stock is fairly valued here, with mid-teens upside in 2022. |

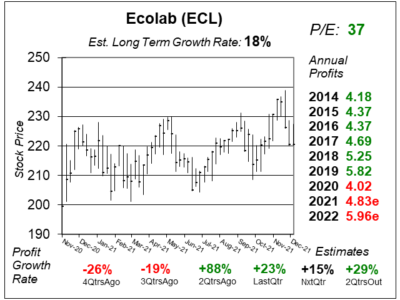

One Year Chart |

ECL has been bassing for the last year, and I think its because the P/E has been high. Investors know ECL is a great long-term investment, so they don’t get flushed out of the stock easily. So even though profits haven’t been at all-time highs since 2019, the stock has held its own. Do notice that profit growth has been good/great the past two qtrs. The P/E of 37 is rich for what I consider to be a 12% grower long-term. The P/E is high because profits are temporarily depressed. If it weren’t for COVID-19, ECL might be making around $7 in 2021. So with the stock ~$220, that would mean the P/E would be 31. ECL has been bassing for the last year, and I think its because the P/E has been high. Investors know ECL is a great long-term investment, so they don’t get flushed out of the stock easily. So even though profits haven’t been at all-time highs since 2019, the stock has held its own. Do notice that profit growth has been good/great the past two qtrs. The P/E of 37 is rich for what I consider to be a 12% grower long-term. The P/E is high because profits are temporarily depressed. If it weren’t for COVID-19, ECL might be making around $7 in 2021. So with the stock ~$220, that would mean the P/E would be 31.

The Est. LTG of 18% is higher than the 16% number last qtr. This stock is more of a 12% grower in the long-run. Profits are bounching back at a more rapid rate. |

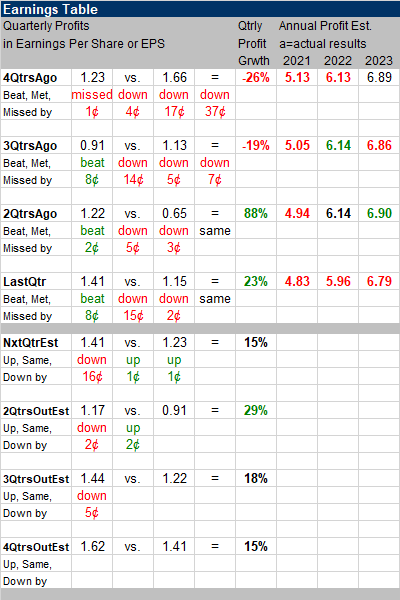

Earnings Table |

Last qtr, Ecolab delivered 23% profit growth and beat estimates of 16% growth. Revenue increased 10%, over last qtr year. Institutional and specialty division led the highest sales growth, during last qtr. Last qtr, Ecolab delivered 23% profit growth and beat estimates of 16% growth. Revenue increased 10%, over last qtr year. Institutional and specialty division led the highest sales growth, during last qtr.

The sales increase was attributed to strong volume and price momentum across all business segments as well new business wins and the recovery of U.S. and European markets. Annual Profit Estimates are mixed this qtr. The company is seeing a rapid rise in raw material costs, and is embarking on a third round of price increases, which should cover these additional costs. Qtrly Profit Estimates are for 15%, 29%, 18%, and 15% profit growth the next 4 qtrs. Next qtr’s estimate will be $0.15 under expectations due to a disruption at one of its plants, higher delivery costs, and customer closures. |

Fair Value |

Above, I mentioned how ECL might be making around $7 this year (2021) if it weren’t for the pandemic. Taking that one step further, perhaps the company would be earning around $8 in 2022. Then, a 32 P/E for this stock would be reasonable during normal operating times. So what might a reasonable price be for next year? 32 x $8 = $256. My current $250 target for 2022 is slightly under that figure, and works out to 42x current 2022 profit estimates. Notice a 42 P/E is high by historical standards, but profits are currently below “normal” levels. Above, I mentioned how ECL might be making around $7 this year (2021) if it weren’t for the pandemic. Taking that one step further, perhaps the company would be earning around $8 in 2022. Then, a 32 P/E for this stock would be reasonable during normal operating times. So what might a reasonable price be for next year? 32 x $8 = $256. My current $250 target for 2022 is slightly under that figure, and works out to 42x current 2022 profit estimates. Notice a 42 P/E is high by historical standards, but profits are currently below “normal” levels. |

Bottom Line |

Ecolab’s (ECL) one of the safest stocks in the world, with a long history of revenue, profit and dividend growth. Even though profits are not hitting All-Time highs presently, smart investors are not going to get shaken out of their shares. Ecolab’s (ECL) one of the safest stocks in the world, with a long history of revenue, profit and dividend growth. Even though profits are not hitting All-Time highs presently, smart investors are not going to get shaken out of their shares.

With travel expected to rise in 2022, people will likely be visiting hotels, theme parks, cruise ships, stadiums, and pools more than they did in 2021. That should keep demand for cleaning supplies strong. ECL moves up from 32nd to 21st in the Conservative Portfolio Power Rankings. My analysis points to mid-teens returns the next two years, which woould be nice as this stock market been crushing speculative stocks. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 21 of 37 |