Ecolab (ECL) Stock Looks Like It’ll Be a Steady Riser Moving Forward

Ecolab (ECP) stock used to be a steady riser. But inflation and COVID knocked profits (and the stock) down. Now ECL looks good again.

Ecolab (ECP) stock used to be a steady riser. But inflation and COVID knocked profits (and the stock) down. Now ECL looks good again.

Ecolab (ECL), a worldwide leader in cleaing chemicals, has had issues that hurt profits the past few years. Now, ECL is back on track.

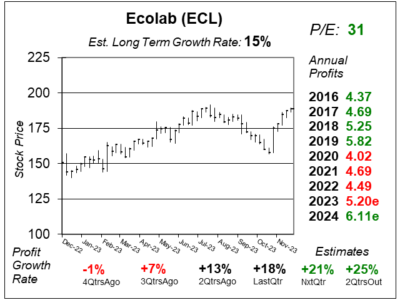

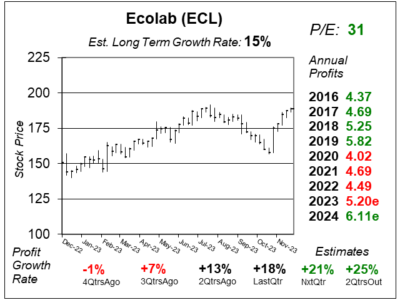

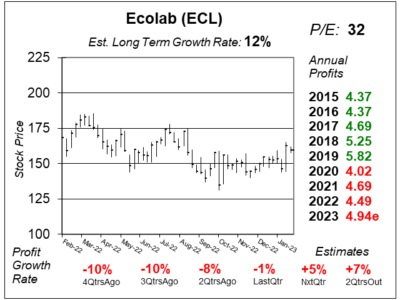

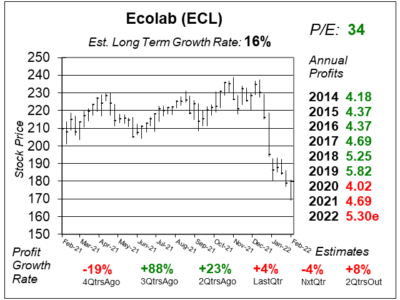

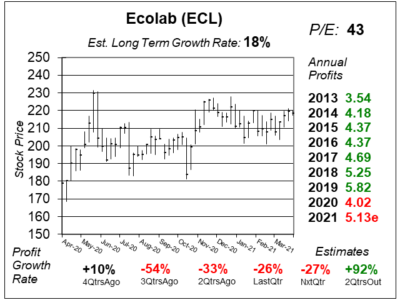

Inflation is finally easing for Ecolab (ECL) as quaterly profit growth is expected to return to a double-digit rate next quarter.

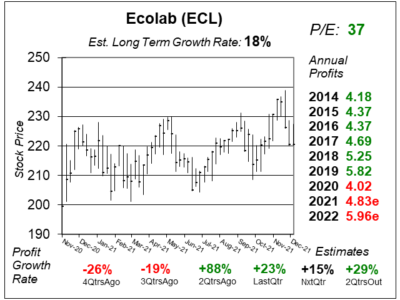

It’s been a challenging few years for Ecolab (ECL). But management now sees a return to low double-digit profit growth, long term.

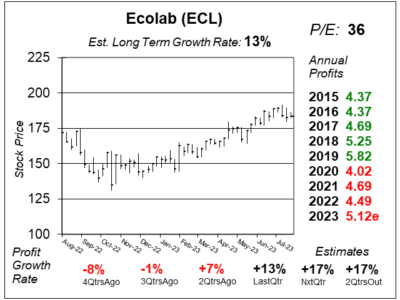

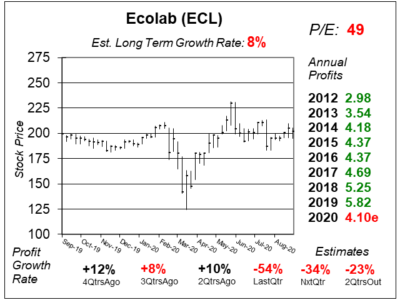

Ecolab (ECL) is dealing with high energy costs, which helped pull down profits 8% last qtr even though revenue grew a solid 10%.

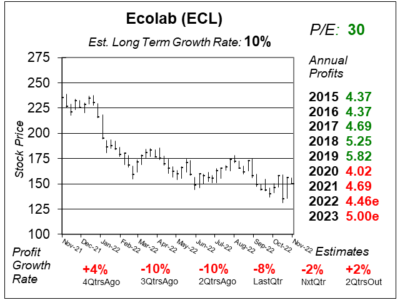

Ecolab’s (ECL) used to profits almost every year. Not lately. Management expects the company to get back on track by the end of 2022.

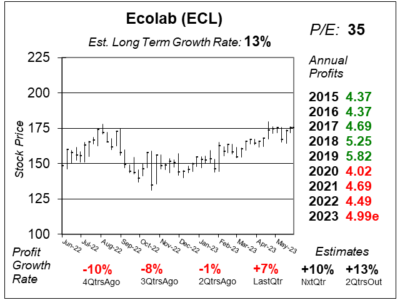

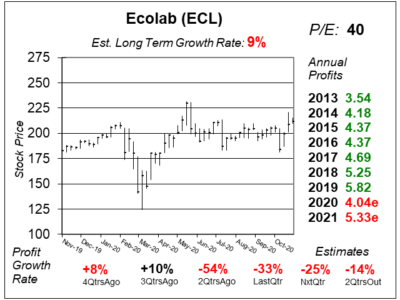

Ecolab (ECL) is combating higher raw material and freight prices, which are eating into profits even though revenue is increasing.

Cleaning chemical company Ecolab (ECL) is seeing high inflation in raw materials and freight costs, and that’s hurting profits.

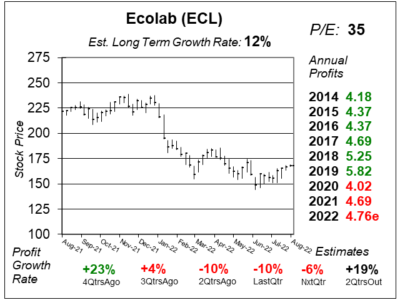

Ecolab (ECL) should see increased demand for cleaning supplies in 2022 as people visit hotels, stadiums, theme parks, and pools.

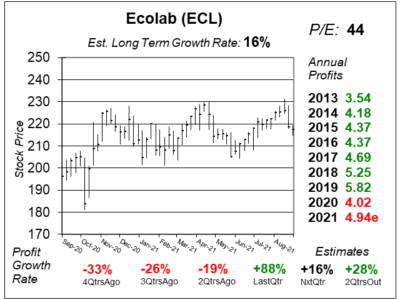

Ecobal (ECL) still isn’t back to peak-profitability yet, but with a lofty P/E of 44 investors are betting on better times ahead.

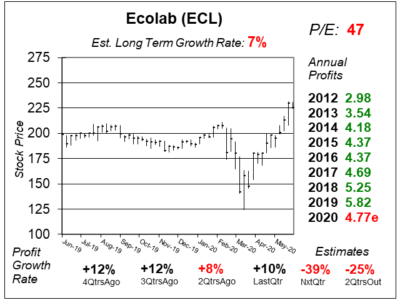

Ecolab’s (ECL) chemical cleaning business was hurt from COVID-19 fo rthe past year. Now, profits are set to rise again.

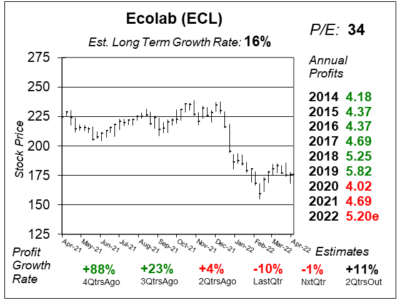

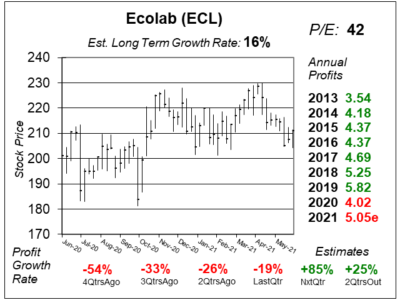

Ecolab (ECL) had profits decline as COVID restrictions, yet the stock is near its highs. Now with a 42 P/E, ECL is expensive.

Ecolab’s (ECL) cleaning supply business is doing well in Healthcare facilities, but business is still weak in hotels & restaurants.

Cleaning and sanitation products are in high demand, giving Ecolab (ECL) growth opportunity for years to come.

Ecolab (ECL) is having a mixed year as some custom customers (hospitals) are doing great while others (hotels) are not.

Ecolab (ECL) is a global leader in cleaning supplies for hospitals, restaurants, hotels in a what is now a Coronavirus world.

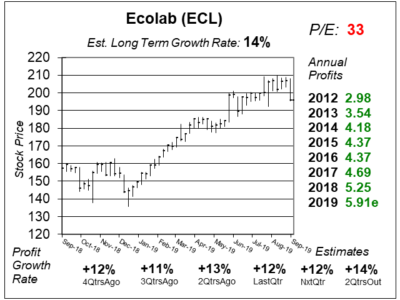

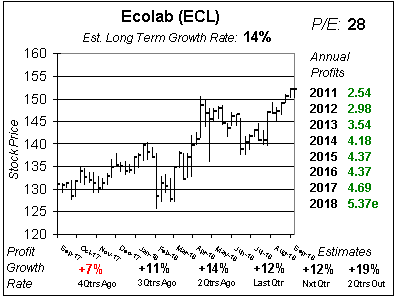

Chemical company Ecolab (ECL) gives investors a safe stock that’s delivered 8 consecutive qtr of profits growth of 10% or more.

Business is good at Ecolab (ECL), and profit margins are improving, thus profits are growing at steady double-digit rates.

Chemical cleaner company Ecolab (ECL) is a master at delivering record profit growth, but the stock is richly priced right now.

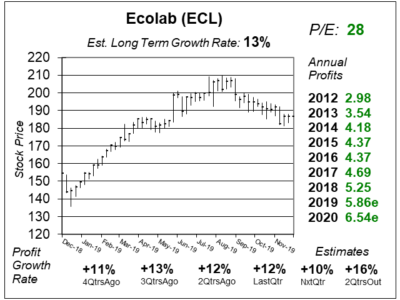

Investors are lovin Ecolab’s (ECL) 12% growth. So much that they pushed the stock from $125 to beyond $175 in two years.

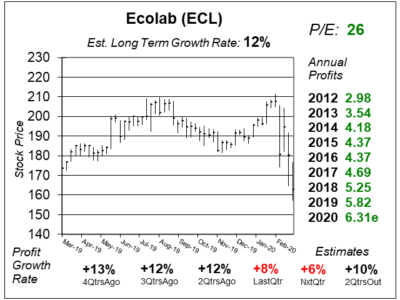

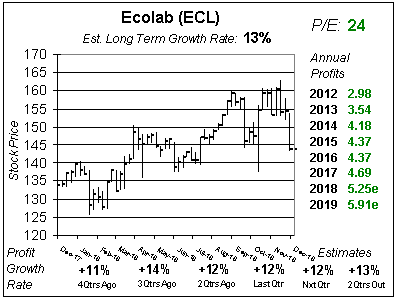

Chemical company Ecolab (ECL) grew profits 12% the past 2 qtrs. And Sharek thinks ECL stock might deliver 12% to investors in 2019.

Chemical company Ecolab (ECL) has been a consistent double-digit grower, while raising its dividend each year since 1991. With the economy doing well, so is ECL.

Chemical cleaner company Ecolab (ECL) is back to growing in the double-digits again as a stable USD and higher oil help results.

Chemical cleaner company Ecolab (ECL) has a couple slow years as oil prices hurt demand. Now oil is higher, and ECL profits are growing faster.

Chemical company Ecolab (ECL) hasn’t been itself due to a slowdown in the Energy sector and F/X costs. Investors should expect more Ecolab-like results in 2018.

Ecolab (ECL) expects growth to accelerate during the 2nd half of the year, and with reduced F/X that should help profits grow at double-digit rates.

Ecolab (ECL) predicts demand for its chemicals and cleaning products to increase during the remainder of 2017. But is the good news already priced in?

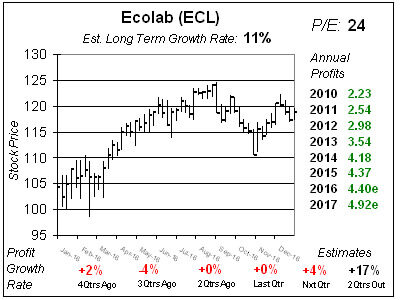

Ecolab (ECL) is expected to have a bounce-back year with profits expected to climb 10% in 2017. But with a P/E of 26 is the good news already priced in?

Ecolab’s (ECL) profits has been hampered by the Energy market and currency headwinds. But those issues could be passing in 2017.

With flat profit growth last qtr (and expected this qtr) Ecolab (ECL) seems like it would be a dog stock. But instead ECL is up this year as business sans Energy is solid.

Ecolab (ECL) has jumped around 20% from its lows set in January & February, but with single digit growth and a high P/E I don’t think the stock can go much higher.

The strong dollar and low energy output have hurt Ecolab (ECL), but recently things have been a changin.

Ecolab (ECL) is great company, but low oil and a high dollar are hurting what would be double-digit growth.

Ecolab (ECL) makes chemicals used for cleaning, and has a clean set of financials. But weakness in the oil sector and the strong dollar are hurting ECL.

Ecolab (ECL) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $1.33 vs. $0.88 = +51%

Revenue Est: +5%