The stock market rose on Friday as investors gained confidence as signs showed that inflation may be peaking.

The stock market rose on Friday as investors gained confidence as signs showed that inflation may be peaking.

Overall, S&P 500 went up 1.7% to 4,280, while NASDAQ increased 2.1% to 13,047.

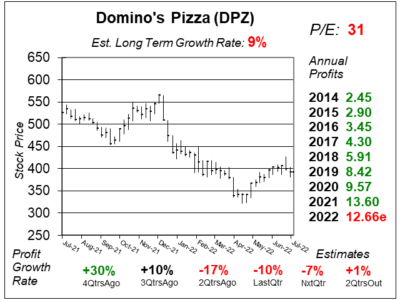

Meanwhile, Domino’s (DPZ) seems to be in the middle of a poor four qtrs as stores are understaffed and people eat out at restaurants again in a post-COVID world.

Tweet of the Day

What can we learn from corporate insiders? For the past month, they have been in an accumulation phase. This could signal an upward trend for stocks over the next 1 to 2 years, @JayKaeppel writes.

1/2 pic.twitter.com/zrD9npOY6w

— SentimenTrader (@sentimentrader) August 12, 2022

Chart of the Day

Our chart of the day is the one-year chart of DPZ as of July 30, 2022, when the stock was at $392.

Founded as a single store in 1960, DPZ’s is the world’s #2 pizza chain and #1 pizza delivery chain, with more than 18,800 locations in over 90 markets around the world. Around 98% of stores are owned and operated by franchisees. The company generates sales and profits by charging franchisees royalties and fees as well as selling them food, equipment, and supplies. DPZ’s is the largest pizza company in the world, based on global retail sales.

The company is going through a slow-growth period, as people go out to eat again in a post-COVID world. Last qtr was the 2nd straight quarter of negative profit growth, and analysts expect two more bad quarters ahead. But after that, profit growth is expected to kick up to the 20% range. In addition, the company is in a tight labor market, especially for drivers. Some stores have shortened hours and there are customer service issues in many stores.

DPZ is part of the Conservative Growth Portfolio. David Sharek’s Fair Value is still a P/E of 28.