Stock (Symbol) |

Dutch Bros (BROS) |

Stock Price |

$72 |

Sector |

| Retail & Travel |

Data is as of |

| June 2, 2025 |

Expected to Report |

| August 5 |

Company Description |

Dutch Bros Inc. is an operator and franchisor of drive-thru shops that focus on serving hand-crafted beverages. Dutch Bros Inc. is an operator and franchisor of drive-thru shops that focus on serving hand-crafted beverages.

The Company offers a variety of customizable cold and hot beverages to its customers. Its hand-crafted beverage offerings include hot and cold espresso-based beverages, cold brew coffee products, Dutch Bros. Blue Rebel energy drinks, tea, lemonade, smoothies and other beverages. Its other beverages include Iced Tiger’s Blood Lemonade, Birthday Cake Frost, Blended Aftershock Rebel, Golden Eagle Freeze, Hot Annihilator, Iced Caramelizer and Iced Electric Berry Rebel. It also offers private reserve coffee sourced through their in-house coffee roasting facility and extracted using La Marzocco machines. It operates approximately 538 shops in 12 states, of which 271 are Company-operated shops and 267 franchise shops. Its shops are located in Arizona, California, Colorado, Idaho, Kansas, Nevada, New Mexico, Oklahoma, Oregon, Texas, Utah, and Washington.Source: Refinitiv |

Sharek’s Take |

Dutch Bros (BROS) delivered an upbeat performance last quarter, reporting 56% profit growth on 29% revenue growth, while beating estimates of 33% and 24%, respectively. The company also reached a key milestone by opening its 1000th store, moving closer to its goal of 2,029 stores by 2029. Despite this strong start to 2025, Dutch Bros expects profit growth to slow in the coming months. Global coffee prices have been unstable; new tariffs could push them even higher. Although the company has locked in some coffee prices for the rest of the year, it still anticipates shrinking profit margins due to rising costs. Labor is also getting more expensive, with recent wage increases—especially in California and for store leaders—adding further pressure on margins throughout the year. Dutch Bros (BROS) delivered an upbeat performance last quarter, reporting 56% profit growth on 29% revenue growth, while beating estimates of 33% and 24%, respectively. The company also reached a key milestone by opening its 1000th store, moving closer to its goal of 2,029 stores by 2029. Despite this strong start to 2025, Dutch Bros expects profit growth to slow in the coming months. Global coffee prices have been unstable; new tariffs could push them even higher. Although the company has locked in some coffee prices for the rest of the year, it still anticipates shrinking profit margins due to rising costs. Labor is also getting more expensive, with recent wage increases—especially in California and for store leaders—adding further pressure on margins throughout the year.

Dutch Bros is a quick-service drive-thru coffee shop chain that serves up iced coffee, energy drinks, and a few snacks. Dutch Bros started began when two brothers who were third-generation dairy farmers bought a double-head espresso machine and opened a pushcart espresso bar in 1992 on the side of the railroad tracks in the state of Oregon. They were quickly making more than $100 a day, and put the money back into the business until one pushcart became five. The company had its first franchise in 2000 and has since grown into an operation with 982 coffee shops, as of December 31, 2024. Of the 982 shops, 670 are company owned and 312 are franchises. Here’s some more interesting points about the company:

Dutch Bros is a compounding story, as management has plans to grow from 1000 shops to 4000 during the next 10 to 15 years. Analysts give the stock an Estimated Long-Term Growth Rate of 26% a year. I imagine profits might have the ability to climb 30-35% a year in the long-run. BROS is in my Growth Portfolio. |

One Year Chart |

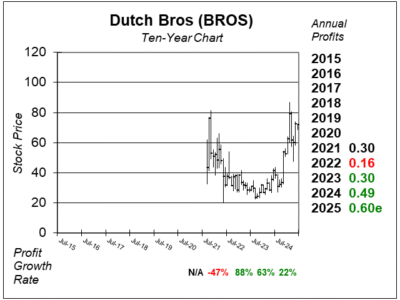

This stock has been a winner this past year, traveling from around $40 to ~$70. This stock has been a winner this past year, traveling from around $40 to ~$70.

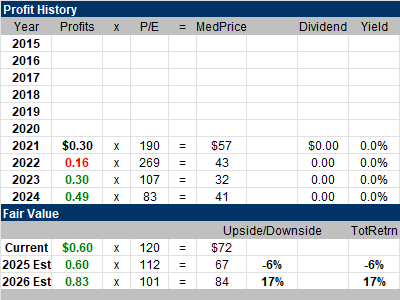

The 120 P/E is high but the company is young and growing profits briskly. Although this P/E looks high here, I don’t feel the stock is overvalued as it sells for a reasonable 7x 2025 revenue estimates. The Est. LTG is 27%, which I feel is accurate. Porfit growth has been erratic this past year. Notice profits declined in 2022. At the time, BROS had high goods inflation and high labor costs to deal with. |

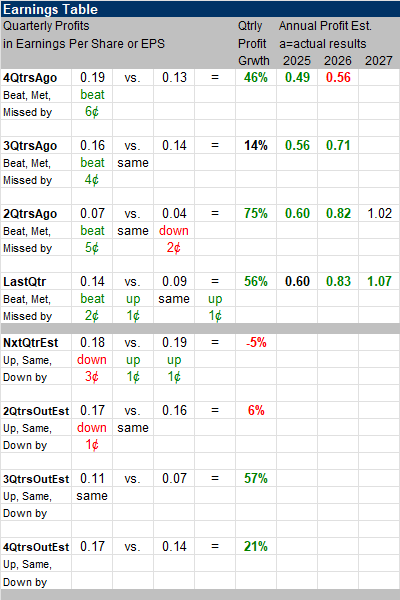

Earnings Table |

Last qtr, Dutch Bros delivered 56% profit growth and whipped expectations of 33% growth. Revenue increased 29%, year-on-year and beat estimates of 24%. Same-shop sales increased 5% while company-owned shops increased 7%. Shop margins decreased to 29.8% from 29.4% year over year. Last qtr, Dutch Bros delivered 56% profit growth and whipped expectations of 33% growth. Revenue increased 29%, year-on-year and beat estimates of 24%. Same-shop sales increased 5% while company-owned shops increased 7%. Shop margins decreased to 29.8% from 29.4% year over year.

Annual Profit Estimates for 2025 remain consistent with last qtr, while 2026 and 2027 increased. Qtrly Profit Estimates are for -5%, 6%, 57%, and 21% growth the next 4 qtrs. Analysts think BROS revenue will grow 24% next quarter. |

Fair Value |

This is too young of a company to price the stock on a P/E basis, so I will use price-to-sales. This qtr the stock sells for 7x 2024 revenue estimates. My Fair Value is 7x revenue. Here are my price estimates for 2025 & 2026: This is too young of a company to price the stock on a P/E basis, so I will use price-to-sales. This qtr the stock sells for 7x 2024 revenue estimates. My Fair Value is 7x revenue. Here are my price estimates for 2025 & 2026:

Current qtr: 2025 Fair Value: 2026 Fair Value: |

Bottom Line |

Dutch Bros (BROS) garnered a lot of attention when it debuted as the shares opened at $33 in August 2021. Within two months the shares pushed past $80. Then the stock built a saucer pattern and broke out in November 2024 when it surged past $35 after earnings were released. Dutch Bros (BROS) garnered a lot of attention when it debuted as the shares opened at $33 in August 2021. Within two months the shares pushed past $80. Then the stock built a saucer pattern and broke out in November 2024 when it surged past $35 after earnings were released.

Dutch Bros is a nice young company with a bright future. This reminds me of Buffalo Wild Wings, and more recently Wingstop. BROS ranks 16th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

16 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |