Stock (Symbol) |

Dutch Bros (BROS) |

Stock Price |

$54 |

Sector |

| Retail & Travel |

Data is as of |

| December 16, 2024 |

Expected to Report |

| February 19 |

Company Description |

Dutch Bros Inc. is an operator and franchisor of drive-thru shops that focus on serving hand-crafted beverages. Dutch Bros Inc. is an operator and franchisor of drive-thru shops that focus on serving hand-crafted beverages.

The Company offers a variety of customizable cold and hot beverages to its customers. Its hand-crafted beverage offerings include hot and cold espresso-based beverages, cold brew coffee products, Dutch Bros. Blue Rebel energy drinks, tea, lemonade, smoothies and other beverages. Its other beverages include Iced Tiger’s Blood Lemonade, Birthday Cake Frost, Blended Aftershock Rebel, Golden Eagle Freeze, Hot Annihilator, Iced Caramelizer and Iced Electric Berry Rebel. It also offers private reserve coffee sourced through their in-house coffee roasting facility and extracted using La Marzocco machines. It operates approximately 538 shops in 12 states, of which 271 are Company-operated shops and 267 franchise shops. Its shops are located in Arizona, California, Colorado, Idaho, Kansas, Nevada, New Mexico, Oklahoma, Oregon, Texas, Utah, and Washington.Source: Refinitiv |

Sharek’s Take |

Dutch Bros (BROS) is expanding like wild as the company tries to take out of Starbucks’ drink business. Growth was driven by 38 new “shop” openings last quarter, with the company on pace for 150 new shops this year. BROS ended 2023 with 876 shops. A lot of the recent success is from management elevating its site selection process. Last qtr, Dutch Bros accelerated the roll out of mobile ordering, now covering 90% of shops, which has received positive feedback and is already driving meaningful business. In the future, expect a more robust food offering with an expanded bakery and hot food options. Dutch Bros (BROS) is expanding like wild as the company tries to take out of Starbucks’ drink business. Growth was driven by 38 new “shop” openings last quarter, with the company on pace for 150 new shops this year. BROS ended 2023 with 876 shops. A lot of the recent success is from management elevating its site selection process. Last qtr, Dutch Bros accelerated the roll out of mobile ordering, now covering 90% of shops, which has received positive feedback and is already driving meaningful business. In the future, expect a more robust food offering with an expanded bakery and hot food options.

Dutch Bros is a quick-service drive-thru coffee shop chain that serves up iced coffee, energy drinks, and a few snacks. Dutch Bros started began when two brothers who were third-generation dairy farmers bought a double-head espresso machine and opened a pushcart espresso bar in 1992 on the side of the railroad tracks in the state of Oregon. They were quickly making more than $100 a day, and put the money back into the business until one pushcart became five. The company had its first franchise in 2000 and has since grown into an operation with 831 coffee shops, as of December 31, 2023. Here’s some more interesting points about the company:

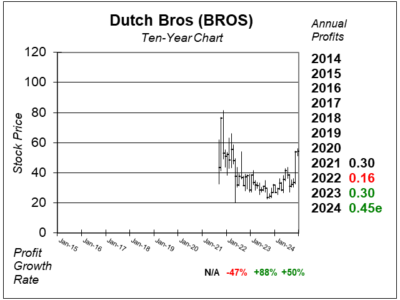

Dutch Bros is a compounding story, as management has plans to grow from 800 shops to 4000 during the next 10 to 15 years. From 2021 to 2023, BROS grew from 716 to 876 year over year, a rate of 22%, while revenue grew 31% yearly. Analysts give the stock an Estimated Long-Term Growth Rate of 26% a year. I imagine profits might have the ability to climb 30-35% a year in the long-run. BROS is in my Growth Portfolio. |

One Year Chart |

This stock caught fire recently. Now its building a small base. This stock caught fire recently. Now its building a small base.

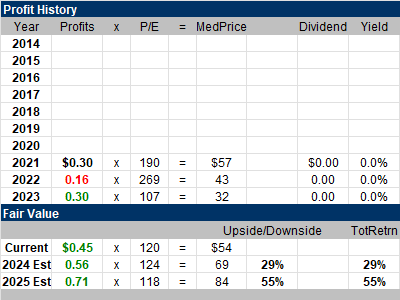

The Est. LTG is 36%, which I feel is accurate. The 96 P/E is high but the company is young and growing profits briskly. Notice profits declined in 2022. At the time, BROS had high goods inflation and high labor costs to deal with. |

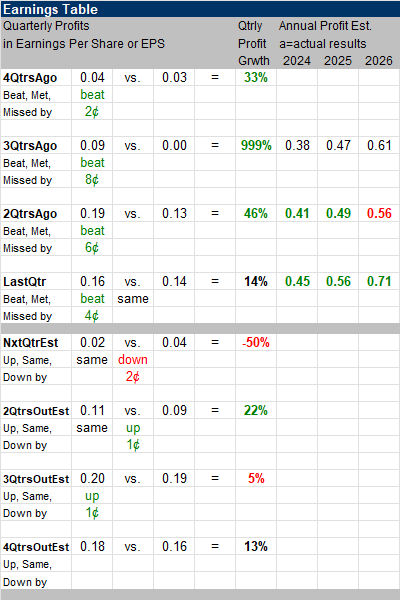

Earnings Table |

Last qtr, Dutch Bros delivered 14% profit growth and beat expectations of -14% growth. Revenue increased 28%, year-on-year and beat estimates of 23%. Same-shop sales increased 3% while company-owned shops increased 4%. Shop margins decreased to 22.2% from 24.1% year over year. Last qtr, Dutch Bros delivered 14% profit growth and beat expectations of -14% growth. Revenue increased 28%, year-on-year and beat estimates of 23%. Same-shop sales increased 3% while company-owned shops increased 4%. Shop margins decreased to 22.2% from 24.1% year over year.

Annual Profit Estimates for 2024, 2025 and 2026 increased. Qtrly Profit Estimates are for -50%, 22%, 5%, and 13% growth the next 4 qtrs. Note profit estimates are for the company to make just $0.02 a share next qtr. BROS also beat estimates by $0.04 last qtr. |

Fair Value |

This is too young of a company to price the stock on a P/E basis, so I will use price-to-sales. This qtr the stock sells for 7x 2024 revenue estimates. My Fair Value is also 7x revenue. Here are my price estimates for 2025 & 2026: This is too young of a company to price the stock on a P/E basis, so I will use price-to-sales. This qtr the stock sells for 7x 2024 revenue estimates. My Fair Value is also 7x revenue. Here are my price estimates for 2025 & 2026:

Current qtr: 2025 Fair Value: 2026 Fair Value: |

Bottom Line |

Dutch Bros (BROS) is a recent IPO that garnered a lot of attention when it debuted as the shares opened at $33 and within two months pushed past $80. Then the stock built a saucer pattern , tried to break out, then fell back down. Dutch Bros (BROS) is a recent IPO that garnered a lot of attention when it debuted as the shares opened at $33 and within two months pushed past $80. Then the stock built a saucer pattern , tried to break out, then fell back down.

Dutch Bros stock has gotten some momentum recently, but I expect ups-and-downs for a while due to the stock’s high P/E. Long-term, this is a great opportunity as the company expands its store base and its limited menu. BROS moves up from 25th to 17th in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

17 of 30Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |