Going into this week, investors were looking forward to a big up day sometime this week. This would serve as a confirmation that a new market rally has begun.

Going into this week, investors were looking forward to a big up day sometime this week. This would serve as a confirmation that a new market rally has begun.

Alas, today’s awful showing has erased hopes that a rally will begin anytime soon. S&P 500 fell 1.4% to 4,229, while NASDAQ declined 1.9% to 13,059.

For now, the stock market is in a correction, and lower prices should be expected over the short term.

Tweet of the Day

Job openings in August just unexpectedly jumped from 8.92 million to 9.61 million.

This jump of 690,000 job openings is the biggest since July 2021.

Not to mention, July 2023 job openings were revised HIGHER from 8.81 to 8.92 million.

The beat on expectations of job openings… pic.twitter.com/qiMLNuWcnw

— The Kobeissi Letter (@KobeissiLetter) October 3, 2023

Chart of the Day

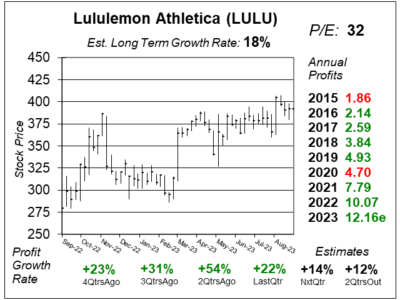

Here is the one-year chart of Lululemon Athletica (LULU) as of September 20, 2023, when the stock was at $392.

Here is the one-year chart of Lululemon Athletica (LULU) as of September 20, 2023, when the stock was at $392.

Lululemon is a Canadian designer, distributor, and retailer of high-quality athletic appeal and accessories, marketed under the Lululemon brand. The brand is known for its technically advanced fabrics, with a superior feel and fit. Apparel items include pants, shorts, tops, and jackets designed for yoga, running, and training.

The company’s profits continue to perform well during tough times for retailers. Last quarter, Lululemon delivered 22% profit growth through the combination of strong revenue growth and a boost in profit margins. Sales grew 18% during the quarter, with same-store sales up 7%. Store and digital channel traffic jumped 20%. Lower airfreight costs continue to increase the company’s operating margin, which grew to 21.7% from 21.5% a year ago, as the company takes advantage of the lowered expenses.

LULU is part of the Growth Portfolio and Aggressive Growth Portfolio. While the Estimated Long-Term Growth Rate is 18%, David Sharek thinks LULU is a 30% profit grower.