The stock market closed lower on Thursday, with bank stocks leading the decline due to concerns over credit quality stemming from bad loans at regional banks.

The stock market closed lower on Thursday, with bank stocks leading the decline due to concerns over credit quality stemming from bad loans at regional banks.

Overall, S&P 500 declined 0.6% to 6,629, while NASDAQ slid 0.5% to 22,563.

Tweet of the Day

Blue Owl $OWL is one of my favorite long term investments. But in the short term it has high costs (rent & salaries) from some recent mergers. Still, I'm surprised the stock is this low. https://t.co/Q9kvU6odOM

— David Sharek (@GrowthStockGuy) October 17, 2025

Chart of the Day

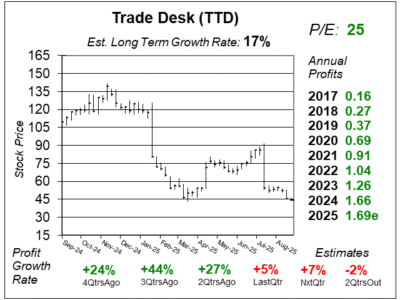

Here is the one-year chart of The Trade Desk (TTD) as of September 18, 2025, when the stock was at $44.

Here is the one-year chart of The Trade Desk (TTD) as of September 18, 2025, when the stock was at $44.

The Trade Desk is facing tough competition from other demand side platforms (DSP). A DSP is a platform with digital advertising inventory where an advertiser can manage their inventory. The competition is intense in the Connected TV (CTV) market that The Trade Desk used to dominate. Other DSP’s are cheaper than The Trade Desk, and some of its customers are signing up to put ads on these other platforms.

Last month, it was announced that advertisers will be able to buy ads on Netflix on Amazon’s (AMZN) DSP. Spotify, Roku and Disney have also recently decided to get on Amazon’s DSP. Walmart recently ended The Trade Desk’s exclusive deal. Amazon is being aggressive with pricing with small margins to take market share. Meanwhile, Google (GOOGL) is negotiating better deals for agencies to use its DSP for media buys. Even Yahoo has a lower take rate than The Trade Desk. Advertisers, including media agencies, are also sick of The Trade Desk’s hidden fees. The Trade Desk is losing its grip on the ad market, and this is being reflected in its weak stock action.

TTD was sold from our Growth Portfolio. The industry is chipping away the company’s dominant position.