Stock (Symbol) |

Advanced Micro Devices (AMD) |

Stock Price |

$167 |

Sector |

| Technology |

Data is as of |

| August 27, 2025 |

Expected to Report |

| October 27 |

Company Description |

Advanced Micro Devices, Inc. is a global semiconductor company. Its segments include Computing and Graphics, and Enterprise, Embedded and Semi-Custom. Advanced Micro Devices, Inc. is a global semiconductor company. Its segments include Computing and Graphics, and Enterprise, Embedded and Semi-Custom.

The Computing and Graphics segment primarily includes desktop and notebook microprocessors, accelerated processing units that integrate microprocessors and graphics, chipsets, discrete graphics processing units (GPUs), data center and professional GPUs, and development services. It may also sell or license portions of its intellectual property (IP) portfolio. The Enterprise, Embedded and Semi-Custom segment primarily includes server and embedded processors, semi-custom system-on-chip (SoC) products, development services, and technology for game consoles, and it may also sell or license portions of its IP portfolio. Its microprocessor customers consist primarily of original equipment manufacturers (OEMs), large public cloud service providers, original design manufacturers (ODMs), system integrators, and independent distributors. Source: Refinitiv |

Sharek’s Take |

Advanced Micro Devices (AMD) AI demand is exploding but the company is currently not able to handle it all. Management stated every GPU task is creating extra CPU demand, driving record EPYC sales. Management stated the new MI350 accelerators are ramping quickly, but export controls and supply limits mean the company can’t meet all the demand. Even so, government and enterprises are lining up, with more than 40 active sovereign AI projects and massive builds. And Oracle will be a big buyer. The big news this week was Oracle’s backlog — Remaining Performance Obligations (RPO) — jumped to $455 billion last qtr from $138 billion just three months earlier. In ADM’s earnings call, Management mentioned Oracle’s as a big customer. Oracle is building a 27000 node AI cluster with MI355X accelerators and EPYC Turin CPUs. With the development of the next-gen MI400 progressing rapidly, management stated they see a clear path to scaling its AI business to tens of billions of dollars in annual revenue. Advanced Micro Devices (AMD) AI demand is exploding but the company is currently not able to handle it all. Management stated every GPU task is creating extra CPU demand, driving record EPYC sales. Management stated the new MI350 accelerators are ramping quickly, but export controls and supply limits mean the company can’t meet all the demand. Even so, government and enterprises are lining up, with more than 40 active sovereign AI projects and massive builds. And Oracle will be a big buyer. The big news this week was Oracle’s backlog — Remaining Performance Obligations (RPO) — jumped to $455 billion last qtr from $138 billion just three months earlier. In ADM’s earnings call, Management mentioned Oracle’s as a big customer. Oracle is building a 27000 node AI cluster with MI355X accelerators and EPYC Turin CPUs. With the development of the next-gen MI400 progressing rapidly, management stated they see a clear path to scaling its AI business to tens of billions of dollars in annual revenue.

Advanced Micro Devices is a semiconductor company focused on high-performance computing technology, software, and products. It develops high-performance CPUs and GPUs and integrates these with hardware and software. CPUs are used for client systems, high-performance computing, and cloud computing. GPUs are used for gaming, artificial intelligence, and virtual reality. The company has four business segments, here’s some info from last qtr:

AMD has been a wild stock the past year. I actually sold the stock in February around $113 due to it being so weak. This quarter, AMD has an Estimated Long Term Growth Rate of 29% per year, and a bit overvalued at P/E of 43. Although AMD doesn’t pays a dividend, management buys back stock. In 2024 management bought back 6 million shares for $862 million. AMD will be purchased for the Growth Portfolio. The stock could a huge winner from AI spending in the coming years. |

One Year Chart |

AMD stock has had a crazy year. And this dip you see here caused me to sell the stock back in February. Now I buy it back at a higher price than when I sold it. AMD stock has had a crazy year. And this dip you see here caused me to sell the stock back in February. Now I buy it back at a higher price than when I sold it.

AMD has a P/E of 43 this qtr. I think the stock is fairly valued at a P/E of 35. But this new AI chip could lead to big profits in the future. The Est. LTG is 29%, slightly above than the 27% last qtr. Qtrly profit growth hasn’t really been a good predictor fo the stock this year. |

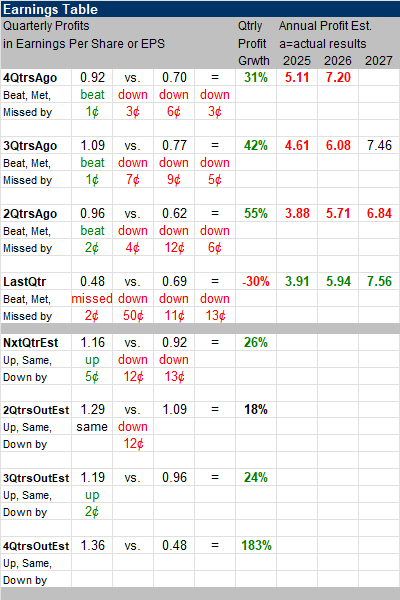

Earnings Table |

Last qtr, AMD produced -30% profit growth and missed expectations of -28%. Revenue increased 32%, year-over-year versus estimates of 27%. Gross margin was 43% compared to 53% a year ago. Operating margin was 12% compared to 22% a year ago. Last qtr, AMD produced -30% profit growth and missed expectations of -28%. Revenue increased 32%, year-over-year versus estimates of 27%. Gross margin was 43% compared to 53% a year ago. Operating margin was 12% compared to 22% a year ago.

Annual Profit Estimates increased this qtr. Qtrly profit Estimates are for 26%, 18%, 24%, and 183% growth in the next four qtrs. Analysts estimate 28% revenue growth next quarter. |

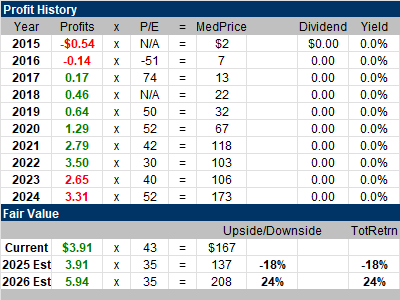

Fair Value |

With AMD at $167 this qtr, the stock AMD has P/E of 43. With AMD at $167 this qtr, the stock AMD has P/E of 43.

My Fair Value is a P/E of 35, which equates to $137 in 2025. When we look to 2026 my Fair Value is $208, giving the stock upside of 24%. But these profit estimates seem like guesses to me. |

Bottom Line |

Advanced Micro Devices (AMD) grew profits nicely during 2017 – 2022. Profits failed to hit new highs in 2023 and 2024. The stock has been crazy the past ten years. Advanced Micro Devices (AMD) grew profits nicely during 2017 – 2022. Profits failed to hit new highs in 2023 and 2024. The stock has been crazy the past ten years.

AMD was extremely bullish on demand for its datacenter chips. Oracle is set to have busines balloon in the coming years, and that means more computing power will be needed. The company also sees significant opporunities powering national computing centers and sovereign AI initiatives. AMD will be purchased for the Growth Portfolio today. The stock will rank 15th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

15 of 34Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |