Stock (Symbol) |

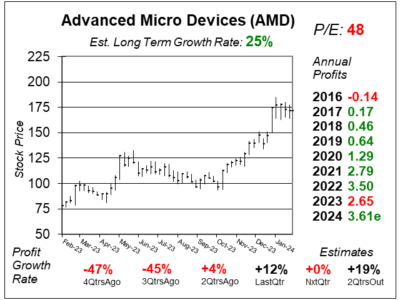

Advanced Micro Devices (AMD) |

Stock Price |

$172 |

Sector |

| Technology |

Data is as of |

| February 13, 2024 |

Expected to Report |

| April 30 |

Company Description |

Advanced Micro Devices, Inc. is a global semiconductor company. Its segments include Computing and Graphics, and Enterprise, Embedded and Semi-Custom. Advanced Micro Devices, Inc. is a global semiconductor company. Its segments include Computing and Graphics, and Enterprise, Embedded and Semi-Custom.

The Computing and Graphics segment primarily includes desktop and notebook microprocessors, accelerated processing units that integrate microprocessors and graphics, chipsets, discrete graphics processing units (GPUs), data center and professional GPUs, and development services. It may also sell or license portions of its intellectual property (IP) portfolio. The Enterprise, Embedded and Semi-Custom segment primarily includes server and embedded processors, semi-custom system-on-chip (SoC) products, development services, and technology for game consoles, and it may also sell or license portions of its IP portfolio. Its microprocessor customers consist primarily of original equipment manufacturers (OEMs), large public cloud service providers, original design manufacturers (ODMs), system integrators, and independent distributors. Source: Refinitiv |

Sharek’s Take |

With a lofty P/E of 48, and just 12% profit growth last quarter, Advanced Micro Devices (AMD) stock seems overvalued. And the reason why is the assumption that profits will fly higher with future sales of AI products. Huge enterprises are signing up to support AMD’s AI infrastructure, which is more than just GPU’s and CPU’s. It’s software too. AMD released ROCm 6 software suite that competes with NVIDIA’s CUDA. CUDA is a big reason why companies work with NVIDIA. Lower prices and good software can cause these Enterprises to make the switch to AMD. Microsoft, Meta and Oracle have already signed up to buy this new AI endeavor. Large Enterprises are bringing their most advanced large language models to AMD. For example, Microsoft was able to bring up ChatGPT-4 on MI300X. With a lofty P/E of 48, and just 12% profit growth last quarter, Advanced Micro Devices (AMD) stock seems overvalued. And the reason why is the assumption that profits will fly higher with future sales of AI products. Huge enterprises are signing up to support AMD’s AI infrastructure, which is more than just GPU’s and CPU’s. It’s software too. AMD released ROCm 6 software suite that competes with NVIDIA’s CUDA. CUDA is a big reason why companies work with NVIDIA. Lower prices and good software can cause these Enterprises to make the switch to AMD. Microsoft, Meta and Oracle have already signed up to buy this new AI endeavor. Large Enterprises are bringing their most advanced large language models to AMD. For example, Microsoft was able to bring up ChatGPT-4 on MI300X.

Advanced Micro Devices is a semiconductor company focused on high-performance computing technology, software, and products. It develops high-performance CPUs and GPUs and integrates these with hardware and software. CPUs are used for client systems, high-performance computing, and cloud computing. GPUs are used for gaming, artificial intelligence, and virtual reality. The company has four business segments, here’s some info from last qtr:

AMD is on the radar for the Growth Portfolio. I’d like to but the stock but we already own NVIDIA in that portfolio, so I don’t really need to have AMD as well. AMD currently has an Estimated Long Term Growth Rate of 25% per year, and a lofty P/E of 48. Although AMD doesn’t pay a dividend, management buys back stock. In 2023 management bought back 10 million shares for $985 million. AMD’s AI GPU seems to be working great. I want to buy the stock, but it just ran from $100 to $175 in just a few months. AMD is on the radar for the Growth Portfolio. |

One Year Chart |

This stock recently broke out at $125 then again at $150. Now AMD is in another shallow base. It could break out again ad go higher. This stock recently broke out at $125 then again at $150. Now AMD is in another shallow base. It could break out again ad go higher.

One thing that might hold the stock back is this P/E of 48. NVDA currently has a P/E of 34. So AMD is more expensive. Maybe analysts envision big profits for AMD in future years? The Est. LTG is 25%, up from 10% 2QtrsAgo. 25% is more appropriate. Qtrly profit growth is meh and that might continue into next qtr. Then profits are expected to accelerate. |

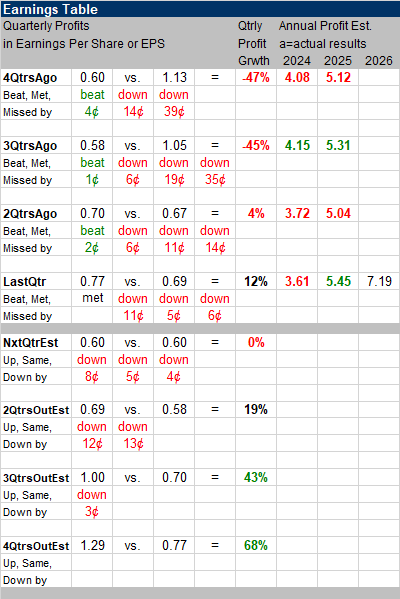

Earnings Table |

Last qtr, AMD produced 12% profit growth and met analyst estimates. Revenue growth was 10%, year-over-year versus estimates of 9%. Gross profit margin was flat at 51% yoy. Operating margin was 23%. Last qtr, AMD produced 12% profit growth and met analyst estimates. Revenue growth was 10%, year-over-year versus estimates of 9%. Gross profit margin was flat at 51% yoy. Operating margin was 23%.

Client segment took the largest growth last quarter at 62%. Driven by an increase in AMD Ryzen™ 7000 Series CPU sales. AMD launched their latest generation of Ryzen 8000 Series notebooks and processors. It is the industry’s first desktop CPUs with an integrated AI engine. Data Center and Client segments are growing sequentially driven by sales of EPYC Processor and Ryzen 7000 Series. AMD launched the MI300x accelerator family. Annual Profit Estimates declined for 2023 but improved for 2024. Perhaps this a positive sign for the new processors. Qtrly profit Estimates are for 0%, 19%, 43%, and 68% growth in the next four qtrs. For next qtr, management expects revenue from Data Center to be flat, Embedded to decline, Gaming Segment to decline, and Client Segment to decline. Analytst estimates a 1% revenue growth for the next quarter. |

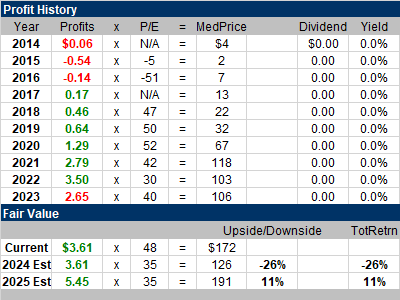

Fair Value |

My Fair Value remains at P/E of 35, As I believe AMD is currently overvalued as its P/E is 48. My Fair Value remains at P/E of 35, As I believe AMD is currently overvalued as its P/E is 48.

My 2024 Fair Value is $126. The stock is $172 ths quarter. Note there is upside to 2025’s Fair Value of $191. But I expect 2025 profit estimates to rise as AI chip demand is strong. |

Bottom Line |

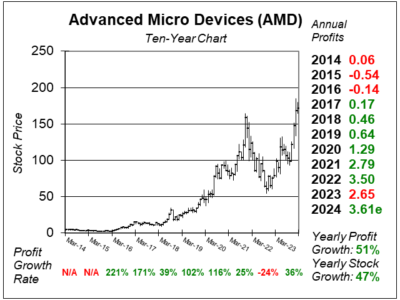

Advanced Micro Devices (AMD) grew profits nicely the past 5 years. But before to that, the company had troubles growing consistently. Prior to 2012, years that stick out profit-wise are a $0.70 profit in 2006 and a $2.89 profit in 2000. Advanced Micro Devices (AMD) grew profits nicely the past 5 years. But before to that, the company had troubles growing consistently. Prior to 2012, years that stick out profit-wise are a $0.70 profit in 2006 and a $2.89 profit in 2000.

AMD is trying to be a NVIDIA’s mini-me. But right now AMD is more expensive than NVIDIA. I feel NVIDIA is charging too much for its H100s, but demand is so strong it can do so. Big companies want AMD to succeed so there’s competition in the market place. AMD is on the radar the Growth Portfolio. I should have bought it earlier and will try to wait for a correction to get in. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |